Texas' independent system operator, the Electric Reliability Council of Texas, faced a challenging year in 2011. Winter cold snaps and unusually hot summer temperatures pushed the system to the edge and required bringing some mothballed plants out of retirement under special contracts covering variable costs.

This situation triggered several years of debate at the Public Utility Commission of Texas on how best to guarantee long-term grid reliability and how to decide whether to supplement Texas’ energy-only market with a forward capacity market similar to those in the Eastern Interconnection.

Energy market revenues were seen as inadequate to stimulate new generation, while planning documents predicted record-low reserve margins. Texans for Reliable Power, an advocacy group representing some of the biggest generating companies in the state, even took out full-page ads in early 2014 depicting Texas in the dark, having fallen prey to blackouts.

In 2014, Texas regulators decided against a standard forward capacity market in favor of an energy-only market design with an operational reserve demand curve (ORDC is a day-ahead, real-time mechanism to signal looming scarcity in the energy market and provide extra revenue for generating capacity) and a higher wholesale energy price cap of $9,000 per megawatt-hour.

This decision has likely saved Texas consumers billions, as well as significantly improving reliability, providing evidence of an energy transition driven by load reductions, significant increases in renewable generation, and cheap natural gas.

An evolving reliability picture

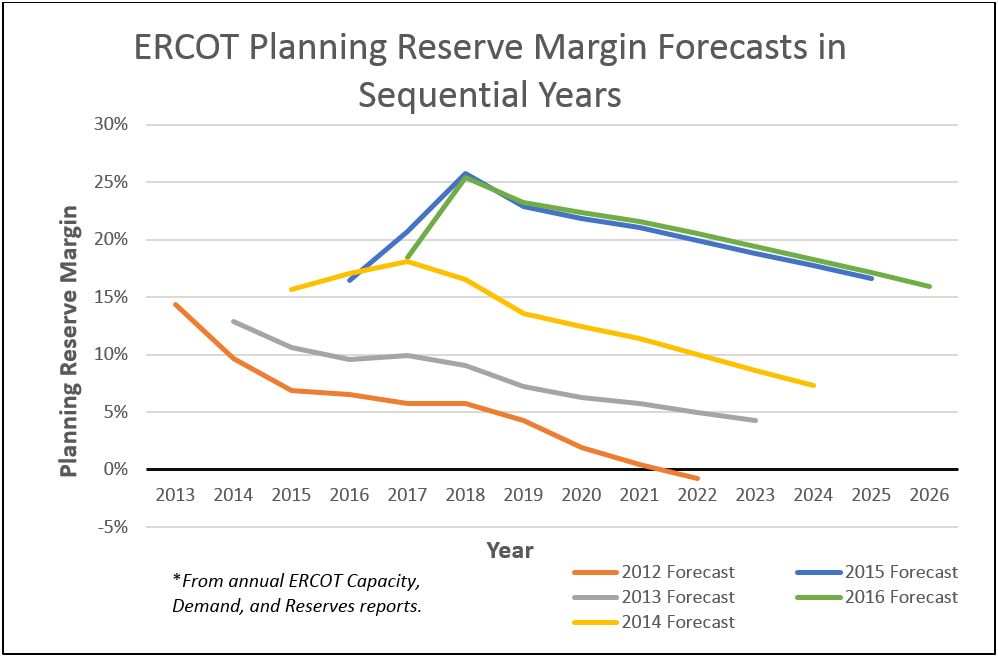

Reliability improvements are fairly easy to characterize, as the reserve margins outlook is clearly getting better. The chart below shows ERCOT forward estimates for summer conditions in four sequential years, expressing reserve margin as the percentage of additional generation capacity over anticipated firm peak load.

Looking to 2022, the forecasted reserve margin rises from -0.8 percent to 20.5 percent (ERCOT’s target is 13.75 percent), indicating a rapidly improving reliability outlook from 2012 to 2015, despite PUC passing on a forward capacity market. So how is this possible?

Dropping peak demand forecast

Falling peak load forecasts are a big part of the story. In May 2012, forecasted 2022 summer firm peak load was 80,694 megawatts. By May 2016, it was only 72,792 megawatts. Even with just the resources anticipated in 2012, load forecasts became much easier to satisfy.

Three factors drove this drop in forecasted peak load. First, in late 2013, ERCOT changed its methodology for forecasting loads, making the previous methodology look high for peak demand growth. Second, the 2014-2015 oil and gas sector crash in Texas removed a significant amount of load. Third, larger loads and retailers are avoiding consumption during peak hours to avoid demand charges and high peak real-time prices. Retail energy providers (REPs) are offering peak rebates, real time prices, direct load control and time-of-use-rates.

