From the end of 2010 until the first quarter of this year, leading Chinese solar companies were able to drop the cost of manufacturing multicrystalline solar modules by 54 percent.

Their ability to finally break the dollar-per-watt barrier in 2011 and continue moving costs downward through 2013 came from one simple factor: price crashes for key materials.

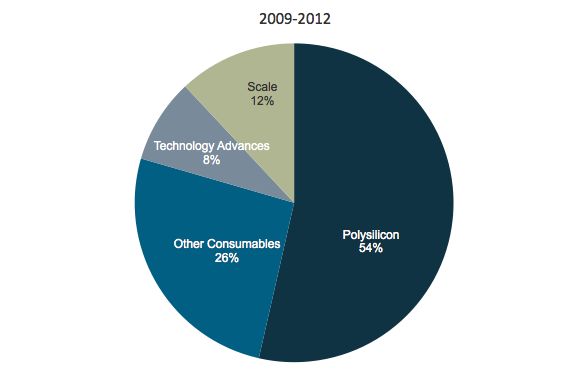

In its latest report documenting the technology and cost outlook for solar producers, GTM Research outlined the dominant role that these price crashes played. The pie chart below, provided by GTM Research Senior Analyst Shyam Mehta, breaks down the four basic factors responsible for cost improvements at leading Chinese solar companies.

Polysilicon prices, which dropped precipitously due to oversupply, contributed to 54 percent of cost reductions. The other important factor -- one that is less often cited -- was the decline in prices for other consumables like wires, frames and glass, which contributed 26 percent:

Source: GTM Research

Together, consumables pricing reductions -- driven mostly by oversupply -- have made up 80 percent of the overall cost drop over the last three years. But with prices for most of these materials at break-even levels, Mehta said it was highly unlikely that we would see this factor playing a major role in the future.

"Those kind of historical reductions don’t seem to be sustainable going forward. The question you should ask yourself is how are we going to get lower," explained Mehta during a webcast on solar manufacturing costs yesterday.

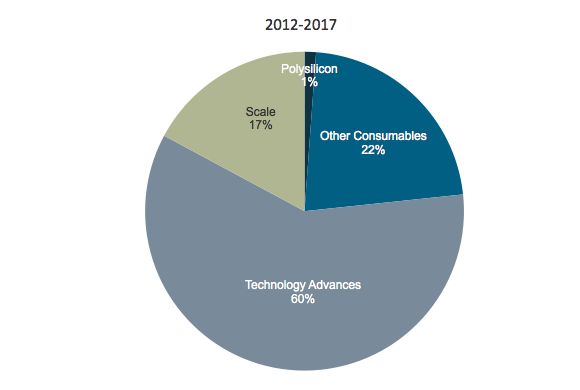

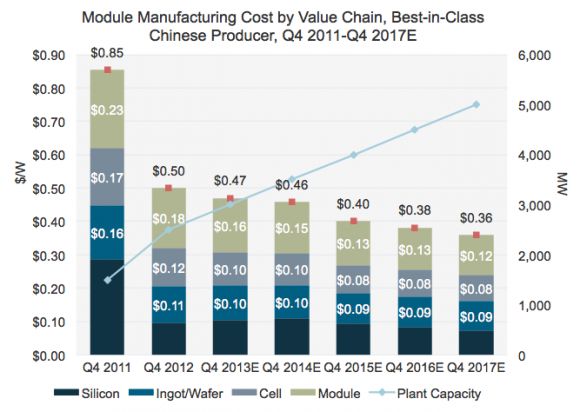

The answer is technology improvement. In Mehta's latest report, he forecasted that top Chinese manufacturers will be making solar modules for 36 cents per watt by 2017. But with very little room for polysilicon prices to keep falling, refinements to technology -- increasing conversion efficiency, reducing yield loss and automating production lines -- become absolutely critical, as the following chart indicates.

Source: GTM Research

From 2013 to 2014, the cost reductions from Chinese companies will only be about a penny per watt. But from 2014 to 2017, companies may shave off another 10 cents.

"This is due to a very large drop in labor costs," said Mehta. "We need a significant increase in the degree of automation employed by Chinese companies to mitigate labor inflation there."

Because labor costs have been relatively low in China, manufacturing processes there have been much more dependent on people. But labor costs have increased by roughly 10 percent annually since 2009, and manufacturers will eventually have to react by automating their production lines -- in line with with Korean, Taiwanese, Japanese, European and American producers. GTM Research projects a 25 percent decline in labor costs from 2012 to 2017 due to automation.

Here's what the combination of factors may bring in 2017:

Source: GTM Research

Of course, simply manufacturing modules at 36 cents per watt does not equate to a sustainable selling point. Assuming a 20 percent margin, these leading Chinese firms will need to sell modules for 45 cents per watt to stay healthy. But Mehta doesn't believe these projections are overly aggressive; in fact, he calls GTM's technology view "conservative."

"There was a reaction from some people that our projection for 36 cents per watt is crazy. To that, I offer the point that our forecast only implies an annualized reduction of 6.3 percent from 50 cents a watt today," said Mehta. "It's not exactly a game-changer; it's 14 cents. But the industry has had a mental block because people didn't think we could produce modules for below 50 cents per watt."

For more detailed analysis of solar manufacturing costs, check out GTM Research's report: PV Technology and Cost Outlook, 2013-2017.