More shrinkage in the smart metering landscape is coming. On Thursday, smart meter giant Itron (ITRI) announced plans to cut about 9 percent of its workforce, or about 750 jobs, and to close or consolidate several facilities, as it seeks to boost profitability amidst what’s expected to be a second straight year of declining sales.

The layoffs, consolidations and closures will come “across all geographies, business lines and corporate services to improve our operations, efficiencies and profitability,” the company stated in a filing with the U.S. Securities and Exchange Commission.

Itron plans to record a third-quarter 2013 restructuring charge of $30 million to $35 million to carry out the plan, 95 percent of that in cash expenditures mostly related to severance costs. But in the long run, it’s expecting the restructuring to yield net annualized cost savings of about $30 million.

This is the second such restructuring in the past two years for Itron. In October 2011, the Liberty Lake, Wash.-based company announced it was cutting 750 jobs (which was then about 7.5 percent of its workforce) and consolidating operations in a move that was projected to save $15 million in annualized costs by the end of 2012 and $30 million by the end of 2013.

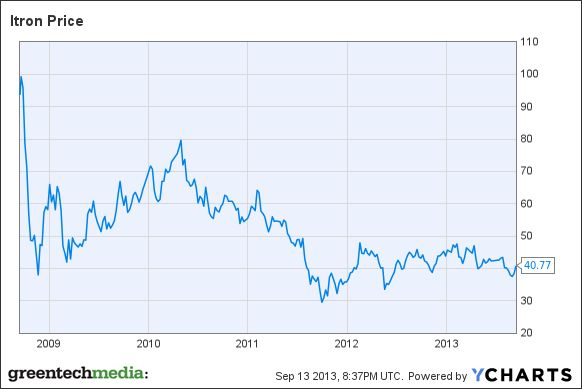

Itron has been struggling so far this year, with first-quarter and second-quarter revenues that CEO Philip Mezey has described as “far below acceptable” levels, as well as far below comparable financial results from 2012. The company’s stock has fallen from a February 2013 high of $47.90 to just above $40 per share as of Friday mid-morning trading, though that was up slightly from the previous day's close -- a reflection, perhaps, that investors have been looking for the company to make a move to combat its flagging financial performance.

Itron's announcement underscores the challenges that it and other smart meter makers are facing in adapting to today’s market realities. In the United States, billions of dollars in federal stimulus grants helped boost smart meter installations through 2009-2011, but the passing of that one-time cash boost has left the market slack since then, with projections indicating slow growth for the next year or so.

Itron has specifically suffered from the run-out of its top five North American smart meter projects. Those include CenterPoint Energy, Southern California Edison and San Diego Gas & Electric, which have largely deployed all their Itron meters, as well as Canadian customer BC Hydro, which is in the midst of rolling out about 2 million smart electric meters, and Detroit Edison, which is considering accelerating its deployment schedule for its remaining 2.2 million smart electric and gas meters.

Meanwhile, big national smart meter rollout plans in Europe, while promising large-scale rewards in years to come, have also been subject to delays and reconfigurations that have left the industry unsure as to when, or in what form, large-scale meter tenders will be opened for bid.

San Jose, Calif.-based Echelon (ELON), which holds significant smart metering market share in Europe, reported second-quarter 2013 earnings in August that fell below expectations, and CEO Ronald Sege said at the time that “continued delays in new project awards in our targeted smart grid markets will further impact our near-term revenue.” Echelon also announced a restructuring last year, with plans to cut its workforce by up to 10 percent.

To be sure, we’ve seen some big new contracts announced, including the U.K.’s award of roughly $3.3 billion in smart meter communications contracts last month -- an award that boosted the fortunes of U.S. smart meter giant Sensus, while disappointing investors in smart meter networking upstart Silver Spring Networks (SSNI). But the U.K.’s nationwide deployment, as well as others in France and Spain, have yet to award contracts for the tens of millions of smart meters that will connect to these underlying communications architectures.

These factors have led to a significant amount of volatility in the smart metering business, which has in turn led to quite a bit of merger and acquisition activity. St. Louis, Mo.-based Esco Technologies (ESCO) announced it was seeking a buyer for its Aclara smart metering subsidiary, citing its desire to stabilize its business growth.

Last year, U.K. buyout firm Melrose PLC acquired German smart meter company Elster for $2.3 billion, and in 2011, Japan’s Toshiba bought Swiss based metering giant Landis+Gyr for $2.3 billion. There’s been plenty of speculation that other big companies in the space could be acquisition targets, such as Sensus, as well as Itron and Echelon.