Millions of people live in cities where going solar would cost them less than their current utility rates -- and most of them don’t even know it.

According to a new report by the North Carolina Clean Energy Technology Center, backed by the SunShot Initiative, a fully financed solar PV system costs less than the energy purchased from a residential customer’s local utility in 42 of the 50 largest cities in the United States.

Among single-family homeowners in those 50 cities, the Center estimates that 9.1 million live in a place where solar would be cheaper than their utility bill if they bought the system outright. Nearly 21 million would be better off going solar if low-cost financing is available.

“Right now, buying an average-sized, fully-financed solar PV system costs less than electricity from their local utility for 93 percent of single-family homeowners in America’s 50 largest cities, and in most places, is a better investment than many of the stocks that are in their 401(k),” said Jim Kennerly, project manager for the Going Solar in America report. “Nevertheless, most people are unaware that solar is this affordable for people of all walks of life.”

Many customers mistakenly think going solar requires having a lot of sunshine. The report points out that solar's value to the customer is more about how much grid energy it can offset.

The Center designed a ranking system for investing in solar in 50 cities using pricing data from the online solar quote service EnergySage. The analysis took into account three metrics: first-year average monthly bill savings, the value of investing in solar relative to a long-term investment indexed to the S&P 500 stock index, and the levelized cost of energy from a rooftop solar array.

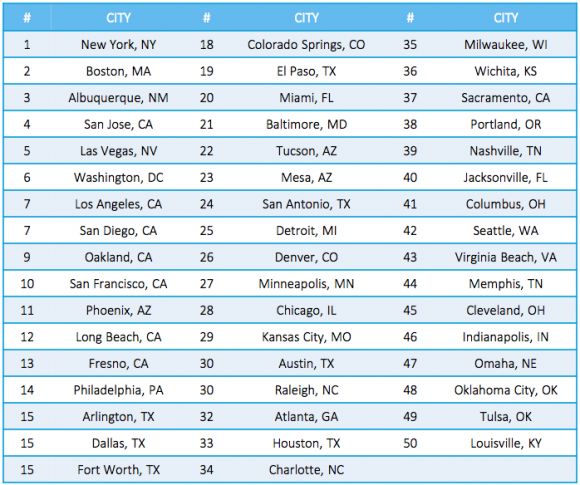

Figure 1: Ranking of 50 Largest Cities Based On Where Solar Offers Best Financial Value

It’s no surprise that places with high electricity rates -- New York, Boston and several cities in California -- claimed some of the top spots on the list. But the study found that solar is also competitive in Kansas City, Atlanta, Charlotte, Milwaukee, Wichita, Columbus and other smaller markets.

That’s because low electricity prices don’t necessarily mean consumers save money. U.S. Energy Information Administration (EIA) data shows that customer in regions with the lowest rates tend to use the most energy and pay the highest bills. For instance, in 2012, the latest year with vetted data, customers in the South Atlantic region paid 11.4 cents per kilowatt-hour on average and $123 for their monthly bill, whereas customers in New England paid 15.7 cents per kilowatt-hour and only $100 on their monthly bill.

Electricity prices aren’t likely to get any lower, either. EIA forecasts that utility rates will rise between 33 percent and 83 percent over the next 25 years -- the typical lifetime of a solar PV system.

Meanwhile, there’s been a rapid decline in the hardware costs for solar energy, which has made the technology much more accessible in all parts of the country. According to Lawrence Berkeley National Laboratory, the median cost of a residential solar project fell from $12 per watt in 1998 to $4.70 per watt in 2013. EnergySage reports that the average cost of a 5-kilowatt rooftop system in the third quarter of 2014, before incentives, was as low s $3.70 per watt.

In the third quarter of 2014, GTM Research found an even greater cost drop for turnkey residential systems of 5 kilowatts to 10 kilowatts, with an average of $3.60 per watt.

