Is it a temporary headache, or are bad times ahead for the solar industry?

SunPower today announced that its second-quarter losses would be greater than anticipated. Non-GAAP losses should come to around 19 to 20 cents per share, more severe than the five cent loss to ten cent non-GAAP profit expected earlier. Gross margin will come to 12 percent to 13 percent instead of 15 percent to 17 percent.

Margins in the first quarter came to 19.6 percent and the first quarter margins represented a disappointing slide from earlier times. So in all, this is a curve that goes down to the right.

"While we met our revenue goals for the second quarter, our gross margin and bottom line performance was impacted by market conditions in Germany and Italy," said Tom Werner, SunPower president and CEO. The quarter also includes one-time charges of $75 million. Including all expenses, losses should come to $1.50 to $1.55 per share.

As a highlight, Werner said that SunPower continues to cut costs and that it reduced inventory. Revenue will come in at $590 million to $595 million, in line with earlier estimates of revenue at $550 million to $600 million.

It is a refrain that has been heard before. In the first quarter, SunPower's revenue came to $451 million, well above the $347 million of the first quarter of 2010 but below expectations. European conditions were to blame.

One can imagine the new corporate masters at Total are thrilled. The French oil giant bought 60 percent of SunPower in April for around $1.4 billion.

Although SunPower makes some of the more expensive (and efficient) panels in the industry, these problems will send chills through the solar world and prompt debate over whether the industry is going through an interim lull or is on the verge of extended dismal times. Simply put, the world has a lot of manufacturing capacity and governments are clinching up on rebates and incentives. Italy and Germany both revised their incentive programs earlier in the year.

Demand for solar, however, continues to climb, and some of the inventory overhang from April that depressed prices earlier in the year has been reduced. The SunPower results could thus be a reflection of the past as much as the future.

Still, the outlook for the third and fourth quarter remains murky.

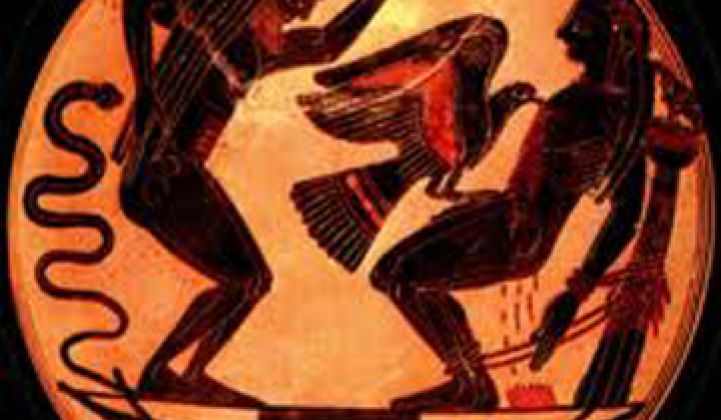

Solar execs have also told me they've been worried about consolidation in the industry since the beginning of the year. Go to a show like Intersolar. You'll see rows and rows of nearly identical crystalline panels. Solar panels in some ways have become the energy world's equivalent of flash memory chips: technically challenging products to manufacture that get sold like commodities. Staying in the market means spending billions just to break even; at some point, it's no longer a business for some manufacturers. It's more like a bad gambling habit. (The picture shows Prometheus, who brought fire to man, getting his liver eaten out by a sacred bird as punishment. Amazing how the ancients predicted this one.)

The economics surrounding panels helps explain why balance-of-system costs will soon account for more of the cost of a solar system than the panels themselves.

REC last week said that its second quarter revenue declined 17 percent from the first quarter -- not the second quarter of 2010 but the previous quarter -- because of module and cell price declines.

Wafer prices are also sharply in decline, sources have told us recently.