A bill that would allow clean energy projects to leverage master limited partnerships, which are used by the oil and gas industry, was reintroduced in the Senate on Wednesday.

“Congress should level the playing field and give all sources of domestic energy -- renewable and non-renewable alike -- a fair shot at success in the marketplace,” Senator Chris Coons (D-DE), sponsor of the bipartisan bill, said in a statement. “This practical, market-driven solution will unleash private capital and create jobs.”

The current MLP market is worth more than $460 billion, according to investment firm CBRE Clarion Securities.

But even without access to MLPs, which are publicly traded entities that are allowed to act like traditional corporations in the eyes of the Internal Revenue Service, other financing vehicles for clean energy projects are already being unleashed. Investment in clean energy hit nearly $340 billion in 2014. Another $5 trillion is expected by 2030.

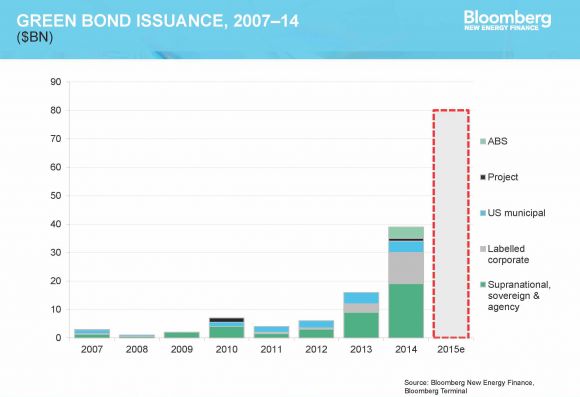

The investment in green bonds has quadrupled in just two years, from less than $20 billion in 2013 to an expected $80 billion this year, Bloomberg New Energy Finance (BNEF) Chairman Michael Liebreich said at the Renewable Energy Finance Forum in New York City on Wednesday.

BNEF values YieldCos at about $4 billion. But Jeff McDermott from Greentech Capital Advisors and other investors put YieldCos' current market value at about $27 billion, a figure McDermott said could easily rise to $100 billion.

“We are now getting to the point that large institutional investors are getting engaged in a substantial way in this emerging asset class,” said Dan Reicher, interim president and CEO of the American Council On Renewable Energy (ACORE). “It is poised for exponential growth.”

Large institutional investors are becoming more sophisticated, but so are foundations and philanthropists, which are increasingly turning their attention to the energy sector as the next big area of impact investing. Liebreich noted that Rockefeller Brothers Fund, a name once synonymous with fossil fuels, is just one example of the funds that announced it will be divesting from fossil fuels.

For now, however, private investment in clean energy dominates. In 2014, there was $240 billion in new project-level asset financing, according to a new study from ACORE’s Partnership for Renewable Energy Finance.

YieldCos and green bonds may be leading the charge on the public investment side, but MLPs would be a welcome addition.

“The more options we have, the more we’ll advance renewable energy investment,” said Reicher. It’s not only MLPs back on the table. The IRS should be making a decision relatively soon on solar assets being included in real estate investment trust (REIT) corporate structures.

“Talk about an attractive world if we had YieldCos, MLPs and REITs,” said Reicher. “That’s a very attractive opportunity.”

As usual, Liebreich was bullish on renewables, but also cautious. According to BNEF, investment in clean energy will eclipse that in the fossil-fuel industry by 2040, but 44 percent of electricity will still come from fossil fuels.