Another of the world’s leading solar PV manufacturing giants has underlined the potential for yet more substantial reductions in the manufacturing cost of solar modules, even as the cost of fossil fuels -- and gas in particular -- surges in the opposite direction.

Beyond the near-term revenue forecasts that obsess market analysts, one of the big takeaways of First Solar’s annual market day in New York last week was its predictions about the cost of solar modules over the next five years.

Most notably, First Solar says it expect its average manufacturing cost to nearly halve, falling from an average $0.63 per watt in 2013 to $0.35 per watt in 2018. That will bring the total installed cost of a module (including racking and inverters) from around $1.59 per watt to less than $1.00 per watt by 2017 -- thus meeting the U.S. Department of Energy’s ambitious SunShot Initiative goals at least three years ahead of schedule.

This is significant, because as solar prices are coming down, fossil fuel prices are headed in the opposite direction. The U.S. has been hailed as the nation of cheap gas, but that title is proving to be illusory, as evidenced by the rapid depletion rates of wells and the growing challenge of tapping deeper and less readily accessible reserves -- not to mention concerns about the new extraction methods' high rate of water usage and other environmental considerations.

As this story from EnergyWire notes, wholesale prices in the northeastern U.S. jumped 55 percent in 2013, due largely to a 76 percent jump in the price of gas to $6.97/MMBTU, which means that gas prices are now back above their pre-GFC, pre-fracking-boom levels.

First Solar now sees the large-scale solar market rebounding, mostly because interest is turning toward solar due to these rising gas prices. Power purchase agreements, according to Deutsche Bank analysts, are in the range of $50 to $70 per megawatt-hour (aided by the federal 30 percent Investment Tax Credit).

Solar companies are meeting those PPA prices. They may not be making a whole lot of profit, but if costs come down as dramatically as SunPower, SunEdison and First Solar have suggested, the companies are generating enough revenue to secure their futures. Gas developers simply can no longer compete because the forward gas prices are pushing gas generation costs well beyond this level.

First Solar says that it has encountered particularly strong interest in the 20-megawatt to 50-megawatt range of projects, which many utilities believe will address their issues around daytime peaks. These projects have lower execution risk for First Solar and offer the company the ability to improve overall cost of capital through a potential YieldCo transaction (i.e., floating off projects into a new high yield company).

First Solar's projected cost reductions are based on several factors. The first is the increase in the company's conversion efficiency, which recently hit a high of 17.2 percent for its cadmium-telluride thin-film panels, and will increase to 19.5 percent by 2017.

First Solar is also about to announce major savings as part of its partnership with General Electric, which is looking at an even cheaper and more efficient utility-scale solar power plant design. The company has also purchased its own silicon-based manufacturing facility in Thailand.

It's notable that Deutsche Bank analysts initially thought that the market was generally discounting these broader trends, and it focused instead on the company's near-term financial numbers. Deutsche, however, was sufficiently encouraged by the potential for an aggressive efficiency/cost roadmap that it lifted its target price for the stock from $50 to $70.

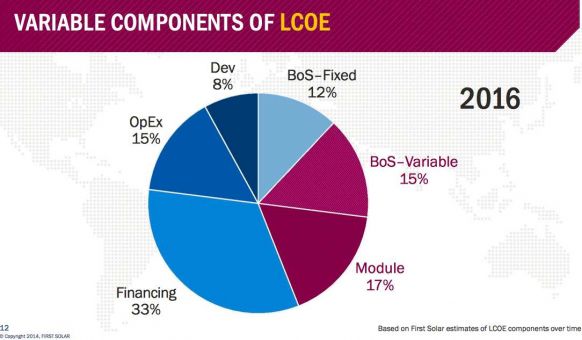

This graph below shows just how small a role that module prices play in the ultimate cost of solar technology. Two-thirds of the costs are related to items that can only be reduced via improvements in deployment.

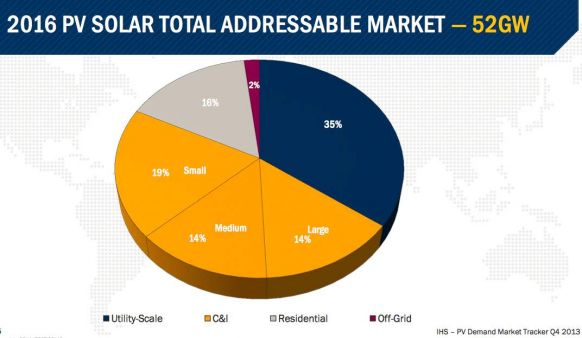

The final graph below shows First Solar’s forecast of the overall solar market in 2016. Interestingly, while the company sees a resurgence in utility-scale mandates, it also recognizes that half the market is in the household and commercial-scale space, which is mostly rooftop.

CEO Jim Hughes told analysts that the company now believes it can compete for that rooftop market -- something it had largely abandoned in the past.

***

Editor's note: This article is reposted from RenewEconomy.