The fully connected home still is not a reality for most consumers, but increasingly, smart thermostats are the norm and not the exception.

Connected digital thermostats are one of the gateway devices on the path toward building a smarter home. In the case of some vendors like Nest, they serve as the hub of the smart home.

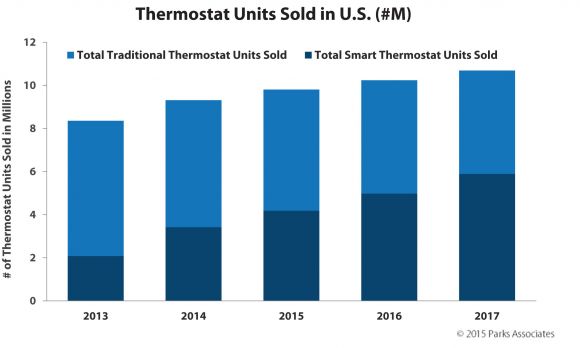

It is no longer just early adopters who are buying up connected thermostats, which are offered by every major vendor in the market. By the end of this year, nearly half of all thermostats sold will be smart thermostats, according to new research from Parks Associates.

As users gain the ability to monitor their energy on the go, they are also looking for more energy options. One out of five broadband households surveyed by Parks last year said they are likely to switch energy providers to one that offers energy and monitoring services.

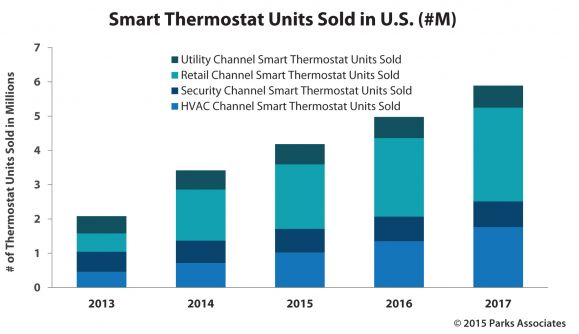

Thermostat sales are growing overall, but there is also a considerable difference in the ways they’re being purchased today in comparison to even two years ago. Customers are increasingly buying their thermostats through retail stores. The HVAC channel is growing as well, but the utility segment is stagnant.

Although in most cases, utilities are not the ones selling the smart thermostats, that doesn’t mean they can’t reap the benefits of these devices being installed.

Utilities can use smart thermostat data from customers who opt in to programs to further fine-tune demand-response offerings. They can also use smart meters to disaggregate data to offer the sorts of tailored monitoring services customers will increasingly be seeking.

Last fall, for example, Bidgely began providing disaggregation analytics to all of TXU Energy’s 1.5 million residential customers that can tell them whether their AC compressor or pool pump is on the fritz.

People are increasingly willing to pay for monitoring services, Parks Associates found. For utilities, the time could be ripe to capitalize on the relationships they already have with customers before they are cannibalized by the more than 100 other companies that are looking to get in on the smart home.

To maintain that relationship, utilities are increasingly leveraging various brands of smart thermostats already on the market into demand-response programs. Those programs will have to grow more sophisticated as people buy their thermostats from many manufacturers in a variety of stores.

“Opening utility programs to include the variety of different types and brands of devices is an important consideration,” Tom Kerber, director of home controls and energy research at Parks Associates, said in a statement. “Energy providers have the opportunity to monetize the mountain of data derived from both smart meters and smart devices.”