The renewable portfolio standards that many states have enacted are responsible for 60 percent of the growth in non-hydro renewable energy generation, according to a new study from Lawrence Berkeley National Laboratory.

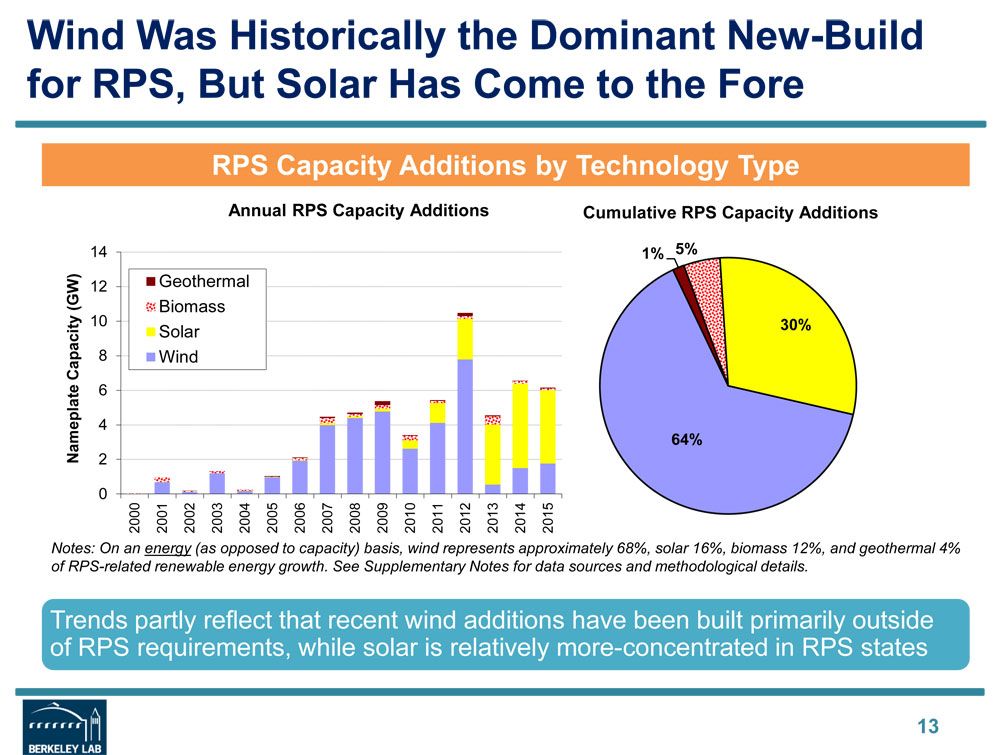

Most of the additional capacity to meet RPS requirements has come from wind, but in recent years, solar energy is gaining traction. Renewable portfolio standards call for a certain percentage of power generation to come from renewable resources, although what qualifies as renewable and which power generators have to meet the obligations varies by state.

The majority of states are on target to meet their differing requirements in the near and long term. In 2014, RPS achievement averaged 95 percent, with only Illinois and New York lagging significantly.

Each state has very different rules around RPS requirements, but the outcome is that they are achieving what they set out to do. The Berkeley Lab study found that build rates are on schedule to deliver the requirements of more than 400 terawatt-hours of clean energy by 2030, roughly double what is available today.

