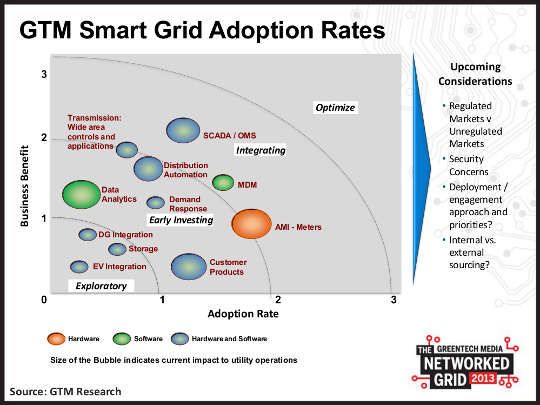

For most smart grid technologies -- from distributed intelligence on the grid to two-way digital meters -- there is a clear arc of adoption by utilities.

For most of these technologies, it’s still early days, said David Groarke, senior smart grid analyst at GTM Research, during the opening keynote at The Networked Grid outside of Los Angeles, Calif. on Tuesday.

“We’re in the early, early stages,” said Groarke. “That can’t be overemphasized.”

GTM Research identifies four adoption zones: exploratory (5 percent market captured), early investing (20 percent), integrating (30 percent), and optimized (50 percent). No technology has risen to more than 50 percent market penetration, although SCADA and outage management systems come close.

Many hardware technologies, such as switch gear, synchrophasors and advanced metering fall into the integration category.

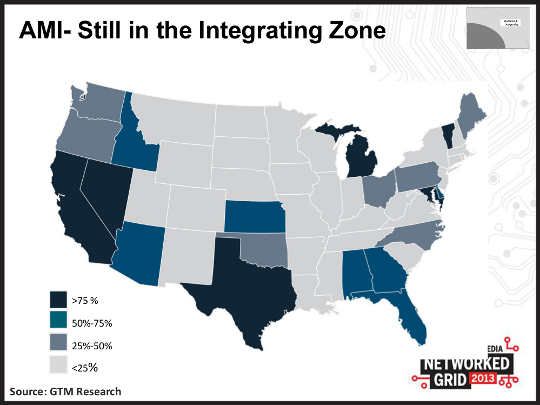

Although more than 30 million meters were deployed largely through stimulus money, fewer than ten states are expected to have more than 70 percent smart meter penetration by 2014, according to GTM Research. Another 25 states are predicted to have less than 20 percent.

While smart meter penetration is expected to lag in the U.S. in the coming years, the opposite will happen in the European Union, which has a more coherent policy. Many parts of the U.S. also have relatively low electricity prices that don’t justify the investment in advanced meters, or already have automated meter reading technologies, which makes the business case for two-way digital meters harder to justify.

Further down the chain, many of the integrated hardware and software solutions, such as distributed generation, electric vehicle platforms and storage are still in the very early stages. GTM Research estimates that the smart market will be worth about $500 billion by 2030, less than 20 percent of which has been realized so far.

The majority of investment is going to sectors that operate partially, or entirely, outside of the regulated utility space, including to energy efficiency, transportation, and energy storage. Within the regulated utility space, however, there is an increasing convergence of IT and utility operations which requires novel software and analytics solutions.

The real innovation will not be the solutions that will link IT and OT, but the monumental shift in business processes within utilities that fundamentally change how they operate. Groarke pointed to smart operations centers within utilities as a trend to watch in 2013.

“This is not a linear path,” Groarke said of the growth of different sectors of the smart grid market. “Utilities will pick and choose what makes it up the curve.”

And although the patterns may be varied, Groarke was bullish on the smart grid’s global outlook in the next three to four years: "We are seeing growth everywhere.”

Watch the full presentation below.