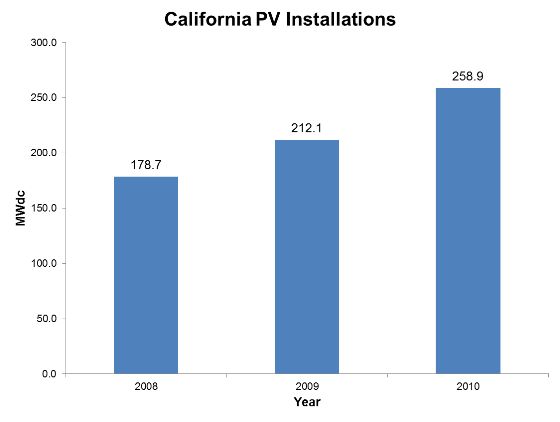

While California retained its position as the largest state market in the country, the number of installations in the state grew by only 22% from 212.1 MWdc in 2009 to 258.9 MWdc in 2010. The majority of this capacity came from residential (127 MWdc) and non-residential (109 MWdc) installations, with only 22.1 MWdc of utility projects coming online in 2010.

The strength of the California PV market is strongly influenced by state incentives and programs. The California Solar Initiative, started in 2006 to provide over $3 billion of incentives to solar-energy projects with the objective of providing 3000 MW of capacity by 2016, drives much of the demand in the state. In 2010, CSI installations remained relatively flat, adding an additional 177.1 MWdc of capacity through residential and non-residential installations. Additionally, the CPUC reports that it received applications for 425 MW of PV projects in 2010. However, it appears that the program may be ready to expire within the year. PG&E and SDG&E have both reached budgetary limits for non-residential incentives. The utilities are still accepting reservation request applications, though there is no incentive guarantee.

Furthermore, there is strong support for solar energy generation in California from Governor Jerry Brown. In April 2011 Brown signed a mandate stating that 33% of the state’s electricity must come from renewable sources by 2020. Three months later, at the July 25 Conference on Local Renewable Energy Resources at UCLA, Brown pushed for a significant amount of CA solar to come from distributed generation. The governor called for 12 GW of energy from urban rooftop solar, wind turbines, fuel cells and other small scale technologies by 2020. It is clear that the direction of the California solar market will continue to be influenced by state incentives and programs well into the future.