California gave the U.S. energy storage market a boost in 2013 when regulators set a 1.3-gigawatt target for the state's three investor-owned utilities.

The mandate has resulted in a wave of contracts for battery and thermal storage projects in California, including a record-breaking 250-megawatt procurement from Southern California Edison.

Now, one national lawmaker wants to do the same for the rest of the country.

Senator Martin Heinrich (D-NM) quietly introduced legislation to the Energy Committee last week that would set national targets for energy storage by 2021 and 2025 in order to meet growing peak demand on the grid and help the integration of renewable energy.

Under the bill, called the Energy Storage and Deployment Act of 2015, large retail electric utilities would need to meet at least 1 percent of their peak demand from storage by 2021. By the end of 2024, they'd need to meet at least 2 percent of peak load with storage. Half of all procurements would come from technologies that can provide more than one hour of electricity.

"The bill is modeled on a successful program in California, which requires three large utility companies to deploy at least 1,325 megawatts of storage by the end of 2024," said Whitney Potter, a spokesperson for Senator Heinrich.

Nearly every kind of storage technology would be eligible. The list in the bill includes pumped hydro, compressed air, hydrogen fuel cells, electrochemical batteries, thermal storage, flywheels, capacitors and superconducting magnets.

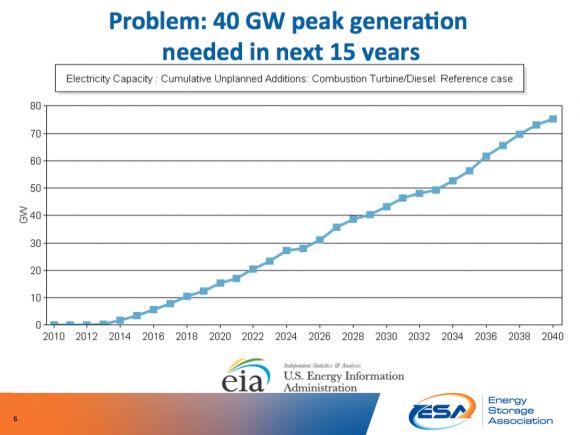

According to the Energy Information Administration, summer peaks across the U.S. in 2017 could hit 824 gigawatts. Over the next 35 years, U.S. utilities will need to procure 40 gigawatts of additional peaking resources.

The proposed mandate would leverage more than 8 gigawatts of storage by 2021 to meet projected peaks, and roughly 18 gigawatts by the end of 2024. (By 2020, without the target, GTM Research currently expects America to cumulatively install 4 gigawatts of projects across all sectors, excluding pumped hydro and thermal.)

Since 2002, lawmakers have tried more than half a dozen times to get a renewable energy target passed through Congress. However, even with support in both parties, many conservatives and opposition groups couldn't bring themselves to support a mandate. (Senator Heinrich co-sponsored the most recent bill that would create a renewable energy target.)

Senator Heinrich's bill may face similar opposition. But it also has something else going for it: novelty.

"This is one of those middle areas," said Katherine Hamilton, a partner with 38 North Solutions. "It's new. But it is a target."

Two years ago, Senator Ron Wyden (D-OR) crafted legislation that would have given storage systems a 20 percent investment tax credit for systems above 1-megawatt/1-megawatt-hour and a 30 percent tax credit for smaller 1-kilowatt/5-kilowatt-hour systems. The bill fizzled out with minimal support.

Senator Lisa Murkowski (R-AK), the chair of the Senate Committee on Energy and Natural Resources, has asked her colleagues to introduce new bills as part of a plan to collect the best ideas into a comprehensive energy bill sometime this year. During a committee hearing last week, lawmakers discussed more than two dozen pieces of proposed legislation.

Senator Angus King (I-ME) introduced a bill earlier this month that would create a national standard for distributed energy interconnection, helping open up the market to new technologies. Supporters are hoping his language makes it into a broader piece of legislation.

Senator Heinrich has tapped Senator King as a co-sponsor of his storage bill. The bill has very little chance of passing as a standalone mandate. But as lawmakers start mixing and matching legislation, the likelihood that storage is included increases.

Even if Congress passed a storage target, implementation would be complex. Integrating lots of storage into the grid will require coordination among regional transmission operators, utilities and regulators to set rate structures that recognize the value of storage for different uses.

"There are a lot of moving pieces," said Ravi Manghani, a senior storage analyst with GTM Research. "In a lot of ways, this puts the carrot before the horse. Meeting the target would require a lot of changes throughout the grid hierarchy."