The timing isn’t great for Tesla to be entering a new market segment.

Elon Musk’s high-tech energy and transportation company is already overwhelmed with production delays, a massive backlog of Model 3 deliveries, a restructuring solar business and several disaster response efforts underway around the globe. Amid all of this, Tesla just logged its largest quarterly loss yet.

Tesla’s decision to enter the electric semi-truck business comes with the added challenge of serving a customer base that’s laser-focused on cost. While everyday consumers can be won over with aesthetics and special features, truck fleet operators prioritize reliability, performance and economics.

There’s a reason why UPS optimizes its routes so that truck drivers rarely have to turn left: It saves the company 10 million gallons of fuel, avoids 22,000 tons of carbon dioxide emissions, and enables UPS to deliver 350,000 more packages each year. To be successful, the Tesla truck will have to do much more than wow an audience of tech consumers; it will have to impress the math wizards in an industry that excels in planning and logistics.

Tonight's Tesla Semi unveiling in Hawthorne, California wasn't about the nitty-gritty information, though. It was about fueling hype and excitement in a way that only Musk can. And one thing is for sure: the Tesla truck has captured the trucking industry’s attention and -- if the deafening cheers at the launch event are any indication -- has blown the minds of Musk fans (as promised). The surprise unveiling of the next-generation Tesla Roadster certainly didn't hurt.

Reporting from the Tesla Semi unveiling in Hawthorne, California. Source: Julia Pyper

Here's what we know about the Semi so far.

First of all, it has a 500-mile range at maximum weight and at highway speed, which is a big deal -- if Musk can actually pull it off. Given that the vast majority of freight moves less than 250 miles, this opens up a significant market opportunity for Tesla. However, according to researchers at Carnegie Mellon University, battery-powered semis only make sense around the 300-mile range, or else they’ll cost a fortune and have limited cargo capacity due to the weight and volume of the technology. For reasons stated in more detail below, there’s likely to be a healthy amount of skepticism in the trucking sector around Tesla’s ability to reach those numbers at an affordable price, in real-world applications.

Musk said Tesla was able to achieve a 500-mile range in part because the Semi “is shaped like a bullet” with a 0.36 drag coefficient, which is on par with a supercar. And to make charging convenient, Semis will be served by “Megachargers,” a new high-speed DC charging solution that Tesla says will add about 400 miles of range in 30 minutes.

Musk didn’t give any details on where or when Tesla will begin to build out the truck stations, but he did say they would be powered by solar and coupled with the Tesla Powerpack so that trucks are literally “running on sunlight.” Just like the Supercharger network, “you’ll be able to travel anywhere in the world on the Tesla Megacharger network,” he said. And because it’s a proprietary Tesla offering, “we can guarantee the electricity rates,” he added. Musk pegged the charging at a wholesale price of 7 cents per kilowatt-hour -- which is likely to prompt some questions among electricity experts.

At 7 cents per kilowatt-hour, assuming a diesel fuel price of $2.50 per gallon, coupled with insurance and maintenance costs, a Tesla Semi driven at 60 miles per hour with an full load on a 100-mile route would cost about $1.26 a mile to operate, compared to $1.51 per mile for a diesel truck, Musk said.

All in, the average diesel truck will be 20 percent more expensive than a Tesla Semi, according to Musk. Adding to the value proposition, Tesla Semis will be capable of platooning, and in that configuration a diesel truck will be twice as expensive, he said. The ability to digitally link trucks together for greater efficiency makes it “not just economic suicide to use one diesel truck; it’s economic suicide for rail,” said Musk.

The interior of the Tesla Semi with two Model 3 touchscreens. Source: Tesla

Here are some of the other takeaways:

• The Tesla Semi can travel 0-60 miles per hour in 20 seconds with an 80,000-pound load, a task that takes a diesel truck about a minute.

• The truck has one gear, which makes it smooth to drive, “just like driving a Model S, a Model X or a Model 3,” said Musk.

• Each wheel is propelled by its own Model 3 motor, which gives the truck more power and means that production will benefit from economies of scale.

