When customers judge the service they receive from their utility, they don’t compare it to another utility. They compare it to their bank, to airlines and to online shopping sites.

“Frankly, when compared to those industries, we have a lot of catching up to do,” said Alex Laskey, president of Opower, which hosted its third annual PowerUp event this week in Miami.

Utilities have been slow to upgrade their digital platforms to provide more personalized and responsive services. At the same time, the rise of distributed energy resources and smart devices has created the need for new systems, and new market entrants are finding ways to serve customers directly.

But this doesn’t mean that utilities are out of the picture.

“For us, the opportunity and the inevitability is that the utility will remain a critical part of this ecosystem, and the choice that we can make together is to make sure that we are a central coordinating and more important part of that future,” said Opower CEO Dan Yates, in a keynote address to utility representatives.

Efficiency is a pillar of Opower’s business. Through its demand-side management services, the Virginia-based company has enabled utilities to achieve more than 10 terawatt-hours of energy savings, which is enough to power 1 million homes for a year.

Improved customer engagement is a byproduct of Opower’s efficiency products. But now it’s now taking a more direct approach with the launch this week of Opower 7 -- the company’s next-generation customer engagement platform.

Opower doesn’t just want to add cool things to a utility’s website; it wants to help utilities address foundational challenges, according to Laskey and Yates. Opower has invested more than $200 million in its customer care platform to date, viewing it as the key to helping utilities to maintain their strategic relevance, and for Opower to grow.

Earlier this week, financial analysts lowered their price target for Opower after the company reduced its 2016 revenue target by $11 million, despite beating expectations in 2015.

A complete digital overhaul

Opower made a concerted shift into the customer care space last year with the launch of NextWeb, which embeds additional functionality into utilities’ websites, and Bill Advisor, a suite of tools to help customers understand their bill and save energy. Opower 7 adds new capabilities to these programs.

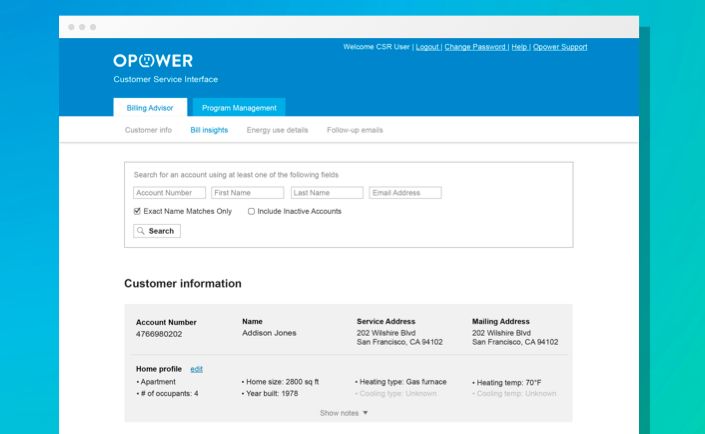

One of the main features of the new platform is a call-center analytics program that helps utilities predict customer inquires, offer insight into bills and cut down overall response time.

“Call center agents are well-intentioned…but they have five systems they’re doing acrobatics to toggle between, and none of them have answers about why a bill is high,” said Laskey, in an interview. "Agents have a scratch pad and are literally pulling up Weather.com to say what may have affected a bill.”

Example of a legacy call-center system

Opower launched the new call center platform with Puget Sound Energy last November, and has already seen call time drop by 40 seconds, or 10 percent. In addition, 77 percent of the customers that called in converted to being web users, meaning they started self-serving via Puget Sound’s website instead of calling in. At the same time, the utility was able to acquire customers’ email addresses (which Laskey said they often don’t have) and can use them to communicate new products and services in future.

Laskey underscored that these results are only from the first version of the call-center program. In later versions, he said it’s easy to see how the call-center process could be entirely automated.

“Consumers want to be able to self-service, and they want that self-service personalized and humanized,” said Laskey.

“There may be a world where whole sets of issues get answered by Siri or Watson,” he said.

Opower's new customer interface

Another new area for Opower is offering enterprise web services -- a complete overhaul of a utility’s website that integrates data across all back-end systems and presents a consumer-centric front-end interface.

“Our role today and over the next three to five years is to build a compete platform to allow us to build your entire website,” Yates told utilities. “We want to be the first screen.”

Yates demonstrated how the web platform can authenticate a customer using Google or Facebook and set up payments with services like Kubra and Stripe. “These little things make the difference between 20 percent and 60 percent usage,” he said.

If a utility isn’t ready for a full website update, Opower has built widgets that show a customer’s usage information and other insights that can be seamlessly integrated into an existing website in seconds with a single line of code. One utility found it was going to cost $1 million to rebuild its web pages with additional functionality, or it could integrate Opower’s widget for $50,000.

"I'm much more excited about our business this year"

As Opower transitions into customer care, the company continues to invest in energy efficiency. This week, the company launched Agile EE, a suite of demand side management capabilities that take advantage of advanced targeting and other tools offered on the Opower 7 platform.

“Why are we still investing in EE? From our perspective, as you make this transition from a commodity provider to service provider, and we know many of you are on that path, we think there’s no better place to start than helping your customers consume your product [in a] smarter [manner],” said Laskey.

Opower’s behavioral efficiency work has shown impressive results, he said. For instance, Baltimore Gas & Electric (BGE) helped its customers shave their peak load by 18 percent last summer with the help of Opower’s demand-response product. Over the same period, BGE’s customer satisfaction rating by J.D. Power and Associates rose 66 points, bringing the utility into J.D. Power’s top 10 list.

Opower had a strong 2015. Fourth-quarter revenues beat expectations and the company signed long-term contracts with its three largest clients -- Exelon, Pacific Gas & Electric and National Grid. Opower executives noted that these contracts represent a backlog of $480 million in revenue.

Still, the company lowered its 2016 guidance with news that an Ontario regulator unexpectedly blocked a contract, and other contracts aren’t expected to launch until 2017.

“I don’t measure the success of our business on a quarterly or even annual basis, and I certainly don’t measure it on what our stock price says. I’m much more excited about our business this year at this conference than last year at this conference,” said Laskey.

“We’re moving into customer care, which is a new business line, and [will be] a big part of our business,” he added.

Does customer care translate to value?

Michael Morosi, senior research analyst at Avondale Partners, said selling this new business line may be trickier than it seems. Opower has found tangible ways to bring its customers value through energy efficiency and demand management, which in many states stems from policy initiatives, he said. And as a bonus, these programs also help bring utilities closer to their clients.

“But does customer engagement have incremental value as a standalone product? That proposition is less certain,” he said.

Almost every utility in the U.S. says it is focused on customer engagement, but they’re only just starting to put money behind it and find out if they can get money back in return.

Opower’s Yates believes the customer care business will grow quickly because it’s essential to the long-term viability of the utility business.

“We can either just be the grid that connects things, but that stands on the sidelines and watches the grid slowly diminish around the edges as other companies step in and start to play big roles,” he said. “Or we can stand up and say our future is clearly to be at the center of this system, to be the coordinating hub, to be brokering these new third parties as they come on-line.”