A German, an Italian, and an American solar developer walk into a bar...

I don't really have a punchline for this.

But suffice it to say that a few years ago, the American solar project developer would have had very little to talk about.

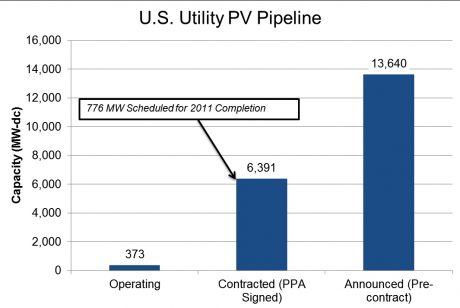

Residential and commercial solar dominated a modest market and utility-scale solar was a rounding error. Utility-scale solar in the U.S. didn't exist in 2006 and was only 58 megawatts in 2009.

That changed in 2010. Now there's more than 700 megawatts of U.S. utility solar scheduled for 2011 completion.

Here's some more utility-scale solar action. Three renewable energy developers have been selected by California utility Pacific Gas and Electric (PG&E) as the winners of its 2011 solar PV program solicitation for 50 megawatts of new solar photovoltaic (PV) power.

PG&E has a program to develop 500 megawatts of new generation from small-to-medium-sized solar projects over five years -- half to be owned by the utility and half by developers who will sell their power back to PG&E.

The projects are capped at 20 megawatts to minimize the permitting and environmental issues that can thwart larger projects (see the First Solar large project drama here). That relatively smaller size enables the projects to be located near existing open-capacity power grids and avoid the challenges of building new transmission lines.

According to PG&E, the projects were selected on the basis of price and commitment to supplier diversity. The 2011 winners are:

- a 20-megawatt project by Recurrent Energy in Kings County

- an 18-megawatt project by Westlands Solar Farms in Fresno County

- and a 12-megawatt project by Fotowatio Renewable Ventures (FRV) in Kern County

All projects will deliver power to PG&E for 20 years, with estimated starting dates in February 2013.

Recurrent Energy, owned by Sharp, has more than 450 megawatts of capacity in operation under construction or in contract.

Westlands Solar Farms is a partnership of Fresno county landowners and energy industry professionals formed to build large-scale solar plants on agricultural lands with excellent solar resources but uncertain water supplies. Its project for PG&E will create about 150 construction jobs in an area that is suffering from high unemployment.

FRV has 40 megawatts of projects deployed in the United States, including the 14 megawatt PV array at Nellis Air Force Base. FRV also has a contract to supply power to Southern California Edison and the rights to develop up to 450 megawatts of solar power at Edwards Air Force Base.

FRV has a pipeline of projects that has grown to 280 megawatts of signed PPAs. That puts them into fourth position behind SunPower, First Solar, and Tenaska.

According to this CPUC document, 20-year contracts in 2013 have a market price referent of $0.109. And according to the pertinent CPUC advice letter, "Each of the three PPA prices is below the 2009 MPR for the 20-year delivery terms of the contracts beginning in 2013."