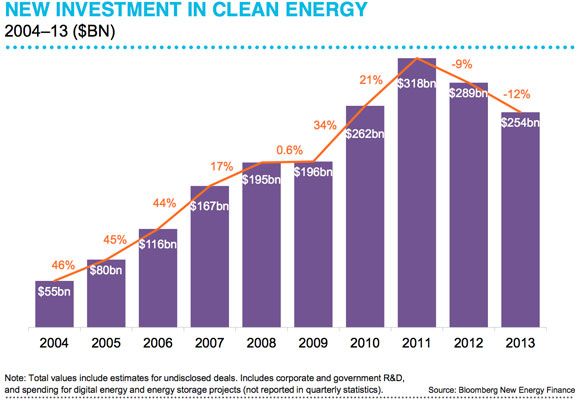

Global investment in renewable energy and clean energy technologies has dropped for the second year in a row, according to Bloomberg New Energy Finance.

Investment figures came to $254 billion in 2013, an 11 percent drop from 2012. The record high for renewable energy financing came in 2011 at nearly $318 billion, according to BNEF. Declines in Europe dragged down the whole market, but there are some bright spots.

“A second successive year of decline in investment will come as unwelcome news to the clean energy sector,” Michael Liebreich, founder and chairman of the advisory board for BNEF, said in a statement. “But the top-line figures don’t tell the whole story.”

There's actually a silver lining in the numbers. Part of the decline was caused by the improving economics of solar and wind, said Liebreich. But advocacy groups estimate that annual investments must increase to $500 billion by the end of the decade -- and eventually $1 trillion annually by 2030 -- in order to stabilize global temperatures.

Regional results were mixed. Japan was a success story in 2013; investment there jumped 55 percent to $35 billion, up from about $23 billion in 2012. Japan was easily the hottest solar market in 2013 because of a feed-in tariff that was instituted to help offset the losses from 50 nuclear generators that were taken offline after the Fukushima nuclear disaster. The first half of 2013 saw twice as much solar installed in Japan as in all of 2013.

In Latin America, commitments to clean energy expanded. Chile, Mexico and Uruguay all invested more than $1 billion each, while Brazil halved its investment down to $3.4 billion.

Over in Europe, investment was down more than 40 percent to about $58 billion last year, which pulled down figures for the entire globe. The drop from Europe's nearly $100 billion investment in 2012 was due to Germany, Italy and France pulling back subsidy payments for new projects, according to BNEF. The U.K. was a modest bright spot, dropping only $1 billion to just over $13 billion in 2013.

The decrease doesn’t rest solely on European shoulders. Chinese clean energy investment was reduced for the first time in a decade, down nearly 4 percent from $64 billion in 2012. The U.S. also contracted by 8.4 percent last year, which included a four-year low in renewable investment in the first quarter.

Clean energy technologies that include smart grid, storage, electric vehicles and efficiency were one of the only sectors that saw a slight increase to about $35 billion in 2013. Wind was down, but only by about $500 million, while solar dropped to $115 billion from $143 billion. Biofuels also decreased in the past year.

Government investment was down, but public market investment market bounced back to $13 billion after 2012’s $4.8 billion investment, the lowest since 2004. Tesla, New Zealand’s Might River Power and SunEdison led the investment increase. Venture capital and private equity, on the other hand, continued to fall to the lowest levels since 2005. The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of 102 clean energy stocks worldwide, also rose by more than 50 percent last year. This month, the NEX hit its highest level since summer 2011.

“Indeed, 2014 has started in the same vein with the spectacular acquisition of Nest by Google for $3.2B,” added Liebreich.