The wind industry’s push toward bigger machines shows no sign of slowing down in the coming years. If anything, the trend could speed up in some segments of the market.

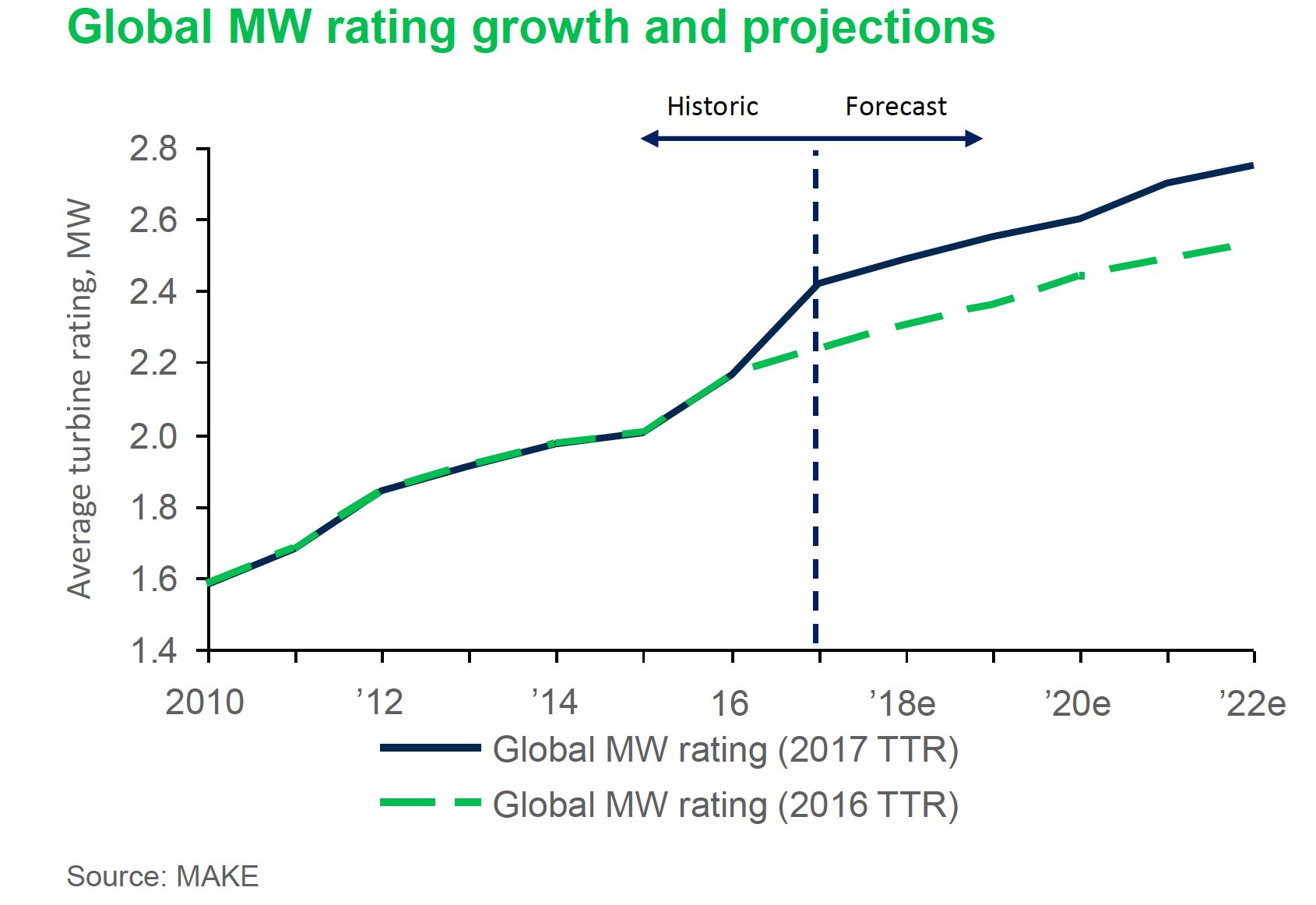

MAKE Consulting's Global Wind Turbine Trends 2017 report, published at the end of last month, revises estimates for turbine growth upward compared to the 2016 edition.

The average rating of wind turbines worldwide is now expected to reach 2.8 megawatts by 2022, up from a prediction of around 2.5 megawatts a year ago.

The revision comes after average turbine ratings beat expectations by around 200 kilowatts per machine in 2017, leaping from a mean expected rating of just over 2.2 megawatts to an actual power of more than 2.4 megawatts.

