Two leading global wind energy companies, Siemens and Gamesa, will merge to form the world’s largest wind provider.

Siemens will hold 59 percent of the company after the merger, and Iberdrola, a shareholder of Gamesa, will continue to hold 8 percent.

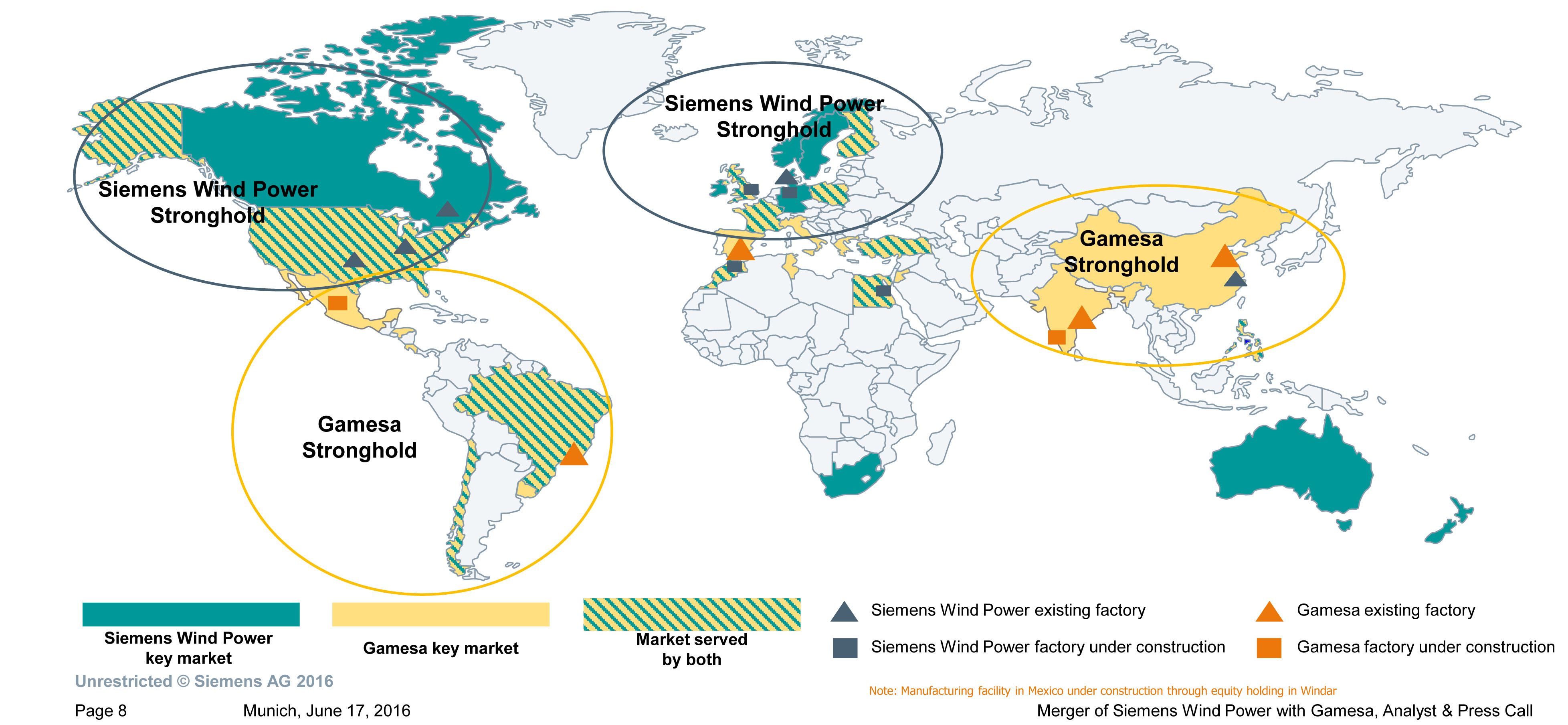

The merger will bring together complementary portfolios. Gamesa has a strong onshore presence in Latin America, China and India, with a very limited offshore portfolio. Siemens, on the other hand, is a market leader in offshore wind and has onshore projects in North American and Europe.

“The new Gamesa will have significantly enhanced market shares in the most important wind markets,” said Gamesa CEO Ignacio Martin. Indeed, in the coming years, virtually all markets could become wind markets. Bloomberg New Energy Finance has forecasted that wind will become the least-cost electricity generation technology almost universally within a decade.

It’s not just geographic synergies that Siemens expects to build on. “Teaming up will enable Siemens and Gamesa to offer a much broader range of products, services and solutions to meet customer requirements,” Lisa Davis, member of the managing board of Siemens AG, said in a statement. “The move will put Siemens and Gamesa in the best position to shape the industry for [delivering] lower-cost...renewable energy to the consumers."

Siemens identified three areas of growth: onshore wind services, offshore wind and emerging markets. Servicing the wind industry could become more lucrative and complex as energy storage is potentially added in, an approach Gamesa is testing in a prototype project in Spain.

Offshore wind installation is a growth area worldwide, with the first offshore wind projects just coming to the U.S., and it is expected to grow more globally as increased regulatory certainty is achieved. China, the world’s largest wind market, is expected to install 1 gigawatt of offshore capacity in 2016 alone, according to Bloomberg New Energy Finance.

China is driving the wind market in emerging economies, but it is hardly alone. In recent years, non-OECD markets have installed more wind than the U.S. and Europe, according to the Global Wind Energy Council, with Brazil, Mexico and India all recognized as fast-growing markets.

Denmark's Dong Energy went public last week on the strength of its offshore wind business.

The merged company will have its global headquarters and be listed in Spain, while the offshore divisions will be in Hamburg and Vejle, Denmark.

The combined companies will have an installed base of 69 gigawatts and revenue of about $10 billion. Siemens will pay out $1.1 billion to Gamesa shareholders, a figure that represents 26 percent of Gamesa’s share price at market close on January 28, 2016.

The deal is expected to close in the first quarter of 2017.