The fuel-cell vehicle market is heating up again with after Toyota announced its 2015 planned release dates for mass-market vehicles.

The Toyota FCV (the mark name as well as the technology acronym) will cost about $69,000 in Japan and a bit less than that in the U.S., according to the Los Angeles Times.

The car is reported to have a range of about 400 miles per tank and can be refueled in just a few minutes. It’s a futuristic-looking and very appealing car for those able to afford it.

Honda is also planning a limited-release FCV in 2015. This will be the latest version of Honda’s concept FCV, previously known as the Honda Clarity. Pricing for Honda’s model hasn’t been offered yet, though it’s likely to be a bit cheaper than Toyota’s offering.

But are policies that support FCV proliferation and adoption really helping to transition transportation away from fossil fuels?

As is the case with Hyundai’s Tucson (which I wrote about in my previous article on FCVs and electric vehicles), Toyota doesn’t project very significant sales in the next few years. Toyota is planning to sell about 5,000 units in the next five years, which seems to put it well within “compliance car” territory rather than representing a serious mass-market vehicle at this time. The sticker price and fueling infrastructure issues are likely the biggest reasons why sales are expected to be limited.

From a policy perspective, we should be very careful at this critical juncture to not make any major missteps when it comes to alternative fuel vehicle policies. Despite the recent boom in oil production in the U.S., it’s clear that this increase is a temporary blip. Official agencies like the Energy Information Administration and International Energy Agency support this conclusion, with projections of U.S. unconventional oil production peaking and beginning to decline by around 2020.

We are pushing against all-time highs again for gas in the U.S., and oil prices have been stuck at well higher than $100 a barrel for some time now.

Regardless of fuel supply issues, climate-change mitigation policies also make it important to avoid major missteps when it comes to viable alternative vehicle options. For these reasons, I’m following up on my previous article by examining California alternative vehicle policy in a little more depth.

The cliché is true: As goes California, so goes the nation -- at least when it comes to energy policy. We have a huge market here in California, and our policymakers are comfortable leading the charge on new policies in the energy arena.

California’s legislated fuel economy standards became a nationwide standard when President Obama incorporated them into the 2017-2025 fuel standards that apply to all states (with some loopholes that reduce the actual mileage requirements quite a bit).

California continues to push the envelope in this area by also requiring automakers to produce a set percentage of zero-emission vehicles (ZEVs) and related low-emissions vehicles, often called partial ZEVs or PZEVs.

A true ZEV is either a battery electric vehicle (BEV) or fuel-cell electric vehicle (FCEV). California has taken this approach because of our state’s ongoing problems with air pollution, as well as concerns about climate change and energy efficiency. Policymakers imposed the ZEV mandate starting in 1990 and in various modified forms long before the higher fuel economy standards kicked in for California or nationally, so the ZEV mandate has been viewed as a parallel effort to spur the vehicle market to higher efficiency, less pollution and innovative technologies.

California also hopes to influence the national car market with the ZEV mandate, and so far, it seems to be doing so, since more than a dozen other states have adopted their own similar mandates.

How the ZEV credit system works

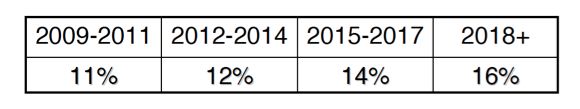

The most recent California ZEV mandate requires major automakers (OEMs) to produce and offer for sale a proportion of ZEVs equal to a certain percentage of all vehicles sold, as shown in the following table.

FIGURE: Current California ZEV and PZEV Requirements for Large Manufacturers

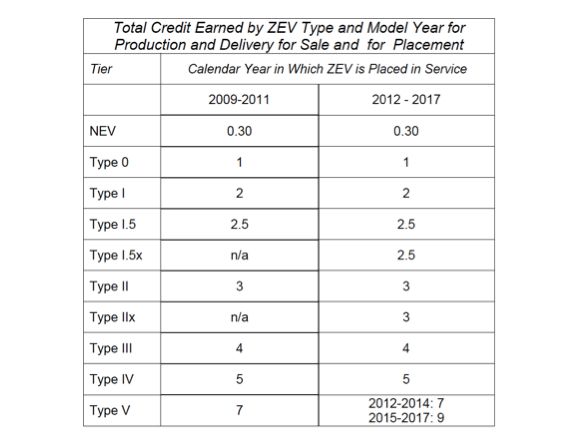

Different types of cars receive different numbers of credits; up to 9 credits per car are available for the 2015-2017 compliance period. The credits are calculated based on total sales and are used to offset the total requirement for each manufacturer. So if an OEM sells 100,000 vehicles in a given year, a 14 percent ZEV requirement means they have to earn 14,000 ZEV credits. These credits can come from selling true ZEVs or various types of PZEVs, or through purchasing credits from others.

