SolarReserve, a utility-scale solar thermal developer, just closed on $15 million of a $30 million round, according to an SEC form D filing spotted by Green Energy Reporter.

It would have been entertaining to have been a fly on the wall in that terms negotiation meeting for this concentrating solar power (CSP) developer, given the current trend of large-scale CSP plants converting to flat-panel solar power plants.

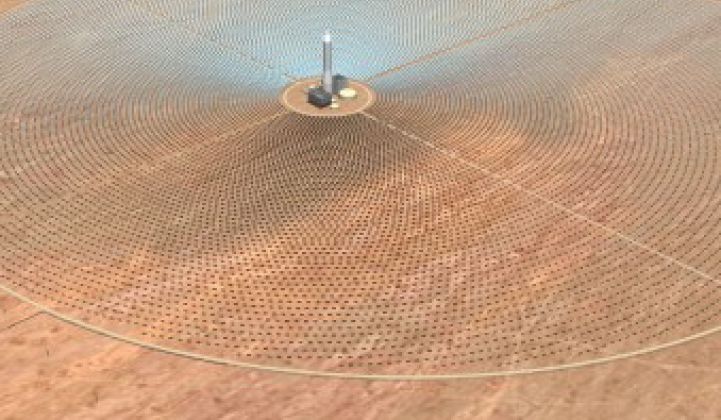

SolarReserve of Santa Monica, California closed a $140 million venture round in 2008 and has a $737 million loan guarantee offer from the DOE for a 110-megawatt molten salt storage power tower with more than 10 hours of thermal energy storage. This will be the tallest molten salt tower in the world, according to the DOE website. The firm licenses the molten salt power tower solar technology from Rocketdyne, a division of Hamilton Sundstrand, a subsidiary of UTC.

SolarReserve has a power purchase agreement (PPA) with NV Energy for this project.

Molten salt energy storage allows the solar system to behave a bit more like a natural gas power plant and a bit less like a field of heliostats or PV solar panels. That's the upside. The downside is that the cost of solar panels has plunged so low (PV modules from reputable vendors are selling for less than $1.40 per watt) that the economics of PV can look more attractive to developers than the CSP plant.

Solar Trust, another developer, just announced that it will convert a planned 500-megawatt solar thermal power plant in Blythe, California into a 500-megawatt photovoltaic power plant. The firm will be turning down $2.1 billion in low-cost federal financing to do so.

BrightSource Energy, another CSP technology company that recently filed an IPO, announced its own molten salt storage technology, and is sticking by its claims that its levelized cost of energy (LCOE) will be more than competitive with other solar technologies.

Investors in SolarReserve include U.S. Renewables Group, Citi Alternative Investments, Sustainable Development Investments, Good Energies, and Credit Suisse.

GTM Research has looked at the LCOE of various solar technologies, with and without storage, and SolarReserve fares rather well in those comparisons. A brochure for the updated GTM CSP Project Tracker (a list of all 40+ CSP projects in the U.S.) is here.