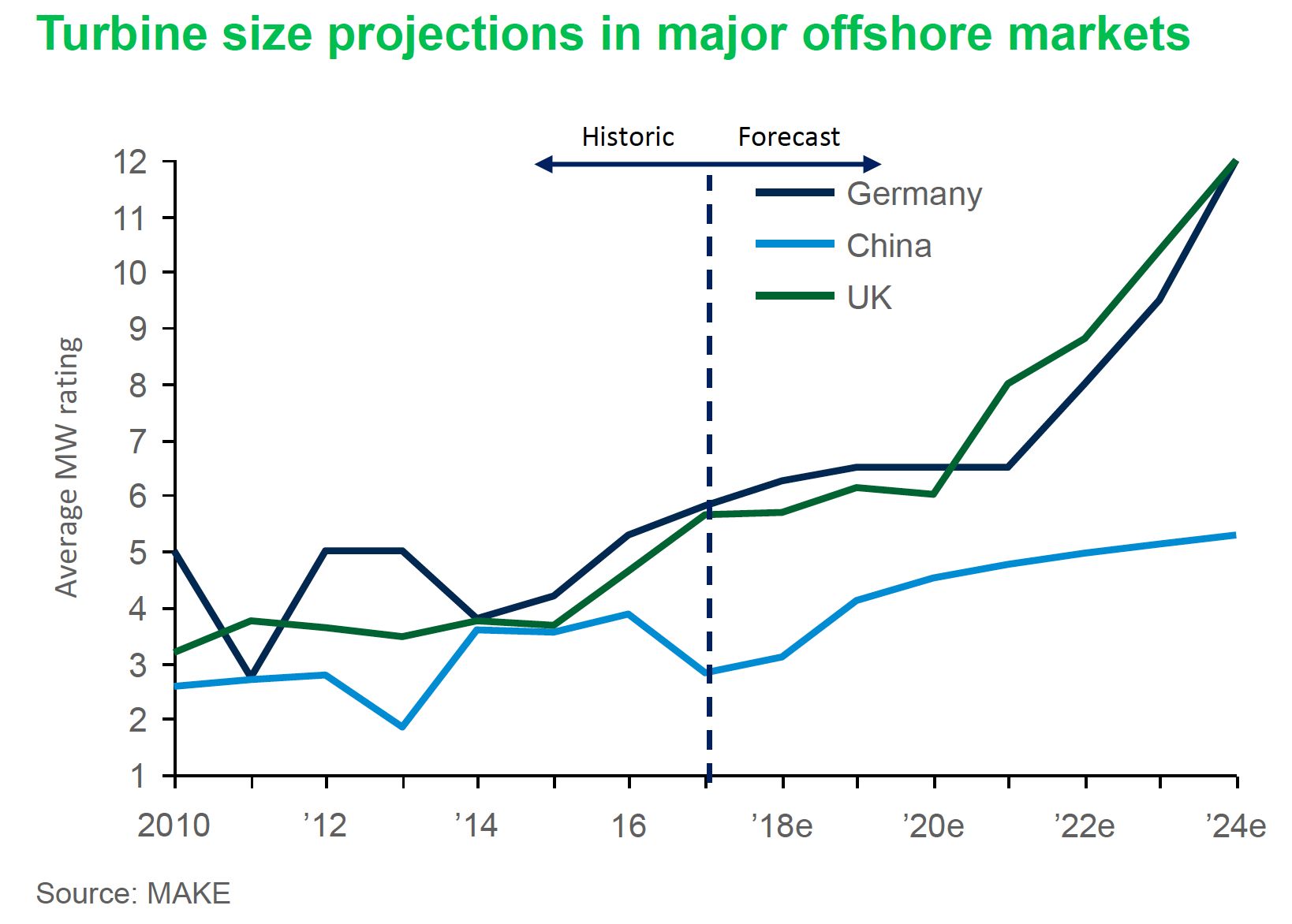

Unsurprisingly, turbine rating growth is highest offshore, particularly in European markets.

MAKE forecasts modest growth in turbines deployed in the busy Chinese offshore market, where machines are expected to increase from around 3 megawatts today to just over 5 megawatts in 2024.

In Europe, the size will shoot up after 2020. The current average offshore turbine size in Germany and the U.K. is below 6 megawatts, but by 2024 it may double to around 12 megawatts.

Most of this increase in growth is due to happen from 2020 onward, with the U.K. market leading the charge. Rotor diameter growth is also expected to continue unabated.