• Like Tesla's light-duty vehicles, the battery pack is laid out flat along the undercarriage, which keeps the center of gravity low, allowing for an improved driving experience.

• The battery is similar in composition to the batteries of Tesla energy products "and is designed to support repeated charging cycles."

• As an electric vehicle, the Semi offers smooth acceleration and regenerative braking that recovers 98 percent of kinetic energy to the battery.

• It's a "day truck," so it does not have a space to sleep.

• The driver is seated in the center of the cab for maximum control and visibility (although this could strike many of today’s truck drivers as odd).

• The cab is outfitted with two Model 3 touchscreen displays, with a host of build-in capabilities such as data logging, routing and remote monitoring. These features have to be added separately in traditional diesel trucks.

• The Semi is equipped with Automatic Emergency Braking, Automatic Lane Keeping and Lane Departure Warning.

• Cameras are installed throughout the truck, enhancing safety by giving the driver a wide view of his or her surroundings. The cameras will presumably be used to enable full autonomy some day.

• The reinforced battery shields the Semi from impact, its windshield is made of impact-resistant glass and jackknifing is prevented by the Semi's onboard sensors.

• Musk pledged the Semi will have a 1-million-mile guarantee.

• It has a frunk.

Anyone interested in purchasing the Tesla Semi can put down a reservation for $5,000 per truck. Musk said production is set to begin in 2019.

Even with all of this information, there's a lot we still don't know about the Tesla Semi Truck. Musk did not address the vehicle’s upfront cost or weight. The truck design may also require owners to invest in different kinds of equipment, like special tires or charging infrastructure. Plus, it’s unclear how Tesla’s prototype will hold up over time.

To be fair, Tesla billed tonight's event as an "unveiling" and not an official "product launch," so it makes sense that Musk wouldn't share all of the details just yet. Still, his bold claims, coupled with the showy event and a lack of specifics, leave some industry observers wondering how serious Tesla really is about bringing an electric freight truck to market, and whether or not it's a distraction from the company's financial woes.

Economics and competitors

Tesla competitor BYD is perhaps the most excited about Tesla's truck plans.

Tesla’s announcement is “great for us,” said Zachary Kahn, director of government relations for BYD Heavy Industries North America, speaking at GTM's Power & Renewables conference last week. “Right now we’re the only one pushing in the U.S. To get that competition and marketing space Elon brings to the table will only help the whole industry.”

The American Trucking Associations greeted the Tesla Semi with an open mind. “ATA supports continued innovation and technological advancements in the heavy-duty truck, engine and fuels markets," said Sean McNally, vice president of public affairs for ATA, in an email. "Electrification, if accepted within the trucking community, will afford fleets another purchasing option as they continue to deliver the nation’s goods in a safe and efficient manner.”

Being "accepted within the trucking community" is the key phrase here. Electric buses and refuse trucks are starting to gain market traction because they have short, predictable routes and benefit greatly from regenerative braking. Battery electric freight trucks are only just starting to prove their value.

“I think everyone realizes that eventually we want to decarbonize the transport sector, and I think we have a clear view on the light-duty side," said Rachel Muncrief, program director for heavy-duty vehicles at the International Council on Clean Transportation. "It’s always been a little bit more hazy on how we do that in the trucking sector, especially the long-haul freight sector.”

“We’re a lot closer to having a clear picture on how to decarbonize long-haul freights than we used to,” she added. “But it all comes down to economics.”

Diesel semis with all of the latest emissions controls run around $125,000 to $140,000 per unit today. Electric trucks from BYD, one of the very few companies offering electric trucks today, cost around $325,000 each and have ranges of under 100 miles.

Established trucking companies have designed vehicles with similar ranges. Scooping Tesla, the market-leading diesel engine manufacturer Cummins unveiled a 100-mile Class 7 electric concept truck named AEOS in August, but so far there are no plans to commercialize it. Cummins says it will bring to market an all-electric powertrain in 2019, but it will be a smaller platform designed for urban transit and delivery markets. Daimler unveiled its own electric semi-truck prototype last month -- the operative word being “prototype" -- that's said to be able to travel 220 miles before recharging.