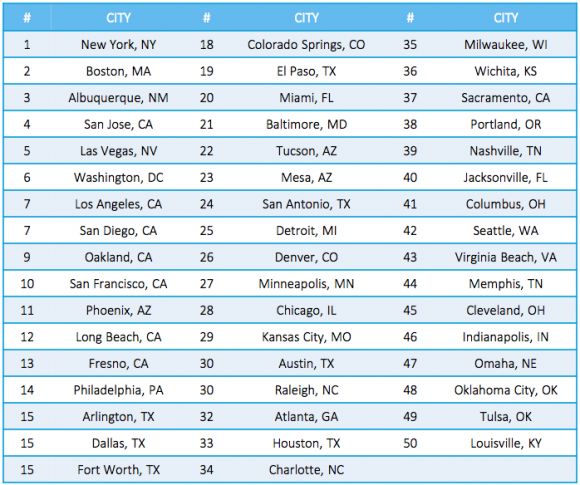

Figure 2: Q3 2014 Price per Watt by U.S. Region

Policies such as the federal Investment Tax Credit, state renewable portfolio standards, net metering and value-of-solar tariffs have helped to encourage more people to invest in solar, which in return has further reduced costs.

Accounting for all of these factors (electricity prices, solar costs, relevant policies, etc.), the report finds that customers in the most of the 50 largest cities would benefit from going solar.

Some places will see significant savings upfront. In Kansas City, for instance, residential solar customers can expect to save $57 per month in the first year of ownership. California residents can see even greater savings of up to $187 per month in that first year.

Costs per watt are higher in California than in the Midwest, however. That means a California customer would pay $19,840 for a 5-kilowatt solar project, while a customer in Kansas City would pay $18,600. In the Northeast, where installation costs are highest ($4.24 per watt), customers would pay $21,000 on average for a 5-kilowatt system.

The report finds that for many of America’s 50 largest cities, the net present value of a dollar invested in solar (what the lifetime of the system is worth in today’s dollars) is greater than a dollar invested in the stock market.

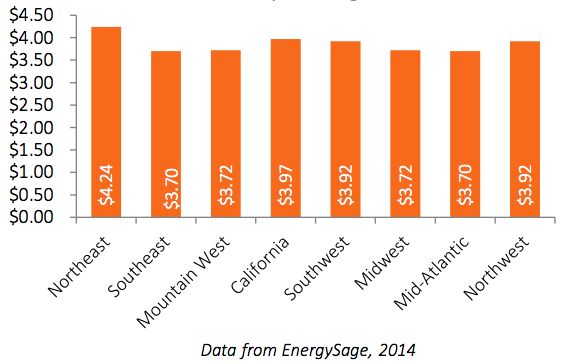

In twenty of the 50 cities, customers paying upfront with cash for a 5-kilowatt system will see greater returns than on the stock market over the 25-year life of the system. In 46 of the 50 cities, customers with a fully financed solar project will see better performance than the stock market. Financing over time benefits more people in all cities. San Jose ($23,171), San Francisco ($21,859) and Oakland ($21,839) came out on top.

Figure 3: Net Present Value of Investing in Fully Financed 5-Kilowatt Solar Project

In many cities, the inflation-adjusted levelized cost of energy for solar is competitive with grid energy. The study calculates that 20.7 million single-family homeowners in America’s biggest cities live in a place where financing brings solar to cost parity. In New York, San Diego and Boston, customers could pay 7 cents less than grid energy.

It's worth noting that the study assumes a 100 percent financed purchase at 5 percent interest over 25 years. Terms vary, but most loans are shorter, at ten to twelve years.

For solar to reach more consumers and compete without incentives going forward, the study calls for further action to reduce non-hardware costs, or soft costs, which account for up to 64 percent of total system costs. Costs associated with customer acquisition, installation labor, financing, and permitting and inspection are especially high.

“Thus,” the report says, “it is not hyperbolic to say that the soft-cost reduction challenge is at the heart of getting rooftop solar PV to a level of broad-based cost-effectiveness (and true nationwide consumer acceptance).”