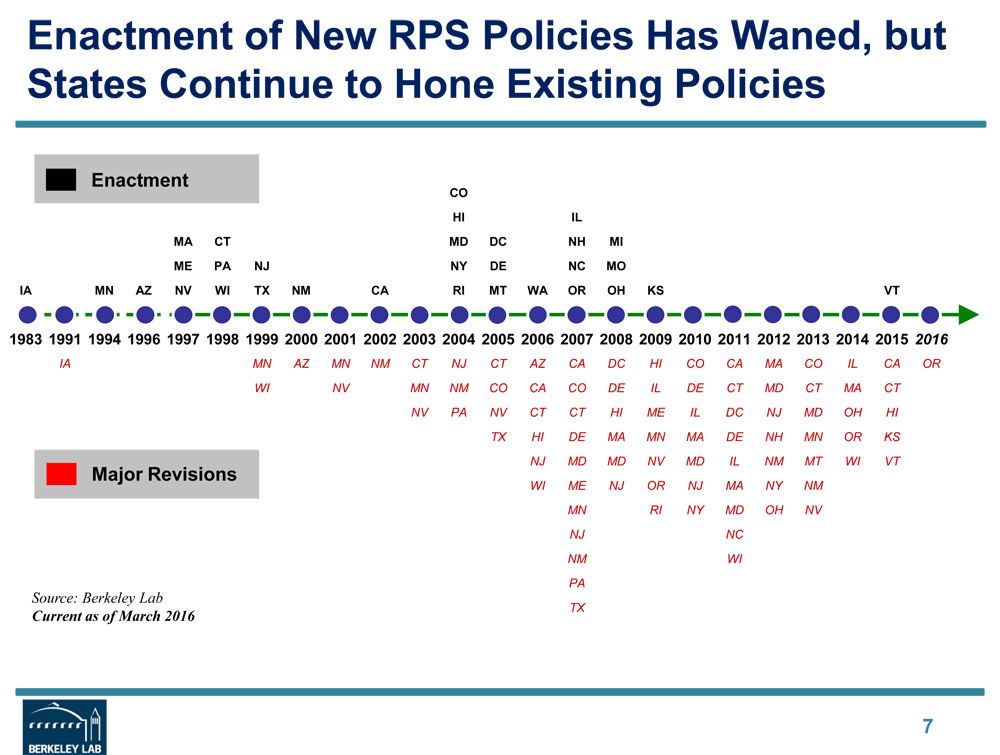

Many states have strengthened their RPS criteria in the past few years, and only two have weakened them. For most states, the adjustments have either been higher overall targets, or specific carve-outs for solar or distributed generation.

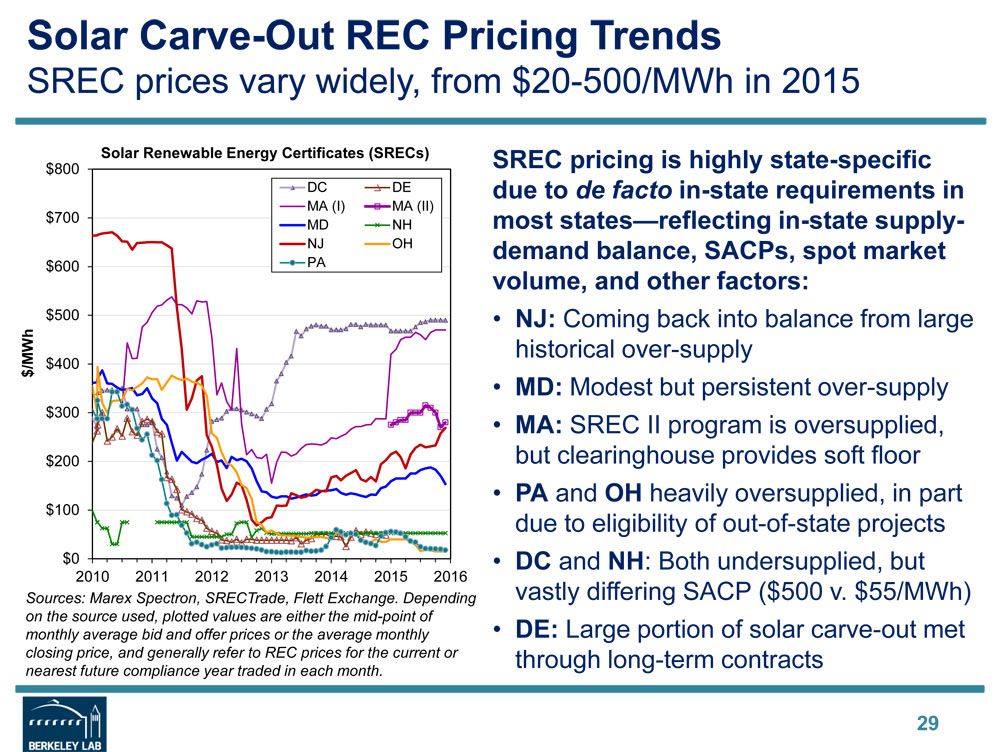

Cost compliance is also all over the map, but in all cases it is below, and often well below, cost caps. The average cost compliance for RPS requirements equated to approximately 1.3 percent of retail electricity bills in 2014, up from 1 percent in 2013.

In states with solar carve-outs, the price for solar renewable energy credits varies wildly. As with other aspects of an RPS, the rules are highly state-specific. Some states, such as Massachusetts and New Jersey, have an oversupply, while District of Columbia and New Hampshire have an undersupply.

The states that have an RPS are also driving investment in renewables in other states that don’t have the mandates. More than 10 percent of projects to support renewable portfolio standards have been built in states that do not have an RPS. Only a handful of states in the U.S. have not seen any renewable generation build-out because of an RPS.

Moving forward, RPS mandates will not be as a big a driver for renewable adoption as they had been in the past, even though they are expected to add another 60 gigawatts of clean power capacity to the U.S. grid by 2030. Instead, market drivers and other regulations are increasingly bringing wind and solar on-line across the U.S. as prices for renewable energy continue to drop.

The shift away from a reliance on RPS mandates to deploy renewables is already underway. In 2013, 71 percent of renewable energy installments were due to RPS requirements, a figure that dropped to 46 percent in 2015.