This is what a solar shakeout looks like.

We are seeing Q-Cells, a long dominant solar PV module giant, lose money, market share, and face. While Chinese crystalline silicon competitors and more nimble American players make strategic moves to stay relevant and viable -- Q-Cells is in a race to catch up, restructure, and survive.

We've already covered some of the second quarter pain felt by First Solar, SunPower and Trina here. Suntech announces its Q2 results later this month.

Shyam Mehta, Senior Solar Analyst at GTM Research, has long foretold the difficulties awaiting higher-cost European c-Si cell and module makers. We've seen similar pain felt by REC.

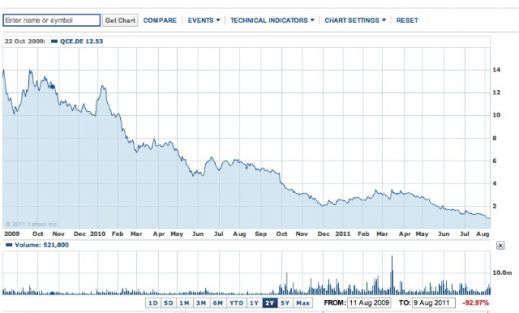

The once high-flying firm now has a market cap of $141.4 million. Here is the sad tale of Q-Cell's stock situation:

Chart from Yahoo Finance

Q-Cells announced its results for the second quarter of 2011. Here are some highlights and lowlights:

- Sales revenues in the second quarter ($450 million) increased compared to the previous quarter ($178 million) "on account of strong systems business."

- The firm lost $439 million in the second quarter.

- Negative EBIT is expected for the full year despite hope for a market recovery in the second half of the year.

- 2012 is "still expected to be a difficult financial year."

As part of the quarterly report, Nedim Cen, CEO of Q-Cells, said, “I am convinced that the strategy of further developing Q-cells into a photovoltaic solutions provider is the right way to go.”

Q-Cells has had some positive news on the CIGS front, which we covered here. But the same cost and structural issues remain in that technology as well.

American solar companies like SunPower and First Solar are feeling the second quarter pinch but are less impacted due to their strategic moves to become downstream suppliers and project developers in the utility-scale solar market.

Q-Cells expects revenues of approximately $1.4 billion and an operating loss "in the three-digit million euro range for the full year 2011."

And if you're in the market for some slightly used solar cell manufacturing equipment, Q-Cells is selling solar cell manufacturing lines, presumably from their European sites as they transition to Asian manufacturing. Equipment includes screen printing lines, furnaces, wetbenches, lasers and a "Production Line to manufacture 6" Multicrystalline Solar Cells with a throughput of approx. 14.3 million pieces/year."