Yesterday we reported that PG&E awarded 50 megawatts of solar PPAs to three different parties.

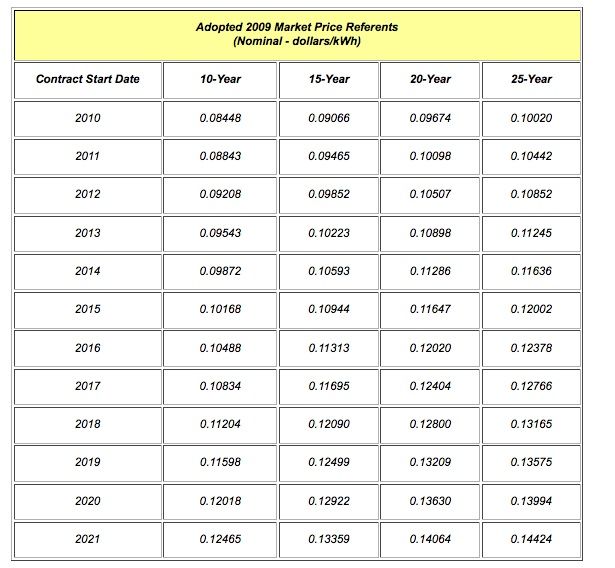

According to the pertinent CPUC advice letter, "Each of the three PPA prices is below the 2009 MPR for the 20-year delivery terms of the contracts beginning in 2013." And according to this CPUC document, 20-year contracts in 2013 have a market price referent of $0.109. The chart and this week's featured number of merit is below.

This suggests that solar project price bids into the grid are undercutting the price for natural gas. That's both good and bad.

It's good because it looks like solar can compete head-on with gas peaker plant power pricing. It might be bad because it's created, in the words of Glen Davis, CEO of Agile Energy, "a hyper-competitive space."

Now hyper-competitive might sound like a good thing -- the invisible hand of competition and all that. But it's the pricing of PPAs that keeps Davis of Agile Energy "up at night," in his words.

In Europe's feed-in tariff scheme, you sell into the market at a set -- admittedly fat -- price. But for Davis or any solar developer to win a PPA in the U.S., the tendency is to offer pricing that just gets lower and lower over time.

"If you're going to participate, you have to be aggressive," said Davis.

But in bidding on projects for 2012, 2013, and 2014 -- with uncertainties about the cost of money, interest rates, and equipment prices -- "the result is that margins are increasingly thin" and it becomes questionable as to whether some of these projects can be brought to market without ruining the bidders.

In a related note, Herman Trabish wrote an article yesterday that quoted pricing in the best wind markets around the country in the three cents per kilowatt-hour range.