Daimler's E-FUSO Vision One, a heavy-duty all-electric truck with a 220-mile range.

In it for the long haul?

Around 300 miles is as long-range as electric trucks are currently expected get, said Patrick Couch, vice president of technical services at Gladstein, Neandross & Associates, a clean transportation and energy consulting firm.

"We're seeing electric truck platforms beginning to have enough range to access certain niches within the trucking market...that may be local and regional haul trucks or port trucks," he said. For longer-range trucks, "I don’t think we’re going to see a technology solution in the near term."

Batteries are by far the biggest limitation for electric trucks, said Couch. It takes a lot of energy to move around a tractor-trailer, which means that these vehicles need big batteries, which adds more weight to the vehicle and could affect the size of the load the truck can haul. In an industry where expenses make up more than 90 percent of revenues, companies pay close attention to how much product they can carry. Battery technology today just isn’t at a place where it can serve the needs of long-haul trucking companies.

"Payload and cost of the battery pack are two of the biggest issues preventing electric trucks from getting to those long ranges," Couch said.

While Tesla's battery chemistry is expected to give it a leg up on the electric truck competition, hydrogen fuel cell trucks may have the advantage here. Salt Lake City-based Nikola Motor Company (Nikola and Tesla, there's a theme here) recently unveiled a hydrogen-electric long-haul truck that's said to be able to travel 1,200 miles on a tank of hydrogen and be market-ready by 2020.

