Tendril, the Boulder, Colo.-based startup that rode the home energy management investment bubble (and then downsized after the bubble burst), has networked millions of homes with smart thermostats, home energy displays and online data portals for its utility customers.

Now it wants to add physics-based home energy models and microtargeted consumer data to that mix -- not just for utilities, but for third-party energy services providers like Nest, NRG Energy and SolarCity.

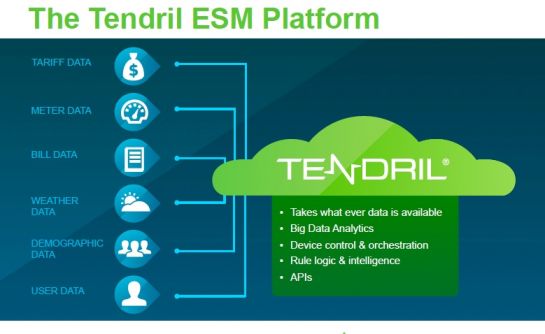

That’s how CEO Adrian Tuck described the ambitions of Tendril’s new Energy Services Management (ESM) platform, released this week. Building on its already hefty load of home energy data, the company has added home modeling capabilities that Tuck called “accurate within a few percentage points in predicting your energy consumption,” built on both publicly available and proprietary data.

“All we need is a name and an address” to build that model, he said. Adding utility energy data, ranging from monthly meter reads to fifteen-minute smart-meter intervals, fleshes out the picture.

That, in turn, can help the company’s utility customers microtarget specific energy saving products and services to individuals who share the same home characteristics, Tuck said in a recent interview. By tracking individual buying and spending decisions against changes in household energy data, it can also monitor and report on the results -- an important feature for utilities spending billions of dollars on mandated efficiency programs.

“We’re able to take all of those customers and say, I’m looking for people who live in single-family homes, in this area, who are property owners, when the temperature is above Y degrees, that they’ve shown a propensity to do this," said Tuck. “We find the 50,000 people in the East Bay who are going to be most likely to buy a product…and through the physics engine, we can give each individual a reason to buy.”

These aren’t claims unique to Tendril, of course. Arlington, Va.-based Opower has tens of millions of utility customers using its paper, email and web-based energy reports, and is collecting all that data to inform its behavior analytics. Nest has deployed a million smart thermostats, and will presumably be mining and analyzing that data under Google’s ownership. Big-data analytics startups like AutoGrid and C3 Energy are collecting and crunching tons of data from sources around the country to inform utilities about how their residential customers behave and react.

In Tendril’s case, it has built the ESM’s consumer and behavioral analytics on the technology of Grounded Power, the startup it bought in 2010, and has based its home modeling expertise on the technology of Recurve Software, which it bought in 2012. Tendril has been generating mailed paper reports like Opower’s, as well as mobile, online and HEM device interactions with utility customers, including a contract with Duke Energy that’s on the way to encompassing 3 million homes across five states, Tuck said.

The benefits come from better knowing which customers to target and how best to communicate with them, explained Tuck. Tendril has response rates of 5 percent to 15 percent, compared to a more typical 2 percent to 3 percent for a traditional utility efficiency program. As for “opt-out” programs, which go to every utility customer that doesn’t decline it, the company is seeing roughly 25 percent conversion to web and email interaction from the initial paper reports, he said.

Tendril is reporting about 1 percent to 3 percent energy savings from mailed reports -- similar to Opower's results -- and about 5 percent to 10 percent as people opt in, set goals, and start acting differently around the house. Adding smart thermostats or home energy controls can boost that to nearly 25 percent reduction during peak hours, something that companies like Silver Spring Networks and AutoGrid are proving out with more than 40,000 Oklahoma Gas & Electric customers.

“Tendril’s name never appears anywhere on this stuff,” he added. “We’re the supplier of technology to others. Almost all of our historical projects have been utility projects.”

But that doesn’t mean that Tuck isn’t looking at third-party energy services providers, from retail electricity utilities and players like NRG Energy, home security and automation players like Vivint, Comcast or Alarm.com, or third-party solar (and energy storage) providers like SolarCity.

“Based on my experience, this costs you $100 million in software” to accomplish, Tuck said -- a nod to the more than $100 million in venture capital Tendril has raised since its 2004 founding. Tendril was also a beneficiary of the Department of Energy’s smart grid stimulus grant program, which funded HEM deployments for some of its nearly 50 utility partners.

But the company almost went under at the turn of the decade, as stimulus money petered out for its hardware and networking-centric product business. After a severe downsizing and restructuring around software and services, Tendril is on a path to 50 percent growth this year, and the company is operating at a profit, said Tuck.

Now all it has to do is compete and coexist with huge competitors like Honeywell or Schneider Electric, and its fellow startups that are eyeing the emerging multi-billion-dollar market for energy-aware home technologies.