[pagebreak:SmartGridFinanceRundown]

In 2004, the term “Smart Grid” didn’t really exist – despite the Demand Response successes of now-public firms like Comverge and EnerNoc.

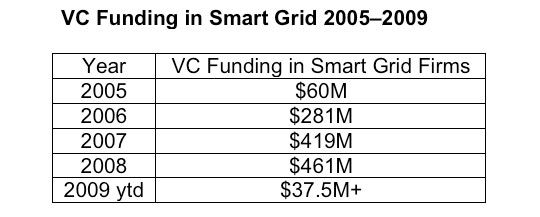

Fast forward five years and we’ve seen hundreds of millions of dollars of VC investment flow into a wide range of smart grid startups, essentially creating a new market and ecosystem from power generators to home networks. This year has gotten off to a slow investment start but that will change in the coming quarters.

Smart grid technology, investment, and infrastructure must emerge if the states are to meet their ambitious Renewable Portfolio Standards.

But beware. As Stephen Lee, the Senior Technology Executive for Power Delivery and Utilization at EPRI, the Electric Power Research Institute warns: Smart grid players must avoid the hype. “We are at the peak of the smart grid hype cycle. When Obama and Biden talk about the smart grid you know it’s being hyped,” Lee said.

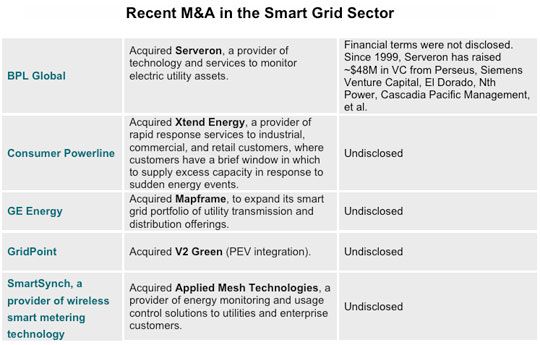

2008 and 2009 Smart Grid M&A

In today’s difficult business environment we expect to see lots more M&A activity and consolidation.

[pagebreak:VCInvestmentintheSmartGrid]

VC Investment in the Smart Grid

Soaring energy costs, an aging electricity grid, national security concerns and government regulation are creating a boom in smart utility meters and the semiconductors that go into them.

Most smart grid investments don’t require hundreds of millions of dollars to create a factory. VCs look at the smart grid market as a capital efficient alternative to the capital-intensive wave of green investments of late. Additionally the technology of the smart grid – wireless communications, mesh networks, semiconductor integration, and software – is a familiar vernacular to the VC community.

Look for big players like Intel, IBM, Cisco and Oracle to begin vying for a slice of the smart grid pie either through investment or acquisition.