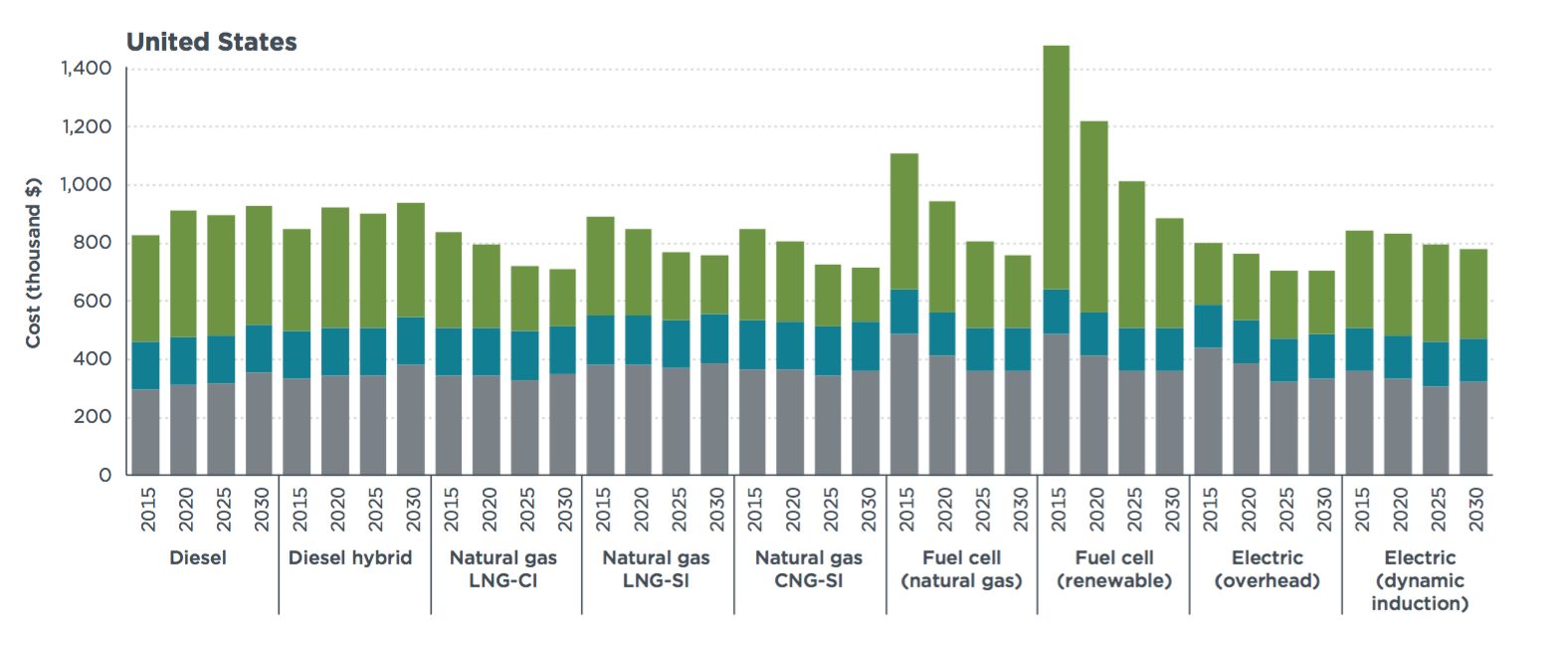

A recent report published by the International Council on Clean Transportation on heavy-duty freight vehicles excluded plug-in electric trucks, because they are simply not considered feasible due to battery size and range issues -- even for regional travel. Trucks powered by wireless charging and overhead charging -- like Siemens' eHighway demonstration now operating in Los Angeles -- were found to be cost-competitive with diesel and natural gas in the 2030 timeframe. However, ICCT's calculations did not include the cost of installing infrastructure, which is a big caveat.

In an interview on the sidelines of the truck launch event, long-time trucking commentator Steve Sturgess suggested that Tesla may not be too concerned about battery range because it's only interested in making a truck capable of hauling the batteries it makes at its Gigafactory in Reno to its vehicle manufacturing plant in Fremont -- a roughly 240-mile journey. If that is the plan, "Tesla just has to size the truck batteries right for that use case," he said.

Source: ICCT

Autonomous trucking and an "alternate dimension"

Assuming Tesla does want to sell its electric trucks widely, getting into the business isn't the worst idea.

For one thing, the company’s brand awareness and sleek, high-tech design could attract the next generation of truck drivers -- something the industry is desperate for. Large truckload carriers have a 90 percent turnover rate. According to Sturgess, it costs a company up to $20,000 every time they have to replace a driver. “You can buy a lot of fuel with that,” he said. If the Tesla Semi can keep drivers on the road, it could justify some of the additional up-front cost, although that will be a tricky metric to measure before making the investment.

The trucking industry's attention to detail could play into the hands of companies with electric offerings, though. While the upfront cost of an electric truck is likely to be higher than an established diesel competitor's, electric vehicles boast lower maintenance costs because there are fewer moving parts and there’s less fuel price volatility and more potential fuel savings. These factors could make an EV look better from an operational standpoint, as Musk said. And as the technology improves and if regulations continue to tighten -- which it seems likely they will -- the cost case will only improve.

In the meantime, though, there are easier ways to decarbonize the trucking sector than with electrification.

“Tesla’s effort is extremely ambitious, and while electric trucks are likely part of the future, there’s lower-hanging fruit available in the near term that will displace petroleum out of the trucking sector,” said Leslie Hayward, vice president of communications for Securing America’s Future Energy (SAFE), a nonpartisan organization that aims to reduce America's dependence on oil.

