In the next 15 years, Texas expects to add somewhere between 14 and 27 gigawatts of solar capacity, according to a new long-term system assessment from the state’s grid operator, ERCOT.

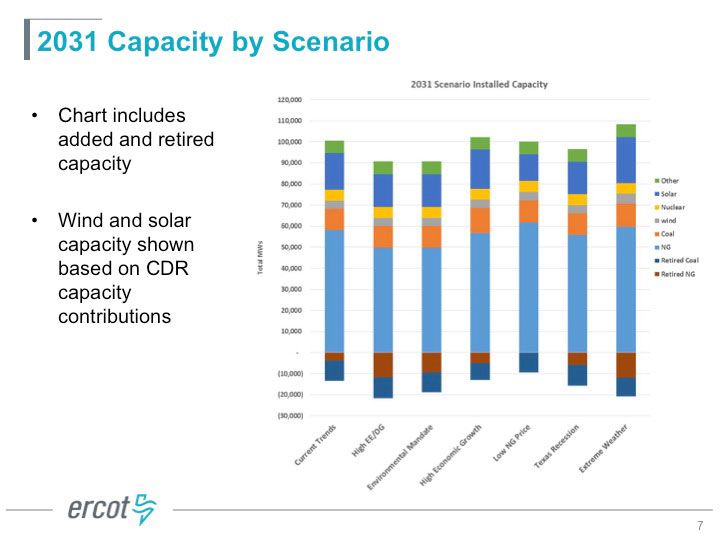

ERCOT is considering eight different scenarios, such as continued low natural-gas prices or extreme weather. Under all scenarios, solar makes up nearly all of the new capacity. In all of the scenarios, ERCOT assumes that changes to the U.S. Environmental Protection Agency’s regional haze rule will go into effect. Those changes are expected to make the rule more stringent and impact power producers with emissions that affect air quality.

As more solar energy comes on-line, coal will retire. About 5 gigawatts of coal are expected to go offline in the next five years because of the regional haze rule, according to ERCOT’s assessment. Even without the regional haze rule, some coal will retire anyway.

Natural gas is now the dominant electric generation source in Texas and could see some retirement as well, although the facilities that will retire are mostly older steam units that will be shut down due to age, rather than environmental rules or market conditions.

By 2031, natural gas would make up slightly less than half of the capacity in Texas, while solar jumps from about 3 percent to about 17 percent. Wind, solar and other forms of electricity capacity were expected to stay roughly the same. In 2015, Texas ranked ninth in U.S. PV installations, according to GTM Research.

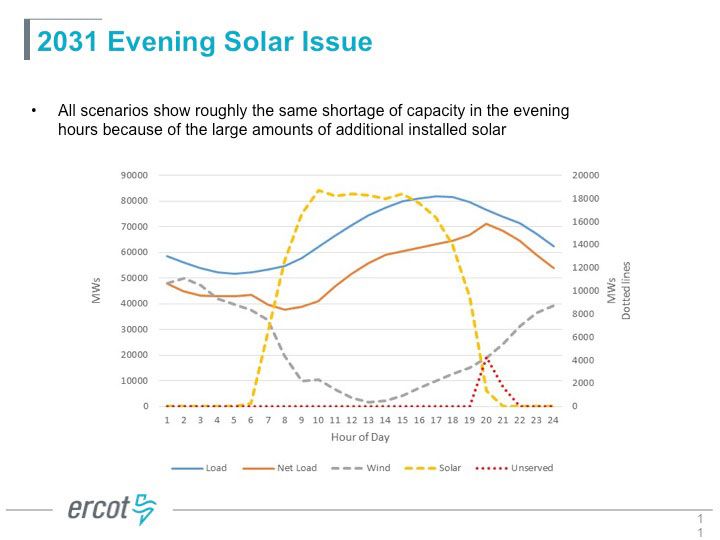

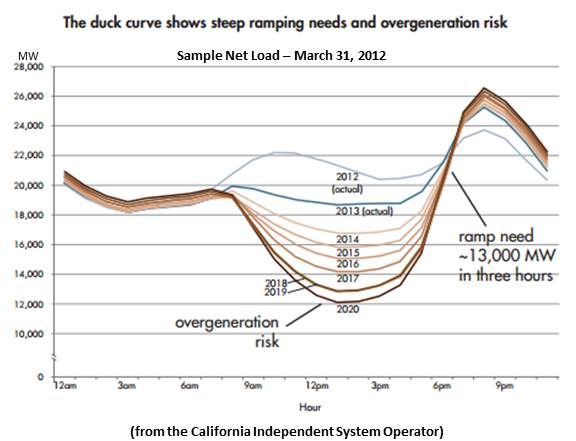

The drop in coal and increase in solar could bring about something that resembles a duck-curve situation in Texas. The duck curve shows the gap between the total load a utility serves and what that load looks like after wind and solar generation serve some of that load. The duck curve in Texas would look more like a lean duck than the plump sitting duck that California’s grid operator has forecasted.

With considerably more solar, the capacity shortage is expected from about 7 p.m. to 10 p.m. in Texas. But there is one scenario among the eight that could alleviate that: a high-storage scenario.

With falling costs, storage may sound like a no-brainer, but nothing is a no-brainer in ERCOT territory. “ERCOT is like the Wild West,” Randa Stephenson, VP of wholesale markets at Lower Colorado River Authority, said during Bloomberg New Energy Summit earlier this year.

For years, Texas had low reserve margins, but the situation has been looking up lately. ERCOT says it has added on enough new wind, solar and natural gas capacity for the coming years to wade out of dangerous waters when it comes to its reserve margins. Furthermore, the future demand forecast has been lowered overall.

But the beefier capacity margins expected in coming years did not take into account the approximately 6 gigawatts of retirements due to the regional haze rule. The current long-term planning also doesn’t take into account the Clean Power Plan, which has been stayed by the Supreme Court. If the CPP moves ahead, ERCOT has modeled that up to 9 gigawatts of coal could be retired.

There are some other potential factors that could impact more generation or more storage, all of which could address the change in generation mix forecasted in Texas. The state now has a price cap of $9,000 per megawatt-hour when capacity is tight, but it rarely hits that mark.

There is also a relatively new operating demand curve, less than two years old, which is meant to ratchet prices up more as demand increases, but it has been ineffectual so far. It is currently being re-evaluated in hopes of making changes that will allow it to be more effective. Those changes are meant to incentivize new generation or more demand response, although it’s unclear whether they will.

Another change that would incentivize distributed energy resources such as demand response and batteries are the reforms proposed by ERCOT’s Distributed Resource Energy & Ancillaries Market Task Force. The task force was recently disbanded, but there is more work being done to integrate distributed resources into the energy markets.

And it may not be distributed resources that would address a duck curve in Texas given the sloth-like pace of significant market rule changes. Instead, utility-owned energy storage could be a more prevalent solution if it requires less market innovation. Fifteen years is a lifetime in clean energy, however, so the solution to meet the problem in 2030 could look very different from the options today.