SoloPower is amongst the early wave of VC-funded CIGS-based photovoltaic entrants, all of whom have earned their share of bruises along the way.

Solyndra, with its cylindrical CIGS tubes, had to pull its IPO. MiaSolé over-promised, under-delivered, jettisoned its CEO, and is now rebounding with a new CEO. NanoSolar lost their CEO amidst some disappointments. Heliovolt recently closed a very down round after switching out its CEO. VCs have a very limited playbook.

And now SoloPower, equipped with a new CEO and with some boardroom nastiness behind it, is looking to close a government loan "in the low hundred millions" to help finance the factory build-out of its CIGS-based, flexible thin-film photovoltaic modules. SoloPower uses a roll-to-roll electrodeposition process, as opposed to the sputtering, printing or evaporation processes used by most CIGS vendors. SoloPower says this allows it to utilize nearly 100 percent of the chemicals it employs in the process, which is much greater than the rate achieved using other CIGS processes. And according to the CEO, Tim Harris, "Many have tried plating [CIGS] but few have succeeded." Note that the plating does not have to be done in high vacuum like the other processes.

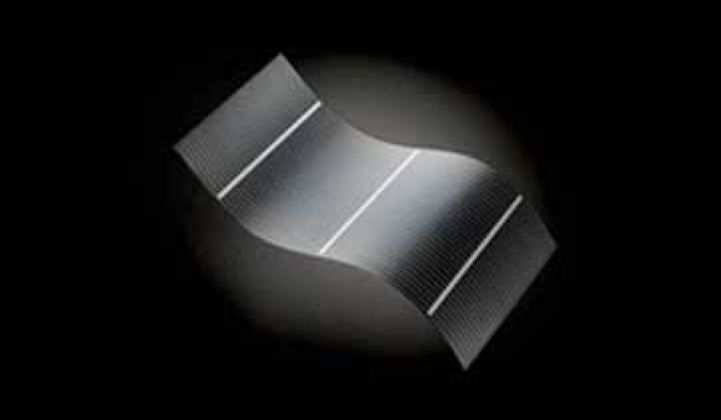

SoloPower is not building "glass sandwich" panels. According to Harris, the CEO, they've "been there, done that." Rather, SoloPower is targeting the commercial and industrial flat-roof market with applications that favor a lightweight, non-penetrating solar solution. The SoloPower panel can be rolled up and walked on.

This is where famed commenter "ECD Fan" says, "Stop perpetuating the myths that somehow there are roofs in the United States that cannot withstand glass solar panels on non-penetrating racks (a total of less than 5 psf extra dead load)" and "Each and every commercial roof in the developed world can withstand the extra 3 to 5 psf dead load required to support a glass panel PV installation."

That said -- and while we're on the topic of ECD -- SoloPower would appear to be going after the same rooftop market as ECD, except they're doing it with a far more efficient product. SoloPower modules boast a 10.5 percent to 11 percent efficiency (compare that to ECD, which ranks somewhere in the 6.5 percent range) and the CEO says that he expects CTO Mustafa Pinarbasi to improve upon that number in the coming quarters. The flexible units can be affixed to the roof with an adhesive or mounted on a lightweight non-penetrating rack.

The company also claims that lighter weight makes installation easier and reduces the cost of balance-of-system components.

The 120-employee company occupies a 110,000 square foot building on the southern outskirts of San Jose, Ca. The firm is still in sample shipping mode but expects to see "early revenue this month." Capacity for 2011 will be about 85 megawatts and growing as the firm moves from making one-foot-wide, 2000-foot-long rolls to making one-meter-wide, 6000-foot-long rolls on their manufacturing floor.

Capex is "way under a dollar" and production cost is "competitive," which means it's too early to know -- or too high to mention.

The team mentioned that First Solar's 50-person CIGS program is a validation of CIGS technology.

SoloPower has teamed with parallel distributed MPPT player eIQ to provide an integrated solar energy package that combines eIQ's parallel array wiring technology and SoloPower’s modules. The combined offering allows customers to obtain a single price quote for a solar array’s entire electrical system.

Here's a partial list of CIGS vendors and some of their recent news:

- Stion just unstealthed as a CIGS startup -- with a bit of a twist.

- MiaSolé looks to ship 13%-efficiency modules by the end of the year

- Solyndra continues to win large rooftop installations such as Anheuser-Busch, Coca Cola and Frito Lay. Inside sources say that the firm is sold out for years to come despite their troubles.

- Nanosolar's most recent announcement was the replacement of its CEO and a visit from Arnold Schwarzenegger.

- Global Solar Energy has 75 megawatts of production capacity at two sites and has recently completed a large rooftop CIGS installation.

- Solar Frontier (the former Showa Shell Solar) sold approximately 43 megawatts of CIGS PV in 2009 and could ship more than 100 megawatts this year according to Shyam Mehta, one of our esteemed solar analysts at GTM.

- AQT won $10M in funding recently and entered an agreement with Intevac.

- Dow invested in Dave Pearce's NuvoSun.

- Daystar got its fifth CEO in twelve months.

- Ascent Solar began production at its FAB 2 production plant (video here).

- Q-Cell's Solibro CIGS facility claims the highest CIGS production capacity worldwide, according to their website.

- HelioVolt announced, well, nothing. Their last press release was in June 2009. Some bad news here.

- Solarion's flexible solar cells

- Wuerth Solar's CIS panels

- Odersun partnering on CIS in China

- Sulfurcell's CIS cells

- Johanna Solar supplied panels for a Bosch building façade. Bosch is an investor in Johanna.

- Saint-Gobain subsidiary, Avancis set a 15.1 percent small aperture efficiency record early this year and just announced a new factory build.

- Illies Renewable will be starting up their CIGS turnkey line from centrotherm, targeting annual production of 36 megawatts.

- Nexcis has an electrodeposition-based CIS cell process in France.

- Other CIGS manufacturers include PV Sunshine (Centrotherm turn-key), Jennfeng, Tokyo Ohka Kogyo (TOK) together with IBM, Ritek, nanowin, and Axuntek