Silver Spring Networks, the champion of helping utilities build, own and operate their own wireless communications networks, has just taken a big step toward inviting the public cellular networks into its smart grid turf.

On Monday, the smart meter networking market leader and IPO candidate rolled out a new set of “Gen4” capabilities, meant to augment the 10 million or so smart meters it’s already deployed for utilities around the world, as well as to add distributed intelligence and cellular capabilities to its new products.

The new release includes cellular transport, micromesh technology, 300 kbps data rates, increased memory, and so-called “gear shifting” to integrate older or slower devices onto the network. All in all, it’s the biggest shift in the startup’s technology since it announced its plans for a $150 million IPO last summer, and is clearly aimed at broadening its business into other areas of the smart grid and reducing its reliance on a few key customers.

Better data rates -- 300 kbps is about three times faster than today's mesh -- will help the Redwood City, Calif.-based startup tackle the distribution automation and demand response markets. And increased memory in end devices should expand and enrich the potential for “distributed intelligence” -- making end devices smart enough to fix the grid on their own, without wasting time communicating back to central control.

But it’s Silver Spring’s moves toward cellular compatibility that will likely get the most attention. That’s because its new cellular transport and micromesh technologies offer the option of embedding cellular communications far deeper into the grid than their current role as backhaul network providers, down to the meter-to-meter level where Silver Spring and the world’s biggest smart meter makers have traditionally used privately owned, unlicensed-band radios to get the job done.

“Anything -- EV chargers, microgrids, whatever -- the exact same communications module we have today can have an integrated cellular option,” is how Anil Gadre, executive vice president of product management, put it. As for where Silver Spring planned to deploy its new technology first, he wouldn't provide details.

Sprint announced on Friday that it was working with Silver Spring to more closely integrate their smart grid M2M technologies, along with smart meter maker Itron, substation automation vendor Lanner Electronics and Power Insight, a startup that promises cellular-to-home energy management technology.

Gadre wouldn’t say much about the Sprint partnership, however, or any others Silver Spring might be working on with major carriers in the U.S. or abroad. “We have existing cellular partners that are different around the world,” he said. “This move is only going to make those partnerships better.”

But where there are partners, there are also competitors. Cellular carriers and partners like SmartSynch and Qualcomm have been pushing public networks deeper into areas traditionally owned by the RF mesh crowd. SmartSynch landed a 1.8-million residential smart meter contract with Michigan utility Consumers Energy in September, for example, a $400 million project that’s led the Jackson, Miss.-based company to plot expansions in Silicon Valley and China.

At the same time, the big telcos have been cutting deals to supply utilities with more communications on the grid operations side. That’s encroaching on markets that Silver Spring would like to help conquer, working with partners like Sentient Devices and Enphase Energy.

Sprint, for one, noted in its Friday release that it supports “advanced meter reading, distribution automation, SCADA (supervisory control and data acquisition) and demand response,” which pretty much matches Silver Spring’s target markets, except for SCADA (as far as I know).

Gadre insisted, however, that cooperation, not competition, was the goal behind its new level of cellular connectivity. “We have had a fill-in strategy with cell modems for a long time, but not integrated as they now are today,” he said. RF mesh relies on a fairly dense deployment to overcome its low power and range limitations, and it’s also susceptible to being blocked by concrete or metal, which limits some urban applications.

On the other hand, cellular has its limitations as well, he noted. Indeed, Silver Spring’s new micromeshing technology allows cellular end nodes to connect to its 900-megahertz network, which could cut down on the number of cellular devices needed in a deployment.

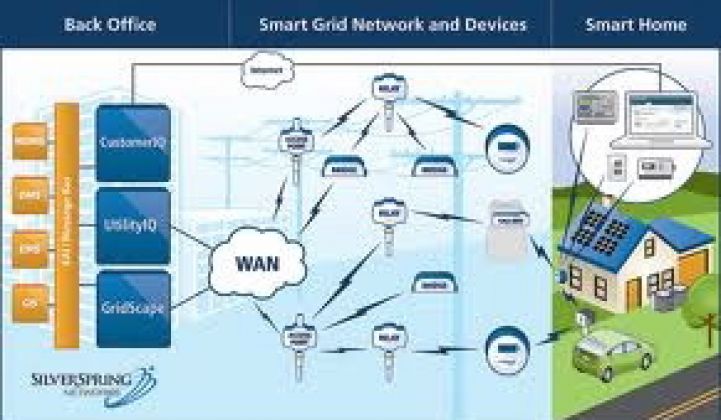

“There are some false controversies” in the industry, he said. “People say, you’ve got to pick a vendor, based on which transport they use, and this and that. We make it easier for you in flexibility and options.” Of course, just which vendor will run the platform for such an integrated utility system is an important question. Silver Spring says it has linked RF mesh and cellular into its UtilityIQ suite, which is built to manage demand response, EV charging and other functions. But we've also seen contenders like SK Telecom and Cisco emerge with master networking products of their own in recent weeks.

Now the question is, how will utilities react to the offer? Stay tuned for more at this week’s DistribuTECH conference in San Antonio, Texas, where the smart grid world is gathering to plot partnerships like these.