For years now, solar advocates and opponents have argued over the merits of various studies about the relative costs and benefits of distributed solar PV.

Different studies have taken different approaches and yielded different results -- so different, in fact, that the Rocky Mountain Institute wrote an entire report just to compare and contrast 16 of the most prominent studies conducted over the past decade.

Most of these studies shared a common characteristic: their focus on the broad impacts of solar proliferation across entire states or regions of the country. This makes sense when measuring the relative economic effects of solar net-metering regulations on non-solar-owning customers, or assessing how much utilities stand to gain or lose from customer-generated energy supplanting their need to sell and procure power.

But this approach doesn’t really get at an important question about how solar does, or doesn’t, support the distribution grid on a circuit-by-circuit basis. That’s a problem, because it’s at the edges of the grid where PV will have its earliest and potentially most significant effects.

Last week, UC Berkeley researchers released a report (PDF) that gets at the heart of this question. Its conclusions underscore an important idea behind policies being developed in solar-rich states like California and Hawaii -- that the grid value of distributed solar is highly dependent on where that PV is located, not just how much of it there is on the grid at large.

It’s a timely report given that next week, California’s big utilities are presenting new plans for how they’re going to incorporate distributed energy resources -- namely, rooftop solar PV -- into their multi-billion-dollar distribution grid budgets. Hawaii is undergoing a similar push to integrate distributed energy with grid costs, as is New York through its Reforming the Energy Vision proceeding.

Using data from Northern California utility Pacific Gas & Electric and solar provider SolarCity, researchers from the Energy Institute at Berkeley’s Haas School of Business modeled long-term physical and economic impacts of up to 100 percent PV penetration on a subset of PG&E’s distribution feeders. Their main goal was to find the value of distributed solar for distribution circuit capacity deferral -- in other words, how solar could help provide power to circuits that would otherwise need to be upgraded to handle peak loads, usually on hot summer afternoons.

This capacity deferral value was relatively low when averaged out across all of PG&E’s feeders -- up to $6 per kilowatt-year. That’s a tiny fraction of today’s solar installation costs of about $380 per kilowatt-year, assuming the 2012 average cost of $5.30 per watt for solar panels. Even if solar reaches the low cost of $110 per kilowatt-year, or $1.50 per watt installed, as the Department of Energy’s SunShot program has targeted, it’s still not a significant addition to solar’s value.

But that average includes about 90 percent of PG&E’s feeders that get no capacity benefit at all from PV, because they aren’t overloaded today and aren’t expected to be within the next 10 years. When researchers focused on the smaller subset of feeders that could use PV’s help, the numbers got a lot more interesting.

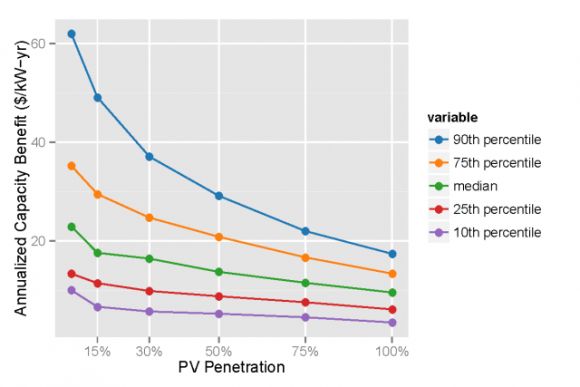

Specifically, the report found that solar on 10 percent of PG&E’s feeders that actually need capacity upgrades in the next decade could realize a benefit from $10 per kilowatt-year to more than $60 per kilowatt-year.

“This range suggests that the value on some circuits could be a significant fraction of the installed cost of PV,” the report found. Here’s a chart from an Energy Institute blog post that puts these figures in visual context.

It doesn’t take that much solar per feeder to realize this value, researchers noted. In fact, the greatest benefits come at low levels of penetration, as solar helps reduce the marginal impacts of peak conditions that force utilities to consider upgrades. Solar coming on-line after that point helps bolster the case, but doesn’t make as big of a difference.

The numbers coming out of Berkeley’s study are likely to be taken up by solar advocates who’ve long argued that utilities are overstating the negative effects of distributed PV on their grid costs. Utilities across the country have been asking regulators to allow them to put fixed monthly charges on net-metered solar customers, for example, based on the claim that their reduced energy bills don’t compensate utilities for their fixed infrastructure costs.

The report specifically cites the new California proposal to allow utilities to impose minimum bills or fixed charges of up to $10 per month, or $120 per year, per residential customer to help cover these costs. “However, these results suggest that PV systems on deferred feeders could have benefits of the same order as the fixed charge,” the report states. “For example, at a low feeder PV penetration (7.5 percent), a 5 kW system would create $50 to over $300 per year benefit in terms of avoided capacity upgrades; even at 100 percent penetration, the benefit could be as high as $100 per year.”

Berkeley’s study also takes a look at the negative effects of solar on grid costs. These can arise when clouds pass overhead and cause solar output to drop and then rise rapidly, causing voltage fluctuations that put increased stress on grid equipment that keeps voltages in check. At high levels of penetration, distributed PV can also cause reverse power flows, with uncertain effects on grid systems that weren’t designed to handle them.

These are complicated costs to model and predict, and this research project didn’t attempt to quantify them in the same way it measured economic benefits of capacity deferral. But it did take a look at the extra costs associated with voltage regulation, and estimated that it could add about $442,000 per year in costs to manage PV penetrations of 100 percent across all its circuits -- a tiny fraction of PG&E’s multi-billion-dollar operations and maintenance budget.

Moreover, “proactive distribution planning may serve to avoid these voltage problems altogether at relatively low cost,” the report stated, since the biggest problems are likely to arise on a relatively small number of circuits. That’s in line with projects looking at the impacts of high PV penetration on Hawaii’s distribution grid, which have found that significant voltage management problems are limited to a small subset of circuits.

Of course, these findings lead to a more complicated set of questions, of the kind that California’s distribution resource plan proceeding and similar proposals in other states are trying to tackle.

One question is how utilities, solar companies and regulators can measure the costs and benefits to come from higher PV penetration on real-world circuits. Another question is how these parties can agree on ways to incentivize solar PV deployment on the circuits that stand to benefit the most?

Stay tuned for next week’s release of plans from California’s big three investor-owned utilities to help shed more light on how these questions may start to be answered.