Dropping load forecasts have significantly decreased the likelihood of energy scarcity over the next decade. In fact, a recent lawsuit brought against ERCOT by Panda Power Funds and various affiliates contends they were fraudulently misled into investing $2.2 billion in new combined-cycle gas power plants by over-optimistic ERCOT forecasts in 2011-2012.

Increasing resource mix

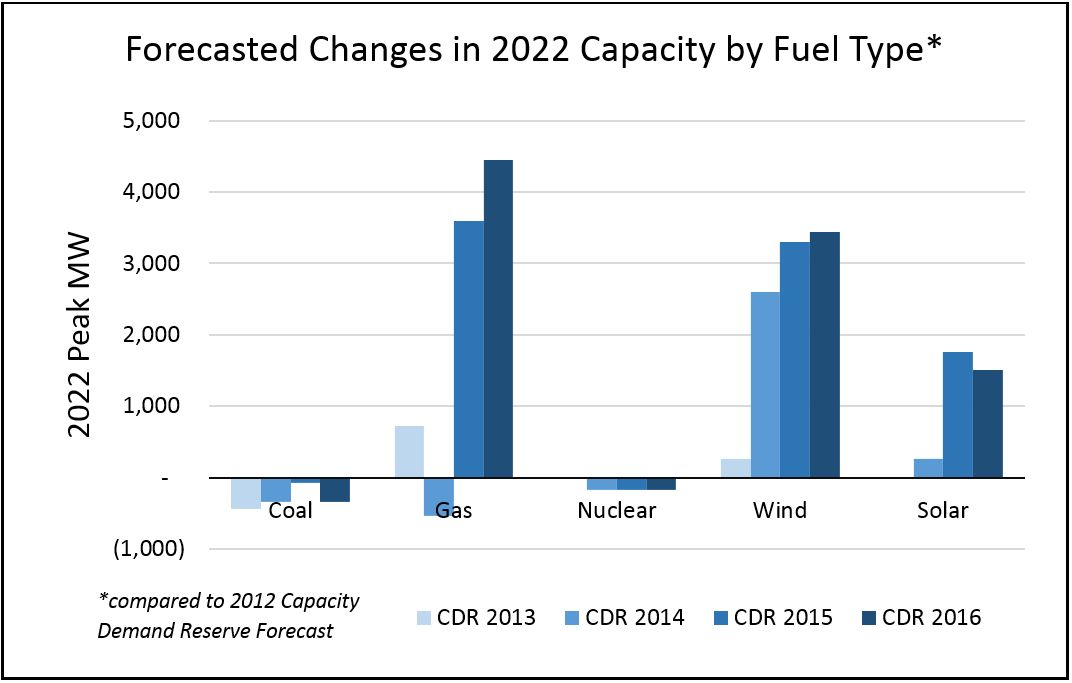

But as the peak demand forecast falls, Texas’ resource mix is increasing. Two overarching trends leap out: a big jump in future wind and solar resources and a big jump in future natural-gas generation.

The chart below shows changes from ERCOT’s 2012 capacity, demand and reserve (CDR) forecast for 2022, with increases (or decreases) in CDR forecasts for peak summer resources in subsequent years broken down by fuel types.

The first trend is easily understood -- technology prices for solar and wind have dropped so steeply they have become increasingly competitive (U.S. solar photovoltaic prices have dropped roughly 50 percent since 2012; wind prices are down by 40 percent), even in a low wholesale price environment. Proactive transmission policy has also facilitated a rapid rise in wind generation that is likely to continue.

The second trend, future gas capacity additions, is more perplexing. The power generation industry, like many commodities industries, is a boom-bust market with ample available risk hedging, so big swings in expected future capacity aren’t unexpected. However, it is strange to see a combined-cycle gas turbine (CCGT) building boom when current revenue recovery from the energy markets is at an all-time low -- bringing us back to the billions in customer savings.

Annual revenues and cost of new entry

A key metric that can help clarify why developers choose to build a new plant in a power market like Texas is the cost of new entry. CONE is basically net revenue (measured in $/kilowatt-year) that a generation company would need to make every year from a plant to cover fixed costs and pay off investors. Net revenue is annual revenue from energy-market sales, along with other ancillary services payments, minus money spent on fuel and other variable expenses.

Established wholesale electricity market design dictates that if long-term market revenues are below CONE, investors will not fund new generation. According to the ERCOT independent market monitor’s 2014 State of the Market Report, a new combined-cycle plant in Texas has a CONE between $110-$125 per kilowatt-year, while net revenues for a generic CCGT plant in 2014 were around $57 per kilowatt-year. Hence, combined-cycle gas plants seeking to satisfy their investors face a revenue gap of around $60/kilowatt-year.

