California’s two days of rolling blackouts in August were the result of disconnects between its existing grid reliability constructs and the needs of an increasingly solar-powered grid, and its failure to prepare for a regional heat wave across the Western U.S. that undermined its reliance on out-of-state resources.

Those are the key findings of a long-awaited “root-cause analysis” from California’s grid operator and utility and energy regulators into the causes of its first rolling blackouts since the 2001 energy crisis, which shut off power to hundreds of thousands of customers for about an hour during the evenings of August 14 and 15. That's forced the state to confront flaws with its resource adequacy (RA) construct for securing the resources needed to meet grid demand peaks that are being pushed later into the day by the state's increasing share of solar power.

Gov. Gavin Newsom ordered the California Public Utilities Commission, the California Energy Commission and state grid operator CAISO to conduct the analysis and take steps to prevent future rolling blackouts under similar conditions. Wednesday’s report provides far more detail into what happened, but its broad outlines closely match the initial analysis from CAISO and the CPUC in the days after the blackouts.

Failing to plan for a once-in-decades heat wave

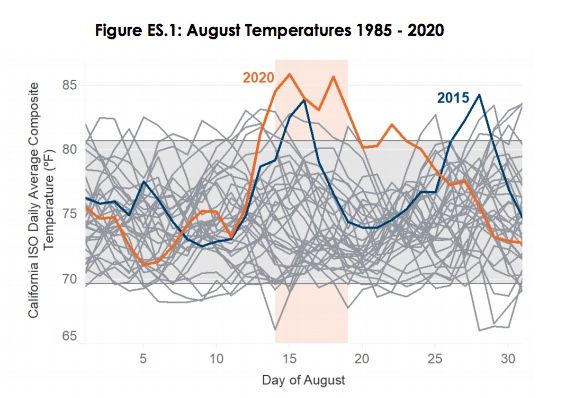

First, California’s “existing resource planning processes are not designed to fully address an extreme heat storm” like the one that hit much of the Western U.S. in August. That regionwide spike in temperatures between 10 to 20 degrees above normal was a “once-in-35-years” event, CPUC President Marybel Batjer said in Wednesday’s report summary.

California’s resource adequacy obligations are planned for a once-every-two-years weather event, with a 15 percent planning reserve margin atop that procurement. This lack of in-state resources dedicated to meeting extreme air-conditioning electricity demand forced CAISO to seek more energy from out-of-state generators and grid-balancing authorities, a step the state has increasingly relied upon over the past half-decade.

But with the entire Western U.S. facing the same temperature spikes, those resources weren’t available on energy markets, the report found. Former CAISO President Steve Berberich highlighted this problem in a press briefing after the rolling blackouts, noting the need for planning that captures the increasing likelihood of extreme weather driven by climate change.

A gap between resource adequacy and current grid reality

Second, California’s resource adequacy construct hasn’t been restructured to assure the state can meet the increasingly late evening peaks in demand driven by solar power.

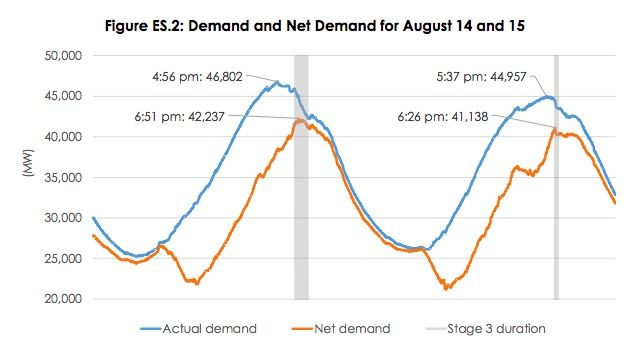

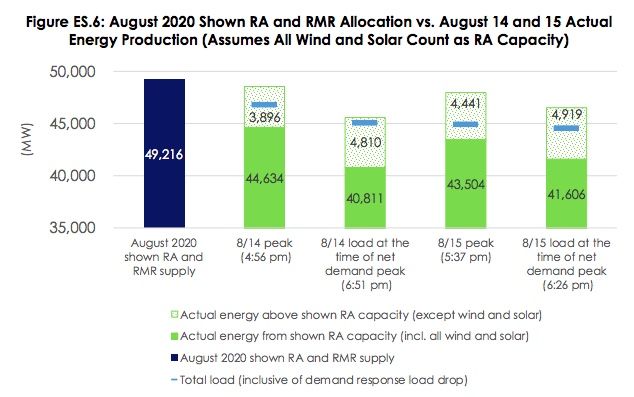

California’s load-serving entities — its investor-owned utilities, community-choice aggregators and retail energy providers — had met their resource adequacy obligations for August. But it is the actual needs of CAISO’s grid during the “net peak” period, when solar generation fades away but electricity demand is still high, that is the focus of RA procurement, as this chart indicates.