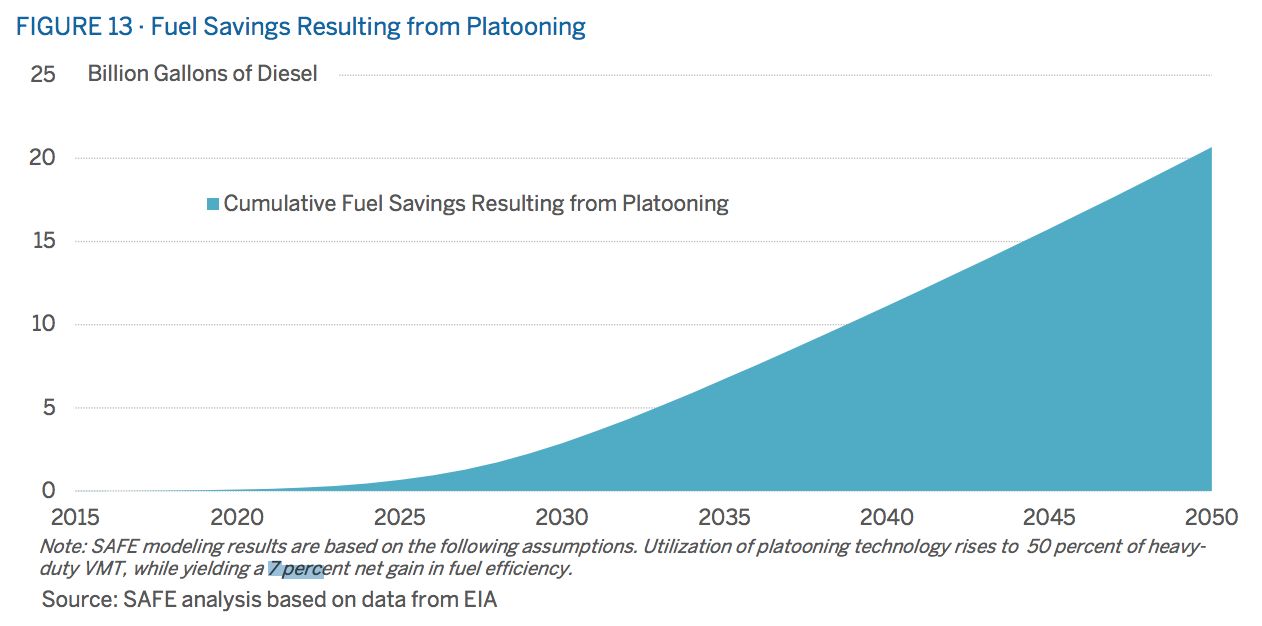

Phase 2 efficiency rules, natural-gas vehicles and advanced driver-assist technologies, such as platooning, all offer meaningful fuel savings, said Hayward. According to a recent SAFE report, platooning -- which allows for two or more heavy-duty trucks to be connected through vehicle-to-vehicle communication technology -- can reduce fuel use by up to 7 percent, depending on the technology and its application. No electrification necessary.

If widely adopted, platooning technology could save a cumulative 20 billion gallons of diesel by 2050 in the heavy-duty segment, the study found. A few companies, including Peloton Technology, are already implementing this solution.

The SAFE report also found that the trucking industry is likely to be an early implementer of autonomous vehicle technology “because freight transportation presents a more predictable and less complex driving environment than urban roads.” This is an area where Tesla clearly hopes to have a competitive advantage with the Semi, given that there are cameras installed throughout the vehicle.

But Tesla may have some catching up to do. Daimler unveiled the Freightliner Inspiration Truck, the first licensed autonomous commercial truck to operate on an open public highway in the United States, in a showy unveiling at the Hoover Dam in 2015. On the flip side, it may not be wise for manufacturers to pitch a technology that will have such profound implications for trucking company employees.

Tesla seems to be aware of this tension. Musk's Master Plan Part Deux, where Tesla first announced plans to build a truck, specifically says the Semi will be "really fun to operate.” In previous talks, Musk underscored that Tesla is designing the truck with the freight industry's priorities at heart.

“We’re getting them closely involved in the design process, so the biggest customers of the heavy-duty Tesla Semi are helping ensure that it is specified to their needs, so it’s not a mystery,” Musk said on a conference call in June. “They already know that it’s going to meet their needs, because they’ve told us what those needs are. So it’ll really just be a question of scaling volume to make as many as we can.”

Musk's comments were a little less down to earth when he announced that the Semi unveiling would “blow your mind clear out of your skull and into an alternate dimension.”

While the unveil was impressive and the technology has the potential to have a major impact on the trucking sector, Musk will need to keep himself grounded to make any of these plans a reality.

An earlier version of this story incorrectly stated that Cummins will bring an electric Class 7 truck to market in 2019. Cummins will bring a smaller, electric powertrain to market in 2019. The Class 7 AEOS truck is a concept.