Capacity markets target closing the revenue gap for generators, but if all 65 gigawatts of dispatchable generation in ERCOT was getting this type of payment ($60 per kilowatt-year) in order to incentivize the right amount of new generation to maintain proper reserve margins, it would equal around $3.9 billion for 2014 and about $5.2 billion for 2015.

With so much money at stake, it is easy to see why some Texas policymakers were not so eager to create a new forward capacity market. So far, Texas’ ORDC mechanism has provided more like $1 to $2 per kilowatt-year to generating companies, perhaps just a sign from today’s energy market that shortages are not on the planning horizon. Even if the Public Utility Commission of Texas is just delaying the inevitable for a few years, prudence has had quite a significant dividend, even while reserve margins have improved.

Why the new resources?

Comparing actual hourly generation from a CCGT plant in the Houston load zone to day-ahead prices from the same zone further complicates the question. For 2014, the plant looked like it was making roughly $51/kilowatt-year in net revenue. Taking into account other revenues from ancillary services and possibly transmission congestion pricing, this seems in line with the $57/kilowatt-year figure quoted above for a typical CCGT facility. For 2015, when natural gas prices dropped by about 39 percent and the plant’s generation output increased markedly, revenues net of variable costs dropped to $33/kilowatt-year.

Continued gas investments seem to be waiting for coal retirements. The economics of a typical coal plant in the Houston load zone yielded, depending on assumptions, net revenues between $100 and $150 per kilowatt-year (CONE for a new coal plant is around $200/kilowatt-year) in 2014 -- bad news for investors but still a feasible proposition with some net revenue.

With low gas prices, however, 2015 became a disaster for the coal plant’s corporate owners. Net revenues in the range of $25 to $60 per kilowatt-year would barely be enough to cover fixed operations and maintenance costs, much less finance expensive new mandated pollution controls.

One way to interpret the future generation glut in ERCOT’s near-term resource forecast is as a giant game of chicken being played between coal and gas. Coal plants are hoping to hang on long enough for natural gas prices to rise, while new gas plant investors anticipate imminent retirements across the coal fleet. Meanwhile, wind and solar (and soon storage) will be eating their lunch, assuming technology costs continue to drop or gas prices return to 2014 levels.

