Tesla Motors has officially hit 325,000 Model 3 reservations representing $14 billion in future sales, one week after unveiling the long-range electric vehicle.

That is a stunning figure that surpasses all expectations. It represents nearly three times the total number of electric vehicles -- both battery electric and plug-in hybrid -- sold in 2015.

Last Friday, CEO Elon Musk tweeted that reservations had reached 198,000 in 24 hours. Tesla claims that is the highest single-day sales of any product in world history.

In the first three days, Tesla received 276,000 orders, representing around $11.5 billion in future sales, according to Bloomberg New Energy Finance. For comparison, Apple sold a record 10 million iPhone 6 models three days after the product launch, representing $3.5 billion in sales.

Reservations do not necessarily translate to sales, however. The $1,000 deposits are fully refundable and so customers can ask for their money back as their needs change over the next few years.

Still, 325,000 reservations at $1,000 a pop amounts to a phenomenally successful crowdfunding campaign. With more than $300 million in hand, Tesla could meet its target to become cash flow positive in March.

Next, the company will actually have to execute on Musk’s vision. Tesla plans to start deliveries of the Model 3 in late 2017, as it ramps vehicle production to 500,000 units by 2020. At this rate, a good chunk of future Model 3 customers are looking at a wait time of three or more years.

Model S and Model X customers face wait times too. Amid the Model 3 excitement, Tesla announced on Monday that it missed its first quarter delivery target by almost 1,200 units, or about 7 percent. Q1 deliveries consisted of 12,420 Model S vehicles and 2,400 Model X vehicles. This represents a nearly 50 percent increase over Q1 2015, but points to weaknesses in Tesla’s production plans.

“The root causes of the parts shortages were: Tesla's hubris in adding far too much new technology to the Model X in version 1, insufficient supplier capability validation, and Tesla not having broad enough internal capability to manufacture the parts in-house,” according to a company press release. “The parts in question were only half a dozen out of more than 8,000 unique parts; nonetheless, missing even one part means a car cannot be delivered. Tesla is addressing all three root causes to ensure that these mistakes are not repeated with the Model 3 launch.”

To speed up deliveries, Tesla plans to make the first Model 3 deliveries close to its factory in California and then move east in a staggered fashion. This is less than ideal for East Coasters who waited in long lines to make reservations, but Tesla insists the staggered deliveries will result in “the best possible customer experience.”

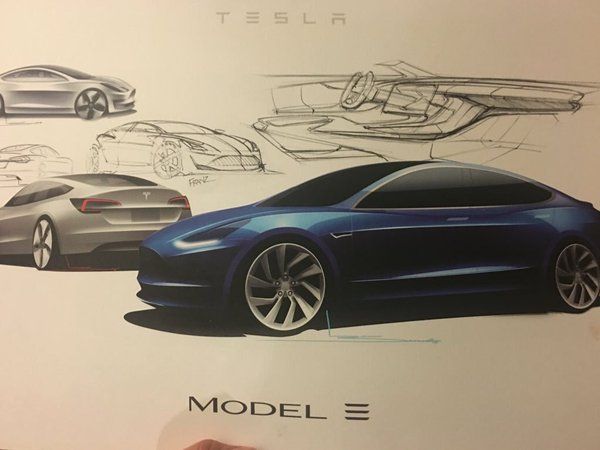

Musk stoked consumer interest over the weekend by holding an impromptu question-and-answer session on social media. The CEO tweeted out Model 3 design sketches and assured future customers that the Model 3 would have a vegan interior option, comfortably fit two child seats and “feel like a spaceship.” All of this on top of a 215-mile electric range at a base price of $35,000.

Fans are thrilled, but financial analysts are hesitant.

Brian Johnson, analyst at Barclays, said Tesla “faces unappreciated risk in ramping volumes,” and will struggle to become a mass-market vehicle manufacturer.

RBC analyst Joseph Spak has a similar outlook: "Demand was never really our concern; it is more about execution and getting production up to meet demand.”

At the time of publication, Tesla’s stock price stood at $260 per share -- a six-month high -- rising over the past week on news of the Model 3 launch. Morgan Stanley analyst Adam Jonas, a long-time bull on Tesla, believes the stock could reach $333 per share. Other analysts are more reserved. As the hype fades, Barclays’ Johnson expects the stock to drop to $165 over the next 12 months.