FIGURE: Number of ZEV Credits for Various Vehicle Attributes

Types III, IV and V vehicles receive higher credits due to their longer ranges and fast refueling capability. For example, the Nissan Leaf is a Type 1.5, and a FCV that achieves more than 300 miles of range is classified as a Type V. The closer a ZEV is to today’s internal combustion vehicles in terms of range and refueling time, the more credits it gets.

One problem with this approach is that it ignores the convenience of being able to charge in one’s own home overnight and avoiding trips to a fueling station -- not to mention the far lower cost of charging a BEV at home compared to the cost of hydrogen or gasoline fueling.

For example, a BEV charged at home overnight takes literally a few seconds of “work” to plug the vehicle in and then remove the plug in the morning. (Home refueling for FCVs is also being contemplated, but it’s not at all clear when or if this will become reality.) In light of this benefit of BEVs vs. FCVs, it’s not clear why fast refueling plus longer range should receive up to 9 credits, versus a maximum of 4 credits for cars without fast refueling.

There is some controversy on both sides of this issue. FCV advocates favor the higher credit for fast refueling because it supports one of the key benefits of FCVs; BEV advocates generally don’t like it because it favors FCVs. Some critics have also pointed out, however, that Tesla was obtaining large numbers of credits for its vehicles’ ability to take advantage of the still-quite-theoretical battery swap capacity that it has demonstrated but has not yet deployed.

However, earlier this year, the Air Resources Board (ARB) changed this loophole to require evidence of actual use, not just capability, which will likely stop Tesla from earning these extra credits for a battery swap feature that isn’t actually available yet. Nevertheless, the first battery swap station is allegedly opening this year in California.

What is clear is that California policy already has a built-in tilt toward FCVs due to the large bonus credit available for fast refueling. This bonus credit reduces to 7 after 2017, but 7 versus 4 is still a big difference -- one that seems unwarranted in my view.

Why does the Air Resources Board project so many FCV sales?

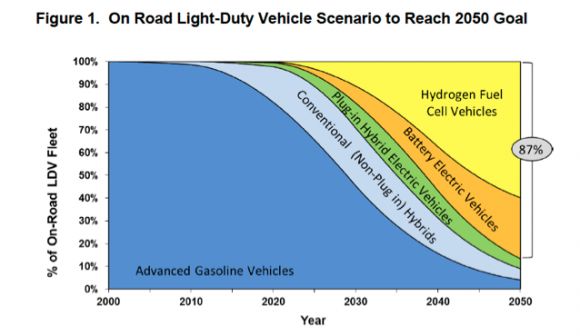

An interesting chart has been included in many ARB and California Energy Commission documents for some time now, showing that by 2050 fully half of all new vehicle sales in California will be FCVs. This chart was first included in a 2011 ARB document that proposed a number of changes to the ZEV program.

Source: Advanced Clean Cars: Initial Statement of Reasons, ARB December 2011

I haven’t been able to find any numbers or explanation for this particular projection (I never received any reply to my inquiries to ARB), despite its inclusion in various documents. And yet the chart is cited by FCV advocates as support for the assertion that FCVs will be a big part of the market in coming years. It is described in the ARB Advanced Clean Car Program summary as “one scenario” for achieving an 80 percent reduction in emissions from the transportation sector.

The chart was created in 2009 by ARB staff but it doesn’t seem to have been updated in light of the tremendous gains made in the BEV and PHEV markets since then. If this is the case, ARB staff should revisit this projection and reconsider its policy positions with respect to the viability or even the need for FCVs. ARB may already be working on a revision, which would be welcomed.

