Solazyme--the company that produces oil for cosmetics, industrial equipment and airplanes from genetically modified algae force-fed on sugar--held its IPO today and the results were positive.

The stock climbed above $21 but closed at $20.71 (under the ticker SZYM). Solazyme sold nearly 11 million shares for $18 a share in the IPO. The company was founded and continues to be managed by two college friends, just like Microsoft, Google and Hewlett-Packard.

Here's the story on the IPO details from late last night:

Solazyme will hold its anticipated public offering tomorrow at $18 a share, slightly higher than the earlier estimated price in the range of $15 to $17.

A total of 10.975 million shares will be issued by the company and shareholders. That's almost $198 million.

It's a signature moment for a boomlet in biochemicals and biofuels. The company -- which produces algae through a fermentation process -- was one of the first to tout the power of algae, which grows faster and produces more oil per acre than corn, soy, rapeseed or other biofuel crops. Advocates say algae is capable of generating 5,000 gallons of oil or more a year per acre, compared to a few hundred at best for other crops.

Chevron, Dow Chemical, Sephora, Quantas, the U.S. Air Force and Unilever are among its strategic partners. Dow, for instance, has signed a deal with the company to develop organisms to produce algae that can make oil for transformers and other grid equipment. Dow may buy up to 20 million gallons in 2013. Investors include Lightspeed Venture Partners, Chevron and VantagePoint Venture Partners.

Like other biofuel/green chemistry companies, Solazyme is currently losing money. It generated revenues of $38 million in 2010 and lost $13.7 million. Still, other biofuel companies like Amyris and Gevo have gone public, quite successfully, while losing money in recent months. Amyris has nearly doubled in price since last year -- $100-a-barrel oil does that.

But unlike many other competitors, Solazyme has also made quite a bit of oil. It produced 455 metric tons of oil between January 2010 and February 2011. The production process the company has honed can produce fuel for $3.44 a gallon in a commercial-scale factory, according to Solazyme.

If the IPO succeeds in this frothy market, expect to see Kior, which has the preliminary paperwork for an IPO already, to move toward an offering. Sapphire Energy, which says it will be able to demonstrate its process for making biofuel out of GMO algae grown in ponds in a little over a year, may make fundraising moves as well.

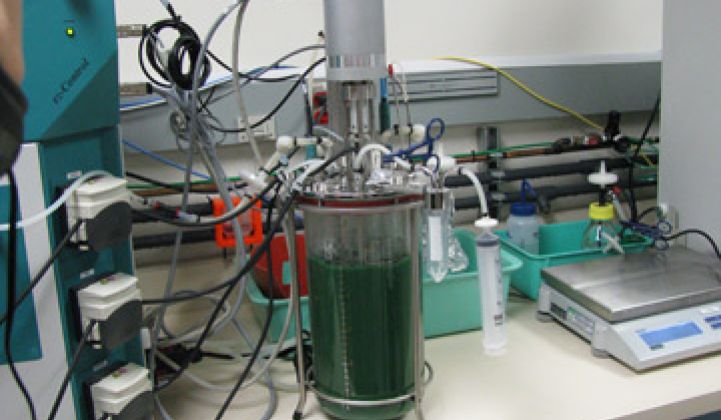

Solazyme does not grow algae through photosynthesis. It has created genetically modified microbes that feed on sugar in large fermenting kettles. When the algae get fat, Solazyme squishes them to extract the oil. Although sugar adds costs, Solazyme does not have to extract algae from water to extract the oil, which is an arduous, expensive process that photosynthesis-based companies face.

Despite the additional cost of the sugar, Solazyme has actually produced far more algae fuel than its competitors. Last year, the U.S. Navy ordered 150,000 gallons of algae-based jet fuel from Solazyme after an earlier trial.

The company was also one of the first to expand from producing fuel to making food additives, chemicals and cosmetics. In the near term, these markets will likely generate more revenue. (That's algae milk in the photo. It doesn't taste bad.)

Solazyme filed for its IPO back in March.

There's more in the video with founders Jonathan Wolfson and Harrison Dillon.