Many conventional electricity generators have already received a battering from rooftop solar. Most fossil-fuel generators, particularly those in Europe and Australia, are struggling to make a profit.

But things are likely to get worse. The influx of battery storage is destined to further reduce demand from conventional generators.

A major new analysis from global investment bank HSBC, called Energy Storage, Power to the People, concludes that the boom days for fossil fuels are over.

“There is no prospect of any return to anywhere near the level of profitability seen in the latter part of the last decade in generation,” write the HSBC analysts.

The HSBC analysis looks at a range of storage technologies and how they will impact conventional energy systems. Its major conclusion is that affordable battery storage will increase distributed generation -- solar panels on household and business rooftops -- and further reduce demand from the grid.

Once again, writes HSBC, the revolution will be led by Germany, and later by major initiatives in California and China.

“The German energy transition encourages the retail customer to become a ‘prosumer,'” the HSBC analysis notes, adding the prediction that domestic storage paired with solar is set to take off.

“We believe that in markets such as Germany, households [which] are in ideological agreement with the drive toward renewables, [which] wish to be more in control of their own power supply and consumption...[and which] are aware that the financial commitment is...twenty years will be prepared to embrace the battery storage principle.”

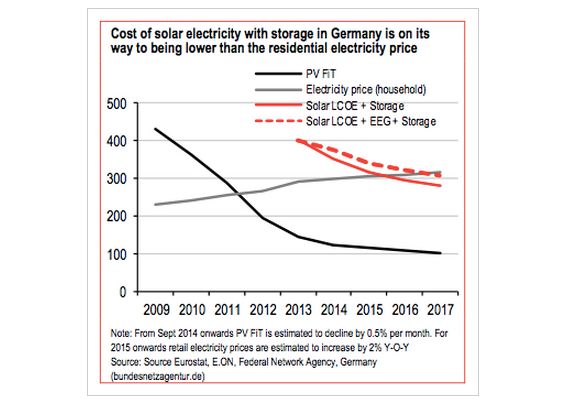

And, as this graph shows, the combined cost of solar and storage is on the way to being lower than the residential price in Germany. Welcome to "storage parity."

HSBC also notes that the German public will drive the growth of battery-based storage of solar-generated power, showing the way as the global solar market gains critical mass -- just as it did with rooftop solar.

“The German government is, more than any other, promoting a localized system within which households (or collectives) actually own the generation. Given that (i) the unit size of 30% (and rising to 50% by 2025, we estimate) of German generation capacity is less than 10 MW, the process of re-localization of power production appears unstoppable,” the report concludes.

HSBC expects the storage boom to go well beyond households and deeper into the energy market to balance large-scale renewables.

Seeing this trend, the large European utilities RWE and E.ON have become heavily involved in distributed energy, regional smart grids, and have focused on energy efficiency, batteries and other storage solutions.

Both utilities now offer storage devices to end-user household customers with solar, and are looking at a variety of grid-scale storage systems. RWE recently installed a compressed air storage pilot plant with a capacity of 360 megawatt-hours to store wind energy in Saxony.

According to RWE, the unit will be able to provide substitute capacity at short notice and replace up to 50 wind turbines of the type used in the region for up to four hours.

E.ON, meanwhile, has snapped up an energy services company, is investing in solar PV battery storage systems for homes, and has built a 2-megawatt power-to-gas pilot unit in the German municipality of Falkenhagen that can produce 360 cubic meters of hydrogen per hour from wind energy.

E.ON is also investing in a range of other battery storage technologies, including a modular 5-megawatt "multi-technology” voltage battery storage plant. It is looking to “identify promising business models early in the process,” and has even invested in a ”smart energy real estate” concept development in Sweden.

***

Giles Parkinson is the founding editor of RenewEconomy. The full version of this piece was originally published at RenewEconomy and was reprinted here with permission.