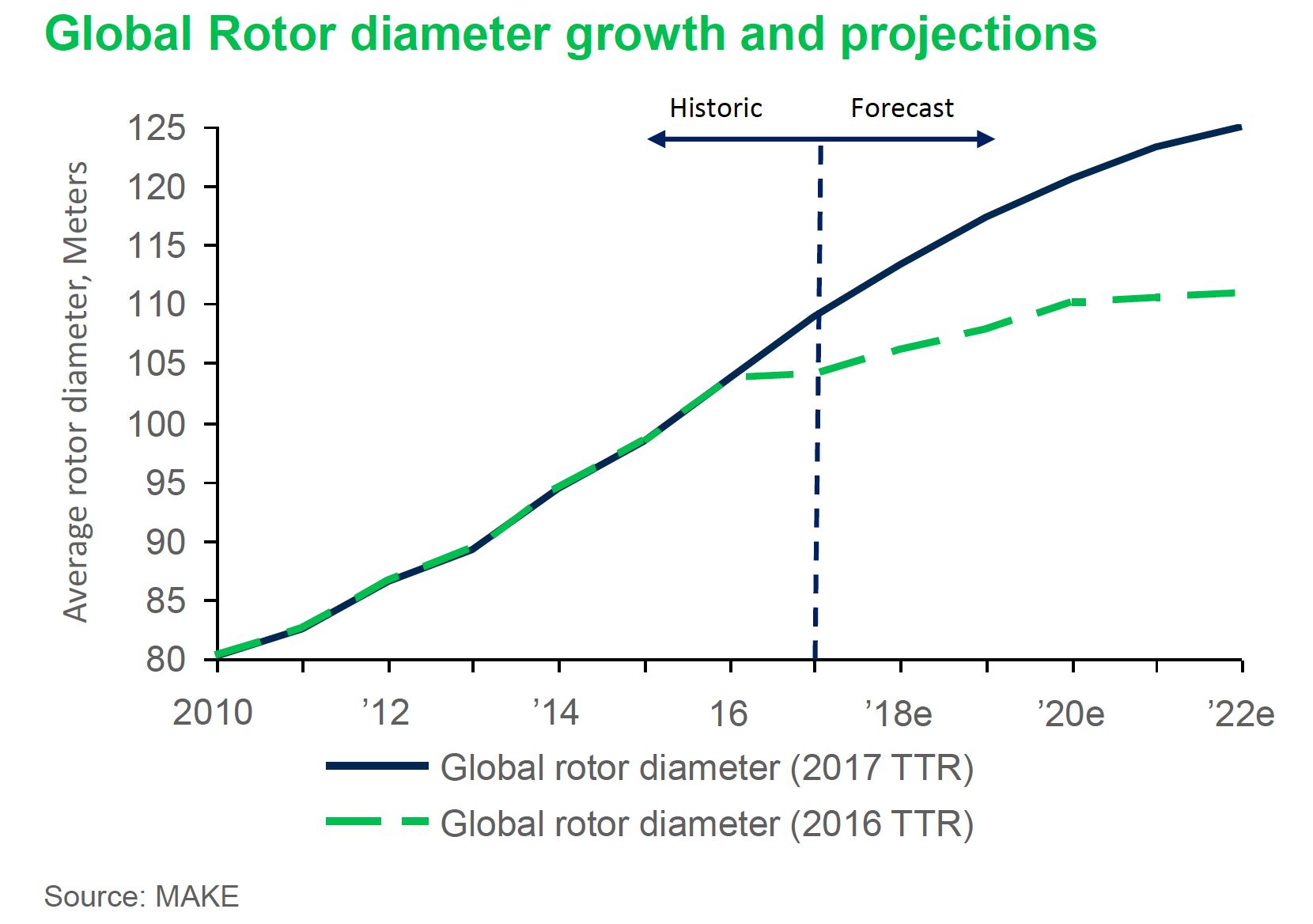

A year ago, MAKE was anticipating rotor diameter would start to plateau at about 110 meters by 2022, but now the analyst firm is predicting average diameters of 125 meters and growing.

“Increased adoption of 3- and 4-megawatt [units] in onshore markets, [as well as] offshore turbine growth, is accelerating turbine megawatt size,” the report notes.

Also, a “focus on high capacity-factor turbines in low wind regimes is driving substantial growth in rotor diameters,” it states.

