A new partnership between REC Solar and third-party financing provider Clean Power Finance is an indication that key state solar markets are tightening.

Earlier this month, REC Solar announced it would offer customers in Arizona, Colorado and New Jersey solar leases through Clean Power Finance's online marketplace. The deal gives customers more potential options -- but it also may be a sign of difficulties in those states.

“I am concerned for the future of solar in New Jersey, Arizona, and Colorado in 2014,” explained REC Solar Regional VP Ethan Miller. “We have had to lower our prices, but costs are no longer falling. It is getting difficult to deliver a good product and still be profitable.”

Longtime REC financing partners Sunrun and CPF are both “high-quality companies,” Miller said. And Sunrun, still REC's primary financing partner, has provided it with "a great product" in California. “But there isn’t a great product in those three markets, and CPF has the ability right now to meet our needs there.”

With CPF’s more diverse financial offerings, Miller said, “We are more likely to have a zero-down or low-down-payment product to offer. In Arizona, Colorado, and New Jersey, we need all the help we can get.”

The third-party ownership business model has driven solar growth by using a lease or lease-like arrangement to provide homeowners and businesses with rooftop installations without big upfront investments or ownership responsibilities. It was started by Sunrun and is championed by CPF, as well as SolarCity (SCTY), Vivint , NRG (NRG), Sungevity, SunEdison (SUNE), and SunPower (SPWR).

GTM Research has thoroughly documented how steadily these offerings have grown:

Source: GTM Research Q1 2013 Solar Market Insight

“We felt like CPF had the credibility to attract major institution financing and be there consistently,” Miller said. “I don’t want to sign a customer and then wait six months to install while someone gets access to funding.”

CPF offers a particular advantage in New Jersey. CPF Capital & Trading, its full-time, in-house Solar Renewable Energy Credit trading desk, can see opportunity where others see risk in the volatile SREC marketplace that Miller said is hamstringing New Jersey solar growth.

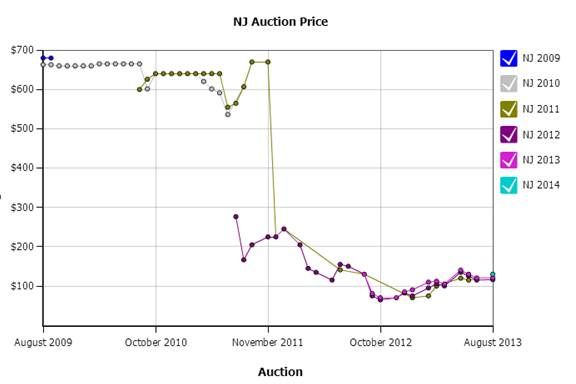

The SREC price is now $150 per megawatt-hour or less, down from a 2011 high of $600 per megawatt-hour. In addition, the 50 percent bonus depreciation will expire at the end of 2013, explained GP Renewables & Trading CEO Gabriel Phillips.

Source: SREC Trade

And in Arizona, regulators’ cuts to upfront solar incentives and a low price of electricity now make it challenging for installers to provide a profitable zero-down offer there, Miller said. Sunrun is fighting with Arizona Public Service (APS), the state’s dominant electricity provider, to save net energy metering.

Numbers in GTM Research's Q1 U.S. Solar Market Insight report show commercial installations dropping precipitously in Arizona. At least one major national installer has stated that it has closed no deals there this year.

“It would stress anybody’s financial model,” Miller said. “We think it’s important to diversify our partner base, because these markets are pushing the third-party-ownership financial models to the very edge of what is sustainable.”

Two of REC Solar’s twenty national offices are in Arizona, and the company just built a national call center in Scottsdale. “The jobs there will support solar jobs across the country,” Miller said. “It would be unfortunate if there isn’t a successful local market.”

Incentives have not dropped as sharply in Colorado, but the cost of electricity is low and SolarCity is engaged in a public fight with Xcel Energy (XEL), the state’s dominant electricity utility, over net energy metering and the question of whether Xcel is obstructing solar growth.

Both APS and Xcel executives have publicly questioned the solar industry’s sense of urgency about keeping net energy metering in place, noted SolarCity Policy Director Meghan Nutting. “They continue to say we cried wolf on commercial incentives and so we’re likely overstating the impact of net metering changes. The changes in Arizona’s commercial market prove what we predicted was, if anything, understatement.”

Though it has signed on for CPF's help, Miller said REC Solar is moving “full steam ahead in those markets. I have faith the utilities and people of those states will advocate for the right thing.”