SunEdison announced today that it plans to separate its semiconductor business from its project development business by spinning it off into a separate public entity.

The company plans to file an S-1 next month, with the actual public offering expected to take place next year. Proceeds from the IPO of SunEdison Semiconductor will be used to grow the company's project development pipeline and pay off debt.

The company lost $102.9 million in the first quarter of 2013 largely due to a downturn in the semiconductor market. The company's stock climbed up 19 percent this morning after the announcement.

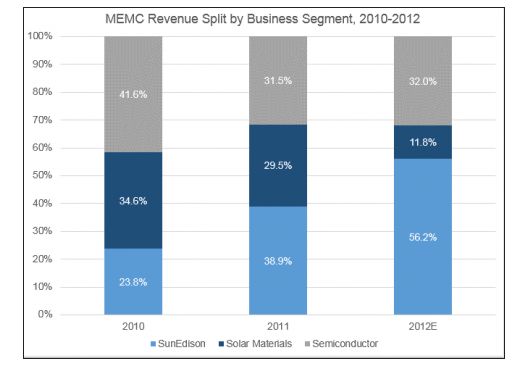

In 2009, SunEdison was acquired by the semiconductor company MEMC. Earlier this March, SunEdison became a public company when MEMC formally changed its name to SunEdison, illustrating the importance of solar project development revenues over semiconductor manufacturing.

Shayle Kann, vice president of GTM Research, explained why the separation made sense, considering these earlier moves by MEMC.

"At the time, a lot of people -- particularly Wall Street -- puzzled over why a wafer manufacturer would integrate all the way downstream with a big project developer acquisition. But it turns out to have been a pretty prescient move, because the development business has become MEMC's dominant source of revenue in a way that almost definitely would not have been true if, instead, it had acquired a cell/module manufacturer," said Kann.

Source: GTM Research Competitive Intelligence Tracker

Analysts expect SunEdison's semiconductor business to generate $950 million in revenues in 2013. However, sales dropped by more than $42 million in Q1 of 2013 due to a slump in the global semiconductor market.

Shyam Mehta, a senior analyst at GTM Research, agreed that the spinoff "makes sense."

"Given that SunEdison's dominant business segment in solar is in the area of project development (and has been for quite some time), it makes sense to separate the solar and semi business segments at this juncture. There are no real synergies to be gained, as there were when MEMC entered the solar wafer manufacturing business -- which is now only a small minority of its revenue. The market dynamics and cash flow cycles for commodity component manufacturing (semi wafers) and solar project development are markedly different," said Mehta.

GTM Research will be hosting a webinar with Mehta today on technology trends and market dynamics in solar manufacturing.

SunEdison's project development pipeline is nearly 3 gigawatts. The company also said it plans to expand further into residential solar PV and solar hot water with an acquisition of the Khosla-backed company EchoFirst.