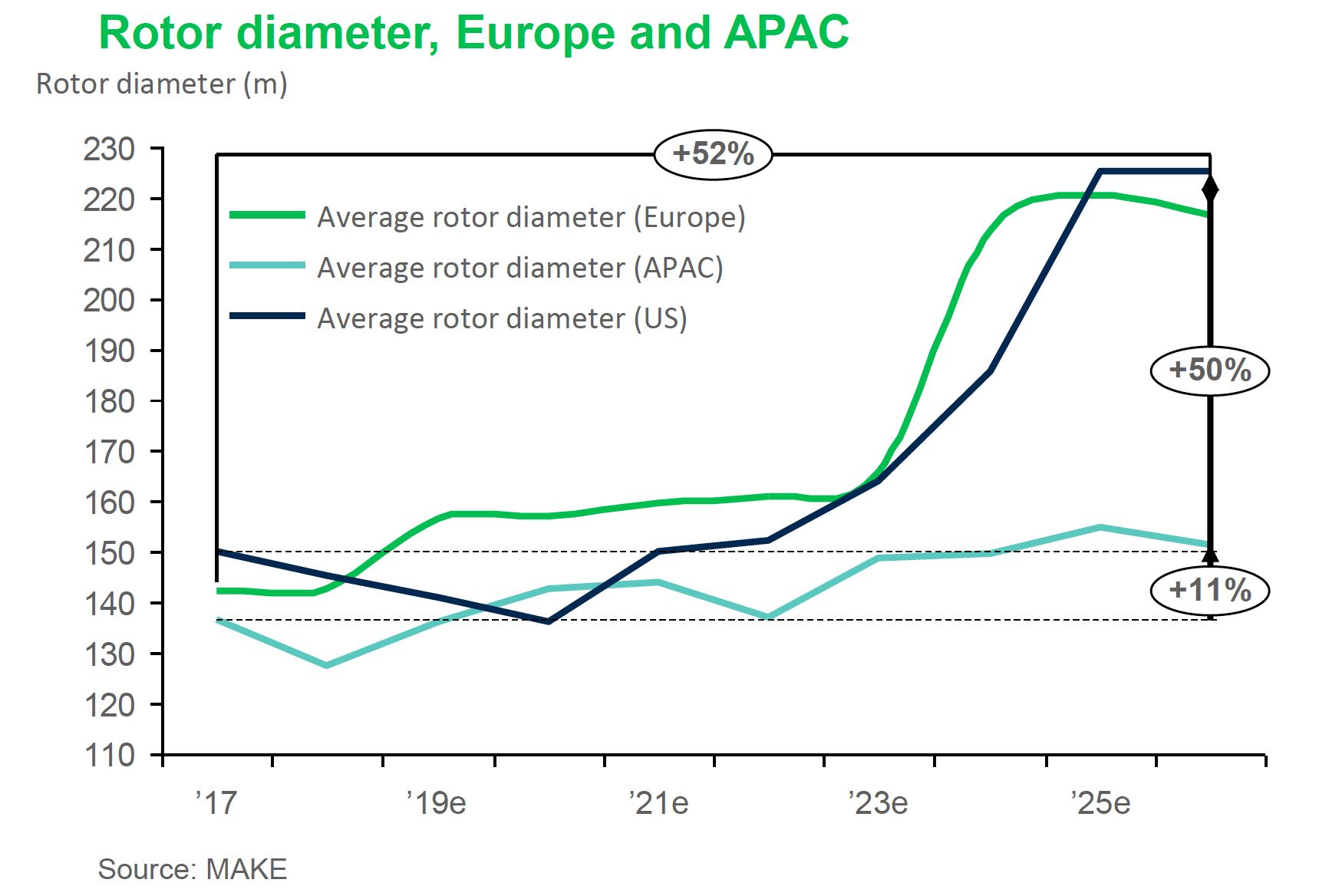

The only sign of a future slowdown is in the offshore market. From around 2024, offshore wind turbine rotor diameters in Asia-Pacific markets look set to level off at around 150 meters, 11 percent above the current average.

Rotor diameter growth will also plateau in Europe and the U.S., but later than in Asia-Pacific. European and American markets are expected to see a fairly flat (or even decreasing, in the case of the U.S.) trend in rotor diameters between now and 2023.

After that time, average rotor diameters in both markets will shoot up to around 220 meters, roughly 50 percent bigger than they are today, before leveling off from around 2025 onward.

MAKE said the trend toward bigger turbines and longer blades is driven by competition across major wind markets, particularly in Europe.

The bigger machines can deliver more power per unit cost, while longer blades are needed for new projects because they are increasingly located in sub-optimal wind sites. “In terms of technology, there are no radical changes,” said Shashi Barla, technology consultant at MAKE.

Instead, he said, “the optimization of existing technologies is increasing.”

Furthermore, because cutthroat competition is eating into wind industry margins, the scope for groundbreaking innovation is narrowing.

“If you are investing in high-end research and development and incurring a lot of costs in this, the total cost of the product would go up, whereas the market trend is that the levelized cost of energy has to go down substantially year over year,” Barla said.

This is one reason why attempts to introduce radically new concepts, such as the two-bladed turbine design that the industry briefly flirted with in 2012 and 2013, are becoming rarer.

Last year one company was still pursuing the two-blade concept, but MAKE’s analysts believe it will be increasingly hard to commercialize such far-out ideas. “I don’t see any technology that would become a game-changer in the future,” said Barla.

“It’s simply not possible considering the price pressure in all the markets.”