Back in October, we profiled AutoGrid, a Silicon Valley startup with some interesting plans for bringing “big data” capabilities to the smart grid. At the time, we noted what appeared to be a pretty tight partnership between AutoGrid and smart grid networking player Silver Spring Networks -- specifically, information that showed that AutoGrid was playing a role in SSN’s big demand response and customer engagement project with Oklahoma Gas & Electric.

Turns out the two are indeed working together. On Tuesday, the two companies announced a partnership to “jointly develop the Silver Spring UtilityIQ™ Demand Optimizer solution, powered by AutoGrid.” In simple terms, Silver Spring is now reselling AutoGrid’s technology as part of its new demand response capabilities.

Tuesday’s announcement also revealed that the partners’ first customer is OG&E, where Silver Spring has hooked up about 42,000 utility customers so far in a first-of-its-kind, smart-meter-enabled home smart thermostat and energy-saving demand response program.

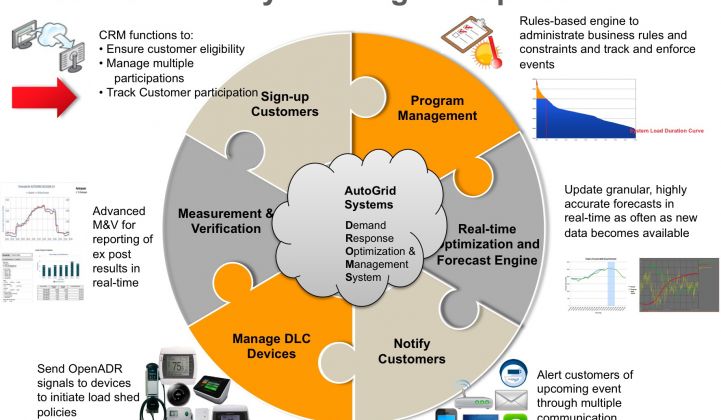

So what are Silver Spring and AutoGrid doing together that they couldn’t do on their own? In essence, the new product combines Silver Spring’s mesh networking and cloud-based software management solution with AutoGrid’s capabilities on the big data analysis and integration front. The results, executives from both companies told me, should be a smarter, more adaptive way to maximize utility investments in getting their customers to manage their power.

Right now, OG&E uses Silver Spring’s smart meter network and Energate smart thermostats to both push variable pricing data to customers and directly control thermostats to shave power use during peak times. AutoGrid’s big data engine adds a couple of new features to that list of capabilities, Anil Gadre, Silver Spring’s executive vice president of products, said in an interview.

First, it crunches tons of data, including weather, property data, demographic information and behavioral feedback data, to do better forecasting of future power use patterns, he said.

Secondly, AutoGrid’s ability to analyze and group customers across a broad set of data points should allow the two companies to gauge how well different groups of customers respond to various pricing signals, he said. That, in turn, can help OG&E figure out which groups are actually reducing power more frequently or reliably than others, and use that data to fine-tune its approach to customers at large.

“The big story for us continues to be how to get more out of the network you’ve already built,” Gadre said. Beyond the new partnership with AutoGrid, Silver Spring announced some other smart grid partnerships at the DistribuTECH show in San Diego this week, including an expanded set of tools and services for its many partners, a transformer monitoring partnership with German smart metering giant Elster and a streetlight networking partnership with Streetlight Vision.

Andy Tang, AutoGrid’s vice president of business development and strategy, told me that the Palo Alto-based startup sees a great opportunity in replicating what it’s done with Silver Spring and OG&E with other Silver Spring customers. Redwood City, Calif.-based Silver Spring has networked about 13 million smart meters for utilities around the country, including Pacific Gas & Electric, Florida Power & Light, Commonwealth Edison, Pepco and Baltimore Gas & Electric, and is also working in Brazil and Australia.

“This really is the prototype for what we’d like to see with other SSN customers,” Tang told me in an interview. AutoGrid has already done some work with Palo Alto’s municipal utility and the Sacramento Municipal Utility District, but adding Silver Spring’s millions of endpoints to its addressable market could open up its software to a lot more customers.

One example Tang cited is AutoGrid’s ability to quickly and accurately assess billing and settlement data for utilities and their customers. AutoGrid also announced on Tuesday a partnership with giant enterprise software vendor SAP, a big player in utility back-office billing and customer service.

Tang said the two will be working together to integrate AutoGrid’s demand management smarts with SAP’s new customer relationship management platform for handling demand-side management -- starting with test projects like analyzing the plug-in vehicle chargers at SAP’s Silicon Valley offices to see if they can be enrolled in a demand response program.

Silver Spring and AutoGrid are far from the only partners combining smart grid technologies and big data capabilities to meet utility needs, of course. Home automation systems from startups like EcoFactor and Tendril to corporate giants like Verizon and Honeywell are based in the cloud, for example. Cloud computing platforms from the likes of Ecologic Analytics and Aclara, or partnerships like Verizon with eMeter and Itron with IBM, SAP and Teradata, are tackling the challenges involved in managing massive amounts of new smart meter data.

There’s no doubt that the smart grid needs big data tools to better manage the complex sets of variables that go into driving energy efficiency and demand management across their millions of customers and miles of power lines. Will the Silver Spring-AutoGrid partnership yield results that add up to more than the sum of their respective technologies? Only time will tell.