Petra Solar has a mission: to back up, not destabilize, the grid with solar power. The South Plainfield, N.J.-based company has deployed tens of megawatts of its utility-owned solar-panel-plus-smart-energy controller modules from Jersey City, N.J. to Tafila, Jordan, and has partnered with the Department of Energy’s showcase solar-grid integration SEGIS program to prove that it works.

Now Petra has officially added the oil-rich, politically troubled Gulf island nation of Bahrain to its list of partners. The project will see 5 megawatts of Petra’s solar-grid modules deployed at the University of Bahrain and the Bahrain Petroleum Company (BAPCO) “township,” or company town, of Awali, in a test of the system’s ability to wean the country off its main source of electricity generation fuel -- natural gas and, of course, oil -- while keeping the grid running smoothly.

Partners on the project include BAPCO and the National Oil and Gas Authority (NOGA), as well as Caspian Energy Holdings, a Washington, D.C.-based “international energy, economic development and public affairs enterprise.” Financial terms of the deal were not disclosed.

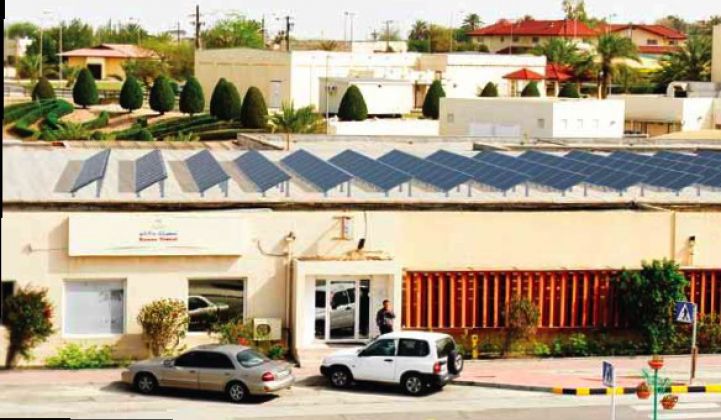

“We’re doing something really different” with the Bahrain project, Mary Grikas, Petra’s vice president of communications, said in a Wednesday interview. That means that Petra won’t just be installing the grid pole-mounted solar modules it’s known for, she said. The Awali project will also include roof-mounted solar, a 1.5-megawatt ground-mounted system, and other locations like car ports, she said.

“They really want to take this town and use it as a model for the rest of the country and the Gulf going forward,” she added, “to show you can really get a significant percent of your energy from solar.” This test phase could lead to a more significant rollout of solar across the country, Grikas said, though she wouldn’t provide details.

Petra combines aspects of solar and smart grid in an interesting way. Each 225-watt solar panel, which may come from various manufacturers, is linked up with a smart energy module. That’s akin to a networked microinverter that can provide grid voltage and frequency monitoring, as well as low-voltage ride-through, reactive voltage injection capabilities and other utility tools to balance the sometimes grid-destabilizing character of solar power.

Petra's VAR injection and low voltage ride-through features were developed in part with funding from the DOE's SEGIS program. To be sure, there are plenty of inverter and microinverter technologies that offer similar power management, with automatic features like ramp-up and ramp-down to avoid voltage spikes or sags on neighborhood power grids when clouds pass over neighborhoods filled with rooftop solar, for example.

But Petra’s product is designed to be owned and operated by the utility, rather than the end customer. That gives a greater degree of active, real-time control than preprogrammed inverters that can’t adapt to changing grid circumstances. Indeed, Petra’s modules and other advanced inverters can help mitigate grid-balancing problems beyond the solar panels themselves, much in the way that distribution automation systems can.

Petra already has an open-ended deal with two of Jordan’s big utilities to develop up to 125 megawatts of its modules over the coming years. That’s up to 50 megawatts with Kingdom Electricity Company (KEC) and up to 75 megawatts of Smart Solar power with Karak Governorate, to be specific. Jordan doesn’t have the oil reserves of its neighbors, and actually spends a quarter of its GDP on energy imports. Petra has started deploying rooftop solar modules as a first phase of that deployment.

Meanwhile, back in its home state, Petra is working with utility Public Service Enterprise Group (PSEG) on a $200 million project to deploy 40 megawatts of pole-mounted solar modules across New Jersey, and was about halfway through that project as of last summer. U.S. solar tax credits can help defray the cost of Petra’s smart energy modules as a part of the overall solar installation.

Because each of Petra’s energy modules are networked, PSE&G can use the Petra platform as a smart grid platform for more than just watching solar panels, Grikas said.

“They are using our software platform for monitoring. They can see on a panel-by-panel basis the wireless network, the energy output on the panel, and they can also get the grid voltage and frequency at every location on the grid,” she said. The utility is even considering adding streetlight sensors to Petra's network, she said.

Petra has built in these capabilities, as well as microgrid capabilities, into the GridWave platform it developed as part of its $6 million DOE SEGIS project with PSE&G, and is looking to expand these capabilities to its other customers, including Bahrain, she said.

In the United States, interconnection rules under IEEE 1547 require rooftop solar to disconnect from the grid, which limits its usefulness as a grid asset. But that can make the panels a liability, rather than an asset, to the grid. Imagine all your neighborhood solar panels dropping off, and then coming back on with surges of solar power, every time the grid voltage has a blip. But Petra’s modules don’t need to disconnect from the grid, because they’re owned and operated by the utility -- a fact that opens up its inverter functions to a broader range of uses.

We’ve seen a lot of new interest from the solar industry in inverters, batteries and control systems that can help integrate grid needs, as well as work on standards for the “smart inverter” sector. The Electric Power Research Institute (EPRI) won a $4.4 million DOE grant in September to try out advanced inverters with utilities San Diego Gas & Electric, National Grid, DTE and Xcel Energy.

It’s important to remember that much of the solar power built over the past few years has been done in a land-rush style, with monitoring and management of assets sometimes left to afterthought. That means a lot of room for technologies to keep solar well-managed, whether it be from inverter makers, monitoring systems vendors and project developers like SunEdison that use software and hardware to do it themselves. Indeed, GTM Research and SoliChamba Consulting predict that this solar monitoring market will grow from 23 gigawatts this year to nearly 50 gigawatts by 2016.

Petra Solar raised $14 million in 2007 and $40 million in a 2010 round for a total of $54 million. Investors include Craton Equity Partners, Espírito Santo Ventures, Element Partners, Blue Run Ventures, U.S. Army venture fund OnPoint Technologies and Kuwait's National Technology Enterprises Company (NTEC).