At the recent Gridwise conference in Washington, D.C., most speakers referenced the importance of playing to “consumers.” Use of the term was like an 'Om' in yoga -- a simple chant with a complex meaning. While the conference shed some light on the growing cult of consumer smart grid mysticism, there’s trouble afoot in smart grid city. According to one study most consumers are clueless about saving energy. Clearly, it’s going to take more than iPhone apps to connect consumers to the smart grid. For now, the industry is talking to itself and not the “end-user.” It seems that the smart grid world is becoming increasingly divided between the utility industry on one side, and consumer advocates fighting smart grid surcharges and expenses on the other, as evidenced by a recent California panel where members of both sides of the divide spoke. Consumer benefits and a workable business model are lost in the middle.

A good first step is for the smart grid industry to get a few clues about the 'clueless' consumer by busting the myths at the center of its consumer mysticism. Here are four thinking impediments the industry needs to overcome, along with some supporting data:

1. The Consumer doesn’t care about saving $10 a month on their electricity bill

Myth context: industry conference panelist explaining why the smart grid doesn’t matter to “Joe Six-Pack.”

Is this true or false?

This is probably true, if this person is a six-figure-salary executive referring to himself or herself.

A recent smart meter and variable pricing trial by PEPCO called PowerCentsDC found that people like saving money, even if it’s just a few dollars a month.

Sounds compelling, doesn’t it?

The smart grid challenge is presenting a compelling value proposition.

Saving money on electric bills is not a size issue -- it’s a question of accessibility. Can the grid deliver the same or better convenience and service at a lesser price? What’s the up-front cost and the ROI? How much time will it take? What’s the three-step program? Instant gratification and no-brainer savings works; long-winded smart grid technology explanations don’t.

2. Consumers don’t want 'Big Brother' utilities controlling appliances in their home

Myth context: pundits explaining why automated thermostat setbacks by utility demand response programs are a bad idea.

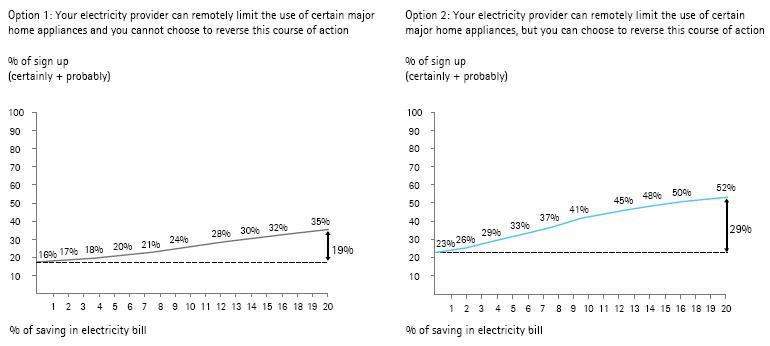

This may be true for some of the population, maybe even a majority. But it’s not true for everyone. In fact, a research study by Accenture (9,100 respondents, 17 countries) found between 16% and 24% of respondents willing to have a utility remotely limit major home appliance use for savings between 1% and 10%. Offering savings of 20% and giving consumers override capabilities bumped positive responses to 52%. So, the majority of consumers would let 'Big Brother' have some control over their appliances -- for the right price.

See below:

Source: Accenture, Understanding Consumer Preferences in Energy Efficiency, 2010

3. More pilots are needed to prove that dynamic pricing works

Context: PUC mandating that a utility run a dynamic pricing pilot as part of its broader smart meter roll-out to prove the technology.

Is it necessary to have more pilots than an airport?

Brattle Group summarized 15 household dynamic pricing experiments. The experiments established consistent peak shaving ranges. Time-of-use pricing creates peak reductions of 3 percent to 10 percent. Adding technology bumped peak shave to 20% to 30%. Critical peak pricing knocked 10% to 30% off peaks, while adding technology components to CPP increased savings to 30% to 50% (generally speaking).

The recent PEPCO PowerCents DC project found similar results.

Answer: we don’t need to prove residential dynamic pricing shaves peaks -- the data show that it does. Pilots to test program designs for impacts on utility revenue, customer bills and overall response rates are what we need. We need program optimization, not concept validation.

4. There’s an entity called 'The Consumer' (singular)

Context: industry pundit making sweeping market generalizations.

This is one of my (least) favorites. Fortunately, it’s becoming less and less fashionable. Any consumer marketer worth their salt knows that consumers are fragmented into multiple segments, especially when we consider behavioral, demographic and attitudinal variables together, as the Accenture study does. It identified six segments. Simplified here for purposes of brevity, the categories included: Proactives (16%), highest willingness to take action to reduce appliance use; Eco-rationals (12%), highest interest in reducing environmental impact; Cost-Conscious (17%), highest interest in bill savings; Pragmatics (21%), slower in adopting technology, more sensitive to savings; Skepticals (21%), lowest acceptance of utility control and lowest trust of utilities; and Indifferents (13%), lowest willingness to take action.

Clearly, these different segments are all poised to respond differently to the same programs.

The takeaway: in the mixed-up modern consumer market, absolute truisms don’t apply.

This ambiguity is an especially hard pill for an engineer to take -- and utilities happen to be crawling with engineers, including in their marketing groups. On the other hand, it creates big opportunities to add value with different programs (all offered on an opt-in basis, of course), rate designs and marketing messages

As Linda Schuck, from University of California Energy Institute, aptly states, “[For residential energy management], we’ve tended to focus exclusively on financial and technology solutions. There’s a lot of opportunity to refine. We need to look at the entire toolbox and pick and choose ways to approach the problem.” (Side note: Linda is also the conference organizer for the upcoming Behavior, Energy and Climate Change Conference on November 14-17 in Sacramento.)

In the words of one integrator tasked with actually getting all this 'stuff' to work, “Just because someone gets up on a stage and says it, doesn’t mean it’s necessarily true.” Wise words, those. The smart grid industry needs to move beyond talking to itself about consumers to begin talking to the actual consumers about what the smart grid can do for them. Ask not what the consumer can do for the smart grid, ask what the smart grid can do for the consumer.