Smart meters have been the starting point for many utilities when it comes to modernizing their assets. It’s no surprise, as the bulk of $3.4 billion in Department of Energy smart grid grants went to projects that included advanced metering infrastructure. But for one utility, meters took a backseat to another smart grid segment: distribution automation.

Distribution automation has really started to heat up in the past six months, and is expected to overtake metering in terms of investment in 2011 and beyond, according to a new GTM Research report, U.S. Smart Grid Market Forecast: 2010-2015. For Avista, the focus on DA started long before it became trendy.

About a decade ago, Avista, which serves 360,000 electricity customers in and around Spokane, Wa., focused on conservation on the utility side of the meter. When prices started to climb, Avista started asking itself what it could do in terms of energy efficiency throughout the asset chain.

The answer was to start close to the customer and work back toward the transmission side. For each area, from feeder balancing and voltage conservation to switching out transformers, the utility laid out a business case, said Heather Cummins, Director of Avista’s Smart Grid Projects.

“We were focusing on energy efficiency and we were thinking how we could leverage the technology,” she said.

Avista found benefits in looking at the long-term plan for upgrading each and every asset. A few years into making feeder and communications upgrades, the economy crashed and smart grid was given a shot in the arm through federal stimulus grants. “We were pretty far along with where we wanted to go,” said Cummins, and the DOE funding allowed the utility to expand its plans.

(For more on how utilities are integrating distribution automation into their smart grid roadmaps, come to The Networked Grid May 3-4 in San Francisco.)

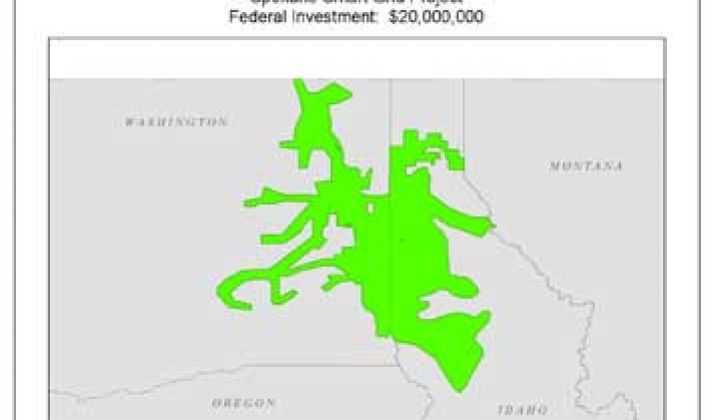

Avista was awarded two ARRA grants. One was for a demonstration project in Pullman, Wa., and the other was a $20 million investment grant for its distribution automation project. The DA project, which covers about one-third of its customers, involves substation automation, voltage controls, smart switches and digital relays using Efacec Advanced Control Systems. Although Avista does not have substantial amounts of renewables on the grid yet, the engineers see these upgrades as foundational for when they do come onto the grid.

The aggressive DA project does not mean that Avista is shunning smart meters, but rather that it’s taking a measured approach. “We see that there’s a lot of opportunity related to installing smart meters,” said Cummins. “But we wanted to better understand what the value was for us and our customers.” The utility is hoping the Pullman project, which is part of the larger Pacific Northwest Smart Grid Demonstration Project, will answer some of those value questions.

Avista is blessed with a lot of hydropower, keeping rates at a pleasant $0.07 kWh for its customers, on average. With fairly mild weather, they do not have peaks as large as some other utilities, so time-of-use rates and demand response aren’t a big push. The DA project does include a communication system provided by Tropos that could be used for AMI, when and if Avista makes the decision to move forward.

As for the early results with DA, Cummins said everyone was pleasantly surprised with some early results. Voltage reduction garnered more efficiency than the engineers had anticipated and they’re continuing to refine the models for voltage optimization. Cummins said Avista is probably further along with DA than most other utilities, but noted that even as a frontrunner, there is still a long way to go. “We’re just at the beginning, so we’re not basing our future business cases on [early results] yet,” she said. “It’s just exciting to see some true in-the-field validation.”