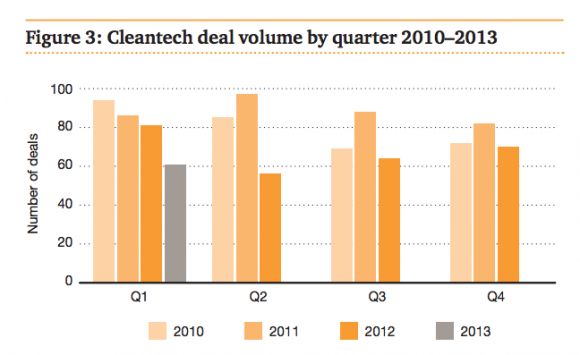

Venture investments in cleantech totaled $369 million in the first quarter of 2013, a 61 percent drop compared to the first quarter of 2012.

The figures, released by PWC's cleantech practice, show that average deal size was down by 48 percent, first-time funding was down by 68 percent and follow-on funding decreased by 60 percent.

"Cleantech funding in the first quarter was lower than any time in the past four years," wrote Tom Solazzo, the leader of PWC's cleantech practice, in the report.

Smart grid and energy storage companies avoided the decline, bringing in $43 million in Q1 -- an increase of 21 percent over last year.

Other sectors didn't fare as well. The transportation sector saw a 99 percent decline in funding (bringing in only $1 million), the solar sector saw an 87 percent decline (bringing in $25 million) and the alternative fuels sector saw an 84 percent decline (raising $36 million).

“The decline was driven by a significant drop in average deal size as well as volume. One bright spot was the modest lift in funding for smart grid and energy storage companies," wrote PWC's Solazzo.

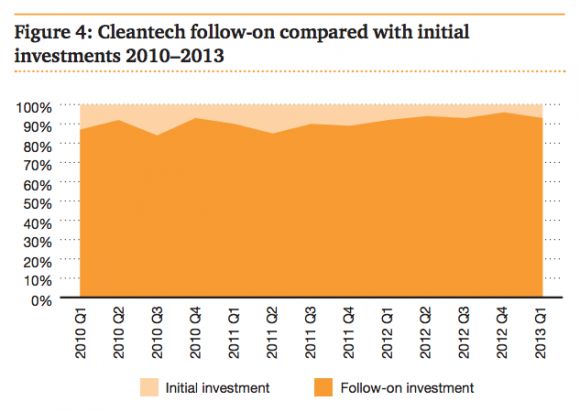

The chart below shows how timid venture investors have been about putting money into new companies. The vast majority of investments are series B or later. And the average size of those later rounds fell by 45 percent to $7 million.

Feeling exhausted or burned by high-profile failures in capital-intensive technology development, many VCs are either pulling out of cleantech or opting for solutions that more closely follow adoption cycles in IT. Some have characterized the investment climate as a bubble that has burst.

Others disagree. Rob Day, a partner with Black Coral Capital, believes that the old paradigm is giving way to a new method of investing in cleantech.

"I happen to personally believe (and am investing around the thesis) that the current investment opportunity is in the Market Reinvention subcategory," wrote Day in a recent blog post on this site, explaining that many VCs will likely continue moving away from the energy-industrial category and toward market reinvention.

"There's a backlog of ready-for-prime-time physical innovations that aren't being adopted nearly as fast as their economic value propositions would suggest, so there are rapid growth opportunities to be found in figuring out how to unleash accelerated adoption," he wrote.

What does this shift mean for investors, limited partners and early stage companies? Sign up for the upcoming Next Wave Cleantech Investing conference from Greentech Media this September to find out.