Lending weight to this recommendation, Honda doesn’t expect full commercialization of FCVs until around 2030 (see slide 7 of the linked presentation). We can argue about the definition of “full commercialization,” but with dozens of BEV and PHEV models already on the market or soon to be on the market, at the very least, BEVs and PHEVs are five to ten years ahead of FCVs in terms of full commercialization.

Greenhouse gas emissions and FCVs

Perhaps a more important issue with FCVs concerns their greenhouse gas emissions. This is a complex issue, to be sure, but we often hear that FCVs are clean and can reduce greenhouse gas emissions.

In fact, the California Fuel Cell Partnership claims that “[H]ydrogen made from natural gas and used in a fuel cell vehicle reduces greenhouse gases (GHGs) by 55% to 65% compared to gasoline used in a conventional vehicle, and by about 40% compared to gasoline in a hybrid engine.”

This is a highly misleading statement, because many car models, including FCVs, BEVs and conventional cars, have half or less the emissions of a conventional vehicle using gasoline, simply due to the smaller size and reduced horsepower of the car. In other words, the “conventional vehicle using gasoline” (23 mpg is the EPA average) is the wrong comparison because it’s too large and has far more power than FCVs and most BEVs too.

FCVs and BEVs should be compared to similarly sized vehicles with similar attributes. And when we do such a comparison, the greenhouse gas emission benefits of FCVs using natural gas as a hydrogen source disappear.

A 2014 University of California, Irvine, study found that a 40 mpg internal combustion engine (a decent hybrid vehicle or a small economy car) produces about 0.34 kilograms of GHGs per mile -- almost exactly the same as FCVs using hydrogen from natural gas delivered by liquid truck.

The emissions for FCVs using hydrogen from natural gas delivered by gas truck are about 0.3 kilograms per mile, for a small improvement over today’s more efficient internal combustion vehicles. FCVs using hydrogen produced with renewable electricity produce emissions comparable to BEVs, but as discussed below, this is an extremely wasteful way to use renewable electricity due to conversion losses.

Certainly, FCVs can and will be developed in larger or more powerful configurations than 40 mpg ICE replacements, and these larger FCVs will enjoy some GHG savings. However, this is a small hook upon which to hang the hat of the FCV future.

A more trenchant critique is offered by Julian Cox, an independent analyst who compares the horsepower of FCVs, EVs and ICEs and attempts to show that the reduced power for FCVs is fully responsible for the reduced GHG emissions that advocates tout. Cox shows also that BEVs don’t suffer from this tradeoff because they are simply more efficient at converting energy into motion and provide similar power to ICEs.

The GHG reduction benefits of FCVs using hydrogen from natural gas are nonexistent or minimal because, while natural gas is less carbon-dense than oil, the conversion process from natural gas to hydrogen to electricity (in the fuel cell) is not a very efficient process. Converting from hydrogen to electricity loses about half of the energy in this step alone.

Nor can we ignore the fact that an increasing percentage of U.S. natural gas is produced from fracking and horizontal drilling, both of which are highly controversial for good reason: there are very significant environmental issues associated with these techniques, which is why hundreds of localities have already banned, permanently or temporarily, such practices.

In short, the natural gas pathway for FCVs seems like a non-starter for a number of reasons, and yet it is acknowledged by most FCV advocates as the likely fuel path for the foreseeable future.

Using renewable energy to create hydrogen from water would give very low emissions for FCVs, but as I pointed in my previous article, it would be far more efficient to simply use renewable electricity directly in BEVs and thereby avoid the 70 percent or more loss of electricity associated with using electricity to create hydrogen and then converting hydrogen back into electricity in the fuel cell.

I still haven’t found a newer study on this issue, but the conclusions of past research were generally confirmed in conversation with a hydrogen expert at the University of Hawaii who stated that about 70 percent of the energy is lost through these two conversions. The same expert said that the efficiency of these processes hasn’t changed much in the last thirteen or fourteen years.

