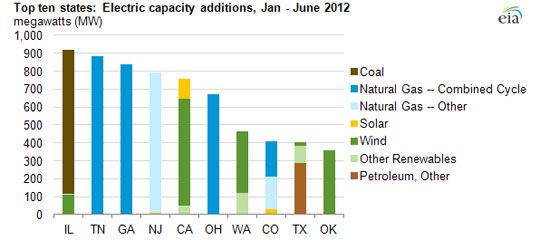

With the low price of natural gas, it’s no surprise that most of the new generation in the U.S. is natural gas. In the first half of 2012, there was more than 8,000 megawatts of new generation, and more than 80 percent of that was either natural gas or renewables -- namely wind.

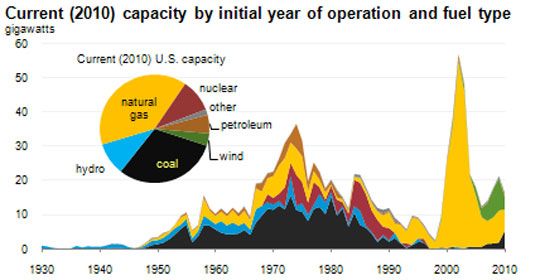

The natural gas boom has been going on for quite some time, with the bulk of new generation being natural gas for the past fifteen years, according to data from the U.S. Energy Information Administration. Combined-cycle gas plants dominated in Tennessee, Georgia and Ohio, with wind making sizeable contributions in Oklahoma, Washington, California and, to some extent, in Illinois, which was the only state that built new coal generation in early 2012.

The move to combined-cycle gas in states like Ohio, which have predominantly relied on coal, comes at a time of uncertainty around when the U.S. Environmental Protection Agency will implement its new rules that will affect the country’s dirtiest coal plants. Power providers most are hedging their bets no matter what the outcome of the MATS rule may be and are moving away from coal.

The EIA noted that in a 2011 annual survey of power plant operators it received no new reports of planned coal-fired generators. Currently, only one of the fourteen coal plants that are reportedly under construction moved from pre-construction to under-construction from 2010 to 2011, according the EIA.

With the exception of California, solar was just a blip on the radar. “Other renewables,” which includes hydroelectric, geothermal, landfill gas and biomass generators, made a larger contribution than solar, with about 250 megawatts of new generation in 2012. Rooftop solar, however, is not included in the utility-scale electric capacity additions.

Wind made the largest impact of all the renewables, with more than 1,300 megawatts deployed. Most of the generation was on the smaller side -- more than 100 of 165 generators were under 25 megawatts. The trend toward smaller-scale generation, whether landfill gas or solar, will drive utilities to have distribution systems that can handle decentralized power sources.

An earlier report from the EIA, which found there will be 27 gigawatts of retired coal in the next five years, noted that while natural gas goes up, renewables could go up significantly.

Of course, time will tell. States are working to meet renewable portfolio standards, which will increase renewables, but forward-looking utilities are also using demand response and energy efficiency (if they’re incentivized to do so) to offset generation for years.

Grid operators are already preparing for different generation scenarios. In Texas, they're raising prices to build more generation. PJM is increasing reliability and investing in transmission. MISO, a stronghold of coal, is looking toward wind and demand response.

Many of the plans are still preliminary, but these changes at independent system operators will impact the electricity generation mix and structure of the grid for generations to come.