What's more, some of the RA resources available, plus resources dedicated to emergency service under “reliability must-run” contracts, weren’t able to perform during critical hours on both days, the report added.

Natural-gas-fired generators in California saw a collective reduction in capacity of between 1,400 and 2,000 megawatts, a combination of a handful of plants being forced offline and slight but widespread reductions in generating capacity from those still running due to heat-related limitations. That's more power than the reductions from the rolling blackouts, Wood Mackenzie microgrid analyst Isaac Maze-Rothstein noted.

Meanwhile, reductions in out-of-state transmission capacity reduced the availability of imports under RA contracts by about 330 MW, compared to their day-ahead commitments, the report found. Wind, solar and hydro resources provided less energy than their RA commitments — a not-unexpected result of their inherent variability.

Demand-response resources and other load reductions were called upon to an extraordinary degree during and after the Aug. 14 and 15 blackouts, and they have been credited with helping to forestall the need for more forced outages the week after. But demand response still provided less than its stated RA capacity value, particularly in later hours when much of it had already been tapped.

All in all, the combination of resources relied on for grid reliability wasn’t available during the hours when CAISO was forced to institute the call for rolling blackouts, as this chart shows.

CAISO’s Berberich attributed this gap partly to CPUC’s failure to order the state’s investor-owned utilities to procure the 4,700 MW of resource adequacy by 2022 it had said was needed. The CPUC ordered utilities to procure 3,300 MW of resources by 2023 last year, but those resources are still in the midst of being brought online, largely in the form of batteries and hybrid solar-storage systems.

But beyond nameplate capacity shortfalls, California’s RA construct is riddled with acknowledged problems in how it measures the value of contracted resources and ensures that they’re available when they’re needed. The CPUC is in the midst of a major RA reform proceeding, looking both at foundational changes and at how distributed energy resources such as batteries, electric vehicles and grid-responsive loads can play a bigger role.

Market practice problems and potential solutions

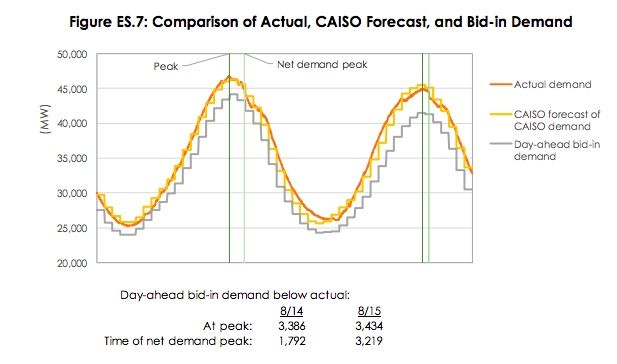

Third, the report identified key day-ahead market practices that made it harder for CAISO to manage its grid emergency. One problem was that utilities, community-choice aggregators and retail energy providers “under-scheduled their demand for energy” in their day-ahead market submissions, effectively underestimating how much energy they actually ended up needing during the days in question.

“Convergence bidding,” a process by which electricity buyers can hedge day-ahead offers via “virtual bids” to better align them with real-time prices, also played a role in overestimating the amount of import resources that would be available, the report found. CAISO suspended convergence bidding in the week following the rolling blackouts to avoid this problem.

Finally, CAISO’s “residual unit commitment” process for ensuring adequate supplies amid these market pricing mechanisms faltered during the days of rolling blackouts by“reinforcing the signal that more exports were supportable,” the report found.

CAISO, CPUC and the California Energy Commission are under intense pressure to make changes to prevent these problems from causing future rolling blackouts. That will require speeding completion of projects coming online to meet future years’ RA needs and expediting regulations to allow more demand response and load flexibility to be brought to bear in 2021.

These agencies are also under pressure to evaluate how RA-credited resources actually perform compared to their commitments and to change market practices to “ensure they accurately reflect the actual balance of supply and demand during stressed operating conditions.” A forthcoming final version of this report will deal with the challenges of adapting traditional methods for balancing supply and demand on California’s increasingly renewable-powered grid.