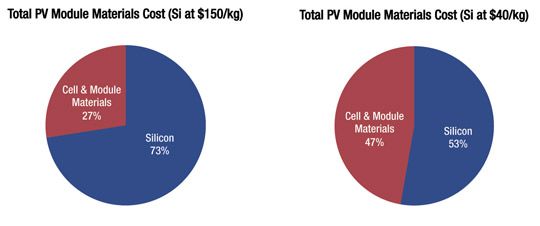

Outside of polysilicon, we don’t often hear a lot about developments in the PV materials industry. Instead, coverage of the PV industry has primarily focused on the chunky gray feedstock as the major PV material since it long represented the bulk of module costs. But with cost declines in polysilicon leveling out towards the $50-60/kg price range (despite periodic fluctuations on the spot market), there is growing emphasis on other materials that are used in the manufacturing of PV modules as a vehicle for further per-watt cost declines, as well as module performance and reliability improvements. All of these issues merit an independent analysis that identifies challenges and opportunities for current or potential material providers.

It was this set of concerns that warranted the compilation of GTM Research’s new report, PV Bill of Materials Outlook: 2010-2015. The report examines key material requirements for both crystalline silicon and thin-film modules, covering glass, paste, encapsulants, gases, wet chemicals, and thin-film feedstock amongst others. Below are some of its major findings:

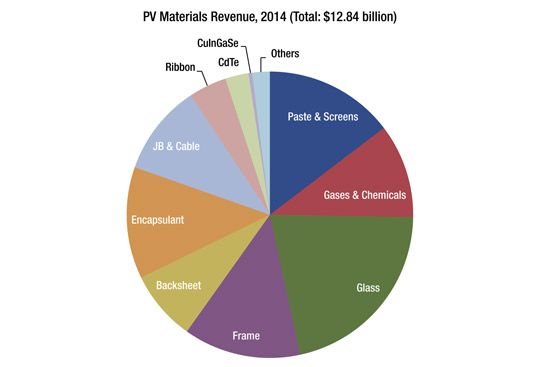

- The global PV materials market, which comprises more than a dozen major materials before the module (excluding polysilicon), is forecasted to hit US$12.8 billion in revenues by 2014. This points to 50% growth over the 2010 market value.

- By 2014, seven PV materials will individually represent global markets in excess of $1 billion. As single revenue streams, the glass, paste/screen and frame sectors will represent the majority of materials opportunities. The fastest growing markets, however, will be those for CdTe and CIGS feedstock, which will grow at annualized rates of 32% and 45%, respectively, due to increases in the value of tellurium and indium.

- Cumulative PV material costs (not accounting for yield improvements) will drop by 15% by 2014. This is mostly a function of efficiency improvements on the cell and module front. This somewhat disappointing number is largely due to the threat of future increases in the price of commodities such as silver, copper, glass, and aluminum; more than 60% of the material costs are comprised of commodity materials.

- Thin film materials will be a $3.1 billion market in 2014. While currently dominated by CdTe, growth from 2010 to 2014 is driven largely by the increase in CIGS production; the CIGS materials market will increase from just $218 million in 2010 to $928 million in 2014.

Now here's the tough news. The consistent threat of consolidation in the thin film space means that material vendors in the space will have to exercise caution when it comes to evaluating potential customers. Ultimately, very few materials vendors will end up serving the key players, and they will likely be forced to work in close conjunction with module producers to create customized solutions that will be optimized for the specifics of their technology, process, and manufacturing location. This point is illustrated by recent news about 5N Plus, headquartered in Montreal. The company, which is one of First Solar’s key vendors for CdTe feedstock, announced that it was expanding its supply agreements with the module producer and plans to build a byproducts recycling plant in Malaysia, not too far from First Solar’s gargantuan module production facility in the same country. This means that First Solar virtually has on-site recycling capability. Given that First Solar currently accounts for about 75% of 5N Plus’s revenues, it wouldn’t be surprising to hear about a full-on acquisition, although 5N Plus’s other business segments would have to be sold off (more on that from my colleague Eric Wesoff here).

Another relevant piece of “material” news comes from glass giant Corning. Earlier this month, the company outlined its plans to reach $10 billion in sales by 2014: of this, “emerging technologies,” of which PV was provided as the only example, were expected to account for up to $500 million. The product in question, which will be manufactured starting in early 2012, is a specialty front glass for thin-film modules which is half as thick is regular PV glass and is designed to boost module efficiency materially by a full 2 percent (more on how it works here).

A single material innovation driving an absolute efficiency gain of 2 percent is -- to put it simply -- an astounding prospect. Suddenly, a tandem-junction silicon module that was previously only 9 percent efficient moves up to 11 percent -- almost on par with CdTe. A similar efficiency boost would see CIGS at parity with crystalline silicon. So at the right price point, Corning’s product could be a game-changer. And for product manufactured domestically (out of a facility in Kentucky), it better be, when buying aluminum from the U.S. is more expensive than ordering a finished frame (plus freight) from China (as a certain Massachusetts-based manufacturer informed me recently). Technology innovation is the only way to fight commoditization: it's impossible to beat the Chinese at their own game.

There are, however, some concerns. First, the PV industry has been quite conservative when it comes to adopting new material solutions, given module reliability concerns, so even mighty Corning may have its work cut out for it in terms of gaining market traction. As demonstrated in the case of 5N Plus, close cooperation with initial customers will be a must to get the product into the market. Second, the thin film glass is closest to commercialization for amorphous silicon (specifically tandem-junction) technology, while similar efforts for CdTe and CIGS are still earlier along in development (the required design innovations for the glass vary by module technology). However, the outlook for a-Si is mixed at best, with a number of producers having fallen by the wayside over the last year. Despite a partial resurgence in 2010, the process flow has proven to be difficult to manage, and only a few producers are expected to scale up to volumes comparable to First Solar or the c-Si giants by 2014: at this point, Sharp, Kaneka, and Astronergy seem the best bets. Will these companies require more customized solutions? Will it make sense for a company of Corning’s scale to offer them? And even so, the report projects the entire a-Si glass market to be worth $511 million by 2014, only 14% higher than 2010, meaning that Corning would be best advised to talk sweet with the tandem-junction companies mentioned above -- and to keep cranking on the R&D front for CdTe and CIGS glass.

For more on the report, visit http://www.gtmresearch.com/report/pv-bill-of-materials-outlook-2010-2015