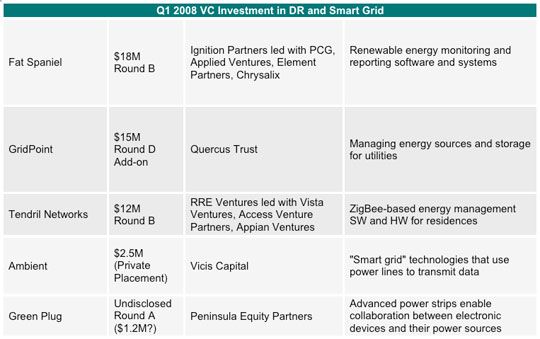

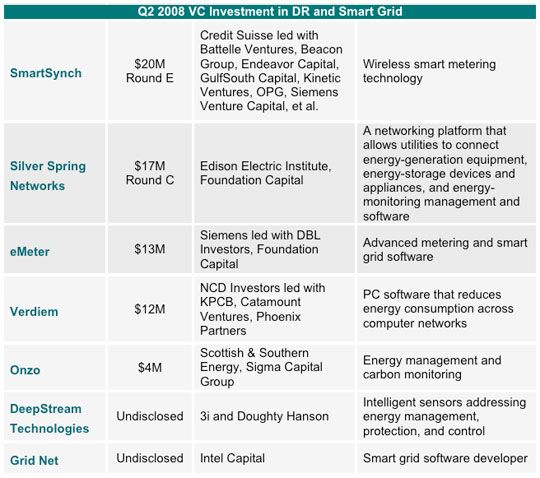

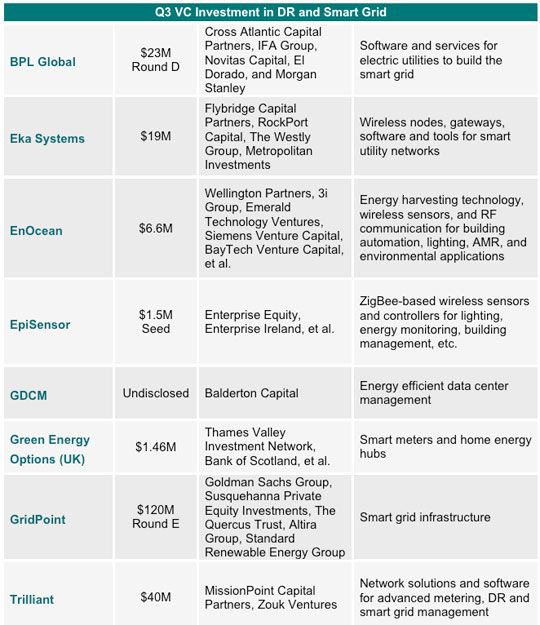

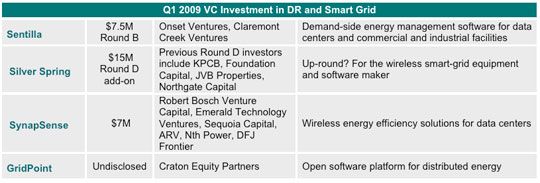

What follows is a detailed list of smart grid VC investments since the first quarter of 2008.

[pagebreak:Q4 2008 VC Investment in DR and Smart Grid]

Q4 2008 VC Investment in DR and Smart Grid

Smart metering in the U.S. currently has a low penetration, with ~6 percent of households having installed the technology in 2006. This is set to increase rapidly over the next few years with some forecasts for smart meter penetration to reach close to 90 percent of households by 2012.

Silver Spring’s $15 million investment comes on top of a $75 million Round D raised in October. In a good economy, Silver Spring would be a natural IPO candidate. Even in this economy – Silver Spring could be the IPO that quenches the IPO drought later this year.

With large-scale contracts with utilities including Pacific Gas & Electric Co. (5 million customers), Florida Power & Light (4.5 million customers) and Pepco Holdings (1.9 million customers), Silver Spring is set to install its devices in millions of meters over the coming years.

Silver Spring’s competitors include smart meter vendors that provide networking and communications themselves – Itron, GE, Landis+Gyr, Sensus and Elster – as well as rival networking providers such as Aclara, Trilliant, Eka Systems and SmartSynch.

[pagebreak:The Final Word]

Shifting gears away from venture capital in smart grid, here’s a bit of info on legislation in smart grid.

As testament to the policy shift in energy, today we have federal politicians with the will to advance a bill with “smart grid” in the title.

H.R. 1774, the Smart Grid Advancement Act looks to reduce peak demand and increase the deployment of smart grid technologies.

The bill incorporates smart grid features into labeling so consumers have the information to purchase smart grid capable products. And the bill takes steps to reduce peak electricity demand. The Smart Grid Advancement Act directs states and load-serving entities to identify peak demand reduction goals based on an aggressive effort to adopt smart grid technologies. Studies show that when implemented on a large scale, demand response could reduce electric costs by as much as $15 billion annually.

Final Word

The only way we can reach aggressive Renewable Portfolio Standards and exploit energy storage, distributed generation, PHEVs, demand response, and smart meters is through an integrated and intelligent grid.

But the entity we call a “Smart Grid” is more of a theoretical construct than a true engineering problem. In a perfect world we could build from scratch, a self-aware, self-healing, sensor-laden, robust and secure mesh network that allowed dynamic forward pricing to inform customer and utility energy usage and choices.

But in the real world – we are attempting to overlay intelligence on an antiquated legacy network that has many masters and many flaws. Utilities tend not to move quickly and are slow to innovate. Legislation is slow and imperfect and standards often compete.

Nevertheless, there is momentum in this field and VC funded startups like Silver Spring and Fortune 500 firms like IBM and Intel are starting to drag the utilities and the grid into the 21st century.