By now, 2013 PV demand dynamics are pretty much yesterday’s news. Japan was big; China was even bigger; the U.S. more than held its own; Europe lost much of its luster; and emerging markets like Latin America and South Africa continued to increase their share of the pie.

Hidden beneath those top-line figures, however, are stories of individual suppliers, each approaching the market with different combinations of strengths, weaknesses, business models and channel strategies. Below, we take a look at some of the more notable ones.

First Solar: Ignored in Asia

It is an extraordinary fact that one of the world’s largest and most successful solar firms has virtually no presence in the two of the world's largest solar markets. Together, China and Japan made up a combined 55 percent of global solar installations in 2013. But less than 0.1 percent of First Solar’s 1.7 gigawatts in shipments last year were deployed in either of those countries.

While First Solar’s lack of success in China is pretty much par for the course for non-Chinese firms, in Japan it has been thwarted by its hitherto singular focus on cadmium telluride (CdTe) technology. The relatively low efficiency of CdTe modules makes them a non-starter in the residential segment, which has been the bedrock of the Japanese solar market.

Moreover, CdTe has an image problem in Japan, owing to widespread historical instances of cadmium poisoning, despite scientific evidence that suggests that CdTe modules pose no risks to health and the environment if properly recycled. While First Solar plans to manufacture and sell high-efficiency crystalline silicon modules in Japan to enable it to penetrate the rooftop market there, its first shipments will not be until 2015, and success is far from a given.

Hanwha, JA and Canadian: Riding the Japanese gravy train

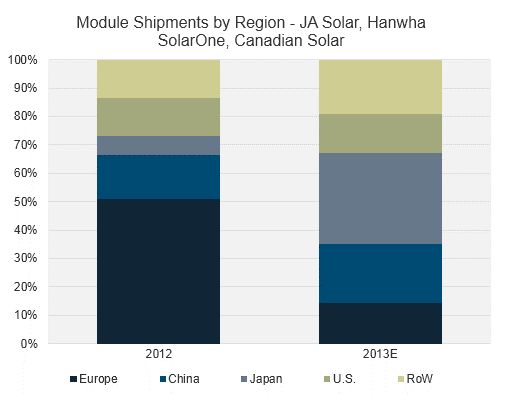

Given that Japan installed nearly 5 gigawatts of PV last year, you’d expect it to figure prominently among most module vendors’ sales territories. Few, though, could have predicted just how warmly this historically insular market would welcome Chinese suppliers. From only 320 megawatts in 2012, the top eight* publicly traded China-based module suppliers shipped an incredible 2.23 gigawatts into Japan in 2013 -- an increase of almost 600 percent. Canadian Solar, JA Solar and Hanwha SolarOne enjoyed particularly outsized growth, with Japanese shipments accounting for almost one-third of their 2013 shipments, compared to just 7 percent in 2012.

Attractive pricing relative to Western and Japanese peers in the more price-sensitive large-commercial and utility-scale segments was certainly a contributing factor to this success. But over and above that, these three firms also benefited from an early focus on the Japanese market and adopting market entry strategies tailored to their individual strengths.

While Canadian has emphasized its quasi-Western identity and focused on selling branded modules and system kits, JA began by producing OEM modules for Japanese firms. Hanwha, meanwhile, has succeeded by leveraging the brand and business network of its parent company, which has been operating in Japan since 1984.

Source: GTM Research Global PV Competitive Intelligence Tracker

ReneSola and Jinko: American Hustle

Until recently, ReneSola and JinkoSolar were not names that one would associate with the U.S. solar market. 2013, however, was a landmark year for both of these firms in the country, with combined shipments growing by more than ten times year-over-year.

Both firms bolstered their U.S. sales and marketing presence heavily back in 2012, and were able to capitalize on limited U.S. allocations by competitors that diverted shipments to more lucrative markets such as Japan in the second half of 2013. Arguably the most important factor is their industry-leading manufacturing cost position, which has allowed them to price modules below more established competitors -- a significant advantage for in the commercial and utility segments in the U.S, and a source of immediate market traction for a new entrant.

Source: GTM Research Global PV Competitive Intelligence Tracker

REC: European renaissance

While most other module suppliers lamented a cooling European market, REC Solar continued to do significant volumes of business on the continent. Europe made up only 28 percent of global installations in 2013, but almost half of the firm’s module output was shipped there.

Business was particularly brisk in the second half of the year, with volume quotas on Chinese module imports coming into effect from August onwards, and REC’s unique combination of a European heritage and an Asian manufacturing cost structure made it ideally positioned to benefit from the trade case. On the other hand, the firm continues to struggle in the U.S. market, which constituted only 8 percent of its 2013 sales. One reason may be the firm’s allegiance to the 60-cell form factor: even in this day and age, REC does not produce 72-cell modules, which are increasingly preferred for larger projects in the U.S.

Source: GTM Research Global PV Competitive Intelligence Tracker

***

Shyam Mehta is Lead Upstream Analyst at GTM Research and author of the recently published report Global PV Pricing Outlook 2014. Join Shyam and other industry leaders at Greentech Media's upcoming Solar Summit in Phoenix.

* Trina Solar, Yingli Solar, Jinko Solar, JA Solar, Hanwha SolarOne, Canadian Solar, ReneSola, China Sunergy