As the smart grid market heats up in Europe, major players are beefing up their investments in smart grid companies that will deliver everything from distribution automation to data center efficiency.

The latest recipient is Power Plus Communications, a German broadband powerline communications company. Earlier this week, PPC raised €12 million ($15 million) in a funding round by Siemens Financial Services' Venture Capital unit, British Gas and existing investor Climate Change Capital Private Equity.

The money will be used to expand PPC's market growth in Europe and the Middle East, where it already has a toehold. For Siemens and British Gas, the investment allows them to strengthen their portfolio in one of the primary communications used across Europe. The Mannheim-based company was founded in 2001 and raised €10M ($12.7M) in 2008 from Climate Change Capital Private Equity.

“This is the only European company we know of that really has a system that works on powerline with broadband communication,” said Bruno Derungs, a partner in Climate Change Capital Private Equity Fund and a member of PPC’s supervisory board. While there are plenty of PLC companies in Europe, most of them use some version of narrowband, rather than true IP-based broadband.

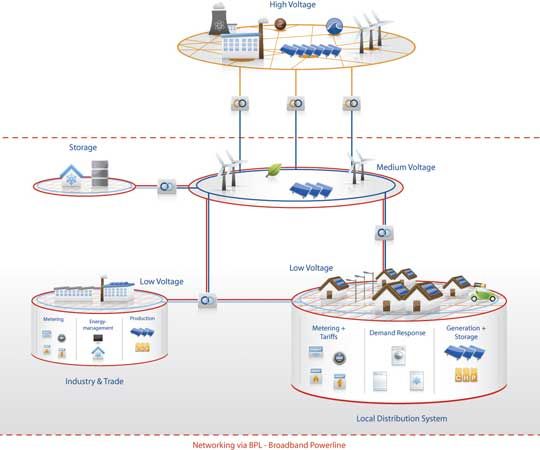

The technology will primarily be used for two applications: real-time communications in the distribution network for maintaining low- and medium-voltage control applications and smart metering to bring data from the meter back to the utility. GTM Research forecasts €6.8 billion ($8.5 billion) per year in smart grid investment in Europe between now and 2016, with the bulk of the investment going to smart metering and distribution automation.

PPC is also a member of the HomePlug Alliance and can reach into the home for demand side management. Derungs noted that the IP-based technology allows PPC to go a step beyond HomePlug and build a mesh network within the home.

In Germany, new rules around smart grid data security will require companies to work off standards-based encryption, which can be constantly upgraded. Derungs said many PLC companies currently cannot meet the new rules because of proprietary systems.

In Europe, the competition for PPC is coming from telecoms, which also offer broadband or DSL, rather than PLC standards such as the PRIME Alliance. “For the German [smart grid] market, we only see broadband powerline or a DSL/fiber, which are both much more expensive,” said Derungs. Deutsche Telecom, for instance, is already partnering with ABB to provide smart grid solutions and is working with home management company AlertMe to offer energy management services in the home.

Although Siemens is headquartered in Europe, one of its largest applications of PPC's technology is in Qatar. Siemens is providing smart grid solutions for Doha, the capital of Qatar, including smart metering and meter data management. PPC will be used to connect the city's transformer substations. Overall, Qatar is reportedly spending $60 billion in infrastructure upgrades in preparation for the 2022 World Cup.

Many PLC companies are using narrowband, but there are companies using broadband over powerline. IBM and International Broadband Electric Communications have brought broadband service to 20,000 of the 340,000 rural American homes. Current, which is based in Germantown, Md., also offers broadband over powerline, and most of its business is coming from Europe.

Currently, PPC works with various European utilities, including MVV Energie AG, Stadtwerke Dusseldorf, DEW21 and Stadwerke Ratingen.

Derungs said that Germany, U.K. and Middle East are the primary growth markets, with some attention on Eastern Europe as well. Eventually, fiber will make broadband obsolete, but not anytime soon, leaving plenty of opportunity for broadband as smart grid applications evolve and require more bandwidth. “I doubt the whole world will have fiber-to-the-home in the next 20 years,” said Derungs.