The controversial, just-revised federal Renewable Fuel Standard (RFS) has created an opportunity for biomass-based diesel producers.

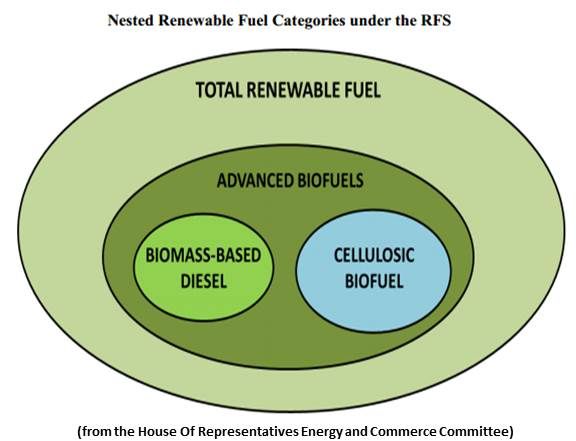

The standard, created to cut transportation sector greenhouse gas emissions, allows the Environmental Protection Agency to set requirements for advanced biofuels based on available supplies. Advanced biofuels include cellulosic biofuels, biomass-based diesel, and sugar-cane based ethanol. According to the EPA, advanced biofuels reduce greenhouse gas emissions by at least 50 percent.

Because producers like INEOS and KiOR, which use cellulose to make liquid fuels, have barely begun to scale up, the EPA foresees only 6 million gallons of cellulosic biofuels being available in 2013. That is a small contribution to the RFS-mandated 16.55 billion gallons of renewable fuels that must be made available.

Biomass-based diesel can fill in the balance of the advanced biofuels requirement and allow refiners and blenders to meet their EPA-established production obligations.

Corn-based ethanol is unlikely to contribute more to the mandated biofuels requirement because it has hit what the industry calls the blend wall.

The E-10 blend of petroleum gasoline assures that corn ethanol demand will maintain its current 13.5 billion gallons per year level, which accounts for 10 percent of the 135 billion gallons of annual U.S. liquid fuels consumption. But additional demand is unlikely to develop. Congress altered the RFS to allow an E-15 blend. But according to biofuels advocates, the oil industry is keeping that tied up in market access complications in order to protect its liquid fuels market share.

The delay in the E-15 opportunity is expected to hold back corn-ethanol-based biofuel producers like POET Technologies (POETF), Valero (VLO), Monsanto (MON) and Archer Daniels Midland (ADM).

And there is not yet significant consumer demand for the higher E-85 petroleum gasoline-corn ethanol blend.

There is essentially no biodiesel blend wall, because biodiesel is interchangeable with petroleum-based diesel. One of the big winners in the opportunity created by the RFS and the blend wall, according to an analysis from Seeking Alpha, will be Renewable Energy Group Inc. (REGI).

REGI operates eight biodiesel facilities with a combined 257-million-gallon annual capacity. Four plants are now in construction that will bring REGI's annual production capacity to 407 million gallons, making it the biggest U.S. biodiesel producer.

REGI’s IPO was a disappointment and its advance in 2012 was, along with much of the rest of the biofuels industry, held back by drought-driven high feedstock prices. But, as Seeking Alpha noted, its share price has increased 167 percent YTD and REGI is now trading above its IPO price.

The RFS controversy could create opportunity for other advanced biofuels producers like Gevo Inc. (GEVO), which is now producing biobutanol-based biofuel at a rate of 18 million gallons per year.

“Even if we assume that the biomass-based diesel category remains unchanged from its 2013 level,” Seeking Alpha observed, “2.3 billion gallons of additional biodiesel production would be required by 2015 to meet the total renewable fuel, advanced biofuel, and biomass-based diesel categories.”

Another key to Seeking Alpha’s endorsement of REGI and the biodiesel sector is the retroactive renewal of the biodiesel blenders' $1 per gallon tax credit from 2012 through 2013. It was part of the January extension of the production tax credit for the wind and geothermal industries.

The retroactive tax credit renewal represents a billion dollars for biodiesel, according to the New York Times, and is expected to drive 2013 production up by almost 20 percent.

“Since a retroactive credit cannot influence behavior, its main effect will be to encourage blenders that produced biodiesel last year to invest more in infrastructure,” the Times quoted National Biodiesel Board spokesperson Ben Evans as saying.

Investment in infrastructure, like REGI’s new plant construction, means greater production capacity and bigger success ahead, according to Seeking Alpha. Continued market and policy forces should take the REGI share price to $40.28 in 2014, “an increase of 164 percent over its current price.”

A change in the RFS or a cut in government support for it by Congress or the EPA could reverse REGI’s prospects, Seeking Alpha noted, but “neither scenario is probable.”

“Despite the efforts of oil refiners to create the impression there are problems with the RFS,” said Biotechnology Industry Organization spokesperson Paul Winters, “it has driven investment and technology development as it was intended to do.”