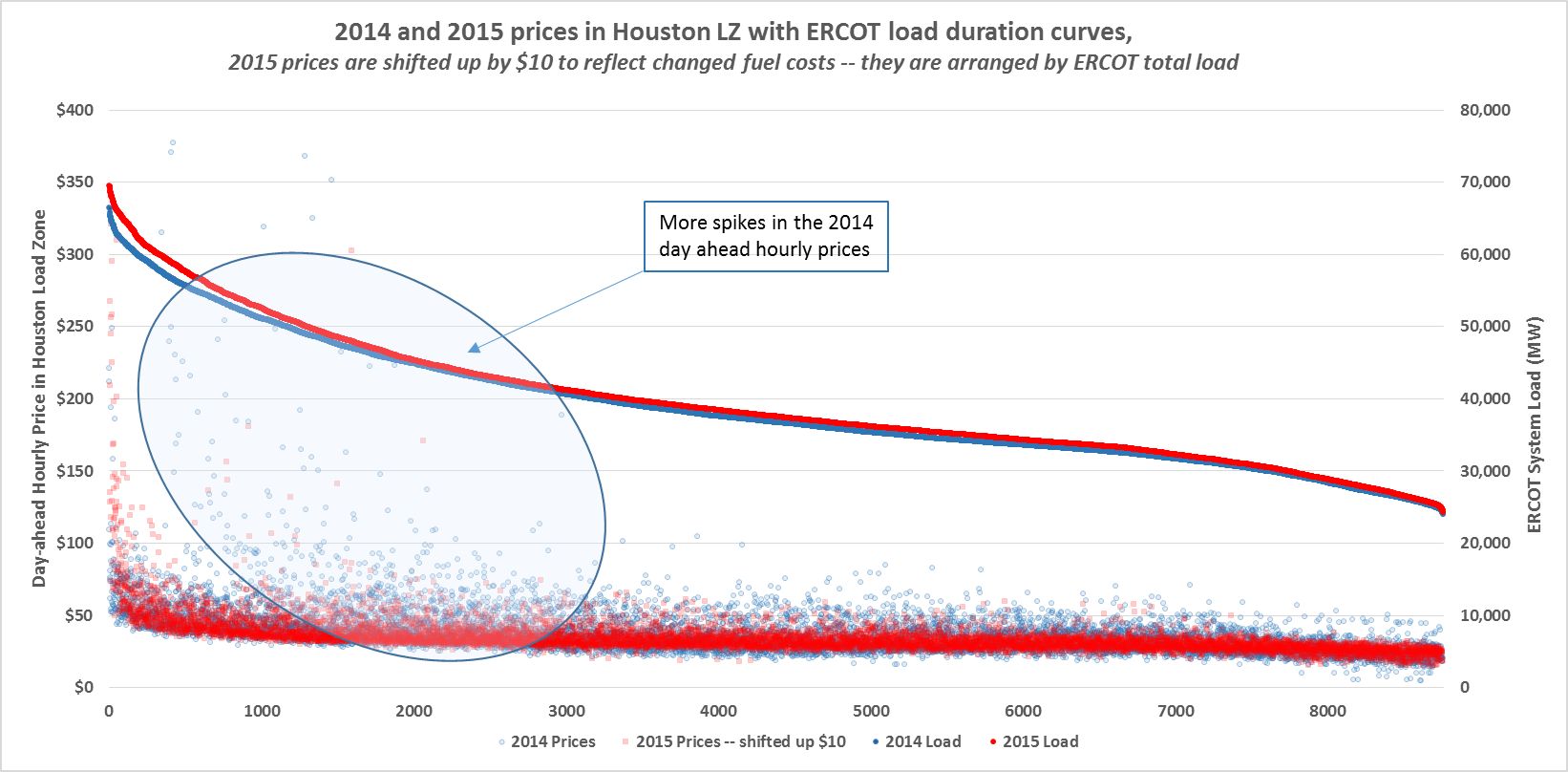

Implications for ERCOT

The transition described above, and its associated surplus, has had two principal effects. First, wholesale electricity payments dropped significantly (about $4 billion, or roughly 30 percent) from 2014 to 2015, mostly due to falling average natural-gas prices (about a $10/megawatt-hour drop in day-ahead prices across the board). Second, reduced price volatility has delivered savings reflecting a more reliable system. New CCGT capacity on top of existing coal and new wind and solar resources has added capacity and flexibility to the supply mix, preventing wholesale price spikes.

Markedly visible tightening of the hourly price distribution in the graph above implies a reduced likelihood of scarcity conditions during those times for 2015. This tightening, unrelated to meeting system peak, also helps explain the significant drop in CCGT net revenues mentioned above.

Why the current overcapacity in ERCOT matters

Savings from lower gas prices and increased renewables in Texas’ wholesale market should eventually benefit all consumers. A forward capacity market focused on recovering CONE for existing power generation companies would have erased much of these savings and prevented consumers from reaping dividends of the coal generation transition to gas and renewables, with several years of system over-capacity and net revenues below CONE.

Fortunately for consumers, Texas regulators have let market participants assume the risk of reading the energy tea leaves. Allowing incumbent generating companies to recover CONE through forward capacity markets during a transition away from coal in other organized wholesale markets may have resulted to a huge giveaway to incumbents. Considering that Texas’ potential $9 billion of avoided “revenue sufficiency” payments over two years could have been used to fund an extra 8 percent to 12 percent of peak capacity in CCGTs, decision-makers elsewhere should reconsider using forward capacity markets to balance energy revenues in order to recover CONE.

The laws of economics will eventually rule as Texas’ energy transition develops. Continued low electricity prices will either drive out coal capacity, or planned new generation projects will have to be canceled due to unattractive prospective returns. If statewide electricity consumption continues growing, wholesale prices will have to rise to entice new investment from power generation companies, or planning reserve margins will drop again.

But if renewable energy and demand-side resources continue their remarkable growth and price declines to provide cheaper grid services and flexibility, the CONE for CCGTs may become the wrong metric for evaluating a sustainable wholesale electricity market.

Decision-makers for wholesale markets must ask whether it makes sense to tie the fulfillment of reliability needs for several hundred random hours in the year to the ability of generating companies to collect sufficient revenues running most of the year. Gathering the necessary flexible resources through ancillary markets or capabilities markets and leaving the rest of the generation fleet to focus on energy provision at least cost, through attrition of the least efficient units, makes economic sense.

Flexibility and capacity can come from myriad sources. Well-designed markets and technology agnosticism on how best to maintain reliability can ensure that wholesale electricity markets like ERCOT keep on saving.

***

Eric Gimon represents America's Power Plan. Thanks to Eleanor Stein, Marilu Hastings, Nelson Nease, Mike Hogan and Bob King for their input on this piece. The author is responsible for its final content.