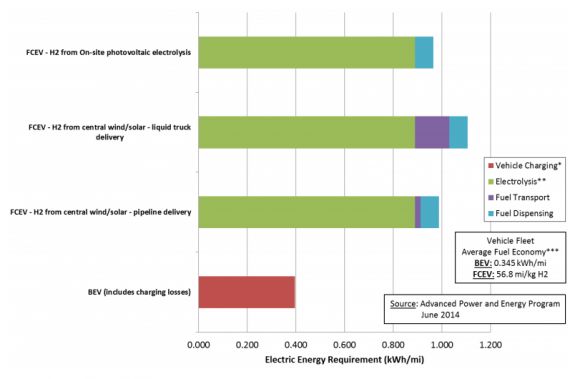

The same conclusion holds whether one's chief concern is greenhouse gas emissions or energy independence: if BEVs are so much more efficient than FCVs in converting renewable electricity to movement of people and goods, why waste that electricity in FCVs? To drive this point home, refer to the following figure from a UC-Irvine study showing that BEVs are 2.5 times more efficient than FCVs when FCVs use renewable electricity to create hydrogen.

With that level of efficiency, a BEV could drive 250,000 miles for every 100,000 miles that an FCV could drive on the same amount of electricity. That’s a big difference. This problem alone weighs very heavily against FCVs as a viable alternative transportation pathway.

FIGURE: UC-Irvine Study Comparing BEVs and FCVs Using Renewable Electricity

In sum, the greenhouse gas emissions benefits of FCVs when natural gas is the hydrogen feedstock are minimal at best. When compared to BEVs, they come out looking pretty bad, particularly when we consider the other environmental downsides to natural gas. And as hydrogen is increasingly produced from renewable electricity, it makes far more sense to use that electricity directly in BEVs and PHEVs due to the large conversion losses from making hydrogen with electricity.

It’s worth noting also that Chevrolet keeps track of how many miles its Volt customers drive in electric mode rather than gasoline mode, and this information is posted online. Perhaps surprisingly, almost two-thirds of all miles driven by Volt owners so far have been electric.

This adds weight to the argument that PHEVs and BEVs combined can do just about everything that FCVs are expected to do in terms of reducing fossil fuel use, while providing the same features that owners expect from their traditional cars. And as vehicle weight and battery costs come down and range goes up for BEVs and PHEVs, this argument gets stronger and stronger.

Which way California?

Wrapping up, I understand entirely why policymakers, manufacturers and some advocates have long supported FCVs. The range and quick refueling benefits are pretty compelling when compared to today’s crop of BEVs.

In researching this article, I spoke with Tyson Eckerle, the governor’s ZEV Infrastructure Project Manager. In posing a number of questions to him about the wisdom of current California alternative vehicle policies, he argued that it’s far too early to pick winners or to have concluded that the market has picked winners yet. He also argued that if we are to meet the California goal of an 80 percent reduction in GHGs from transportation by 2050, we need to have 100 percent of all new car sales coming from ZEVs by 2040, and to reach that very ambitious goal, we simply can’t rely only on BEVs and PHEVs.

Another FCV advocate who I’ve talked to in some depth has argued that the current bumper crop of BEVs is a short-lived phenomenon because of hidden battery longevity issues that will only become apparent a number of years after the cars are sold. Most BEVs have solid battery warranties, so this is not a big issue for consumers at this point. Rather, it’s potentially a big issue for manufacturers if they are forced to pay heavy costs due to batteries that don’t last as long as advertised. We can’t, of course, know if this is a real concern yet because only time will tell. But if it is a real issue, it will certainly give the BEV sector a black eye.

This is not a simple debate, but looking at the environmental issues associated with FCVs, the fuel efficiency and cost issues, the timeline for achieving full commercialization, as well as the range benefits and convenience of PHEVs, FCVs don’t look at all promising to me as a big part of achieving a low-carbon transportation system.

We already have a growing market for BEVs and PHEVs, a nascent path to much improved range and lightweighting, and a clear path for lower costs for these vehicles as battery costs steadily fall.

Based on these facts, it does seem plausible to me that we could reach 100 percent or near all new vehicle sales by 2040 with enhanced BEVs and PHEVs. The end result of these improvements will be higher range in BEVs and PHEVs along with steadily lower costs.

Simply put, the market developments for BEVs and PHEVs over the last few years, plus the greenhouse gas emissions and efficiency problems of FCVs, seem to have already rendered moot the longstanding policy and technology support for FCVs in California. But this new reality hasn’t yet been internalized by California’s policymaker community.

***

Tam Hunt is the owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii.