A few months ago, we wrote about the tumbling cost of building energy management software. That price point has fallen again, from just a few dollars to totally free.

Noesis Energy is a startup that has recently gone from beta to live, with a service area of more than 380 million square feet under its belt.

The Austin-based company is part of a new group of companies in the space leveraging the 'freemium' model, where software applications are offered for free and then extra services are available for additional cost.

Noesis just raised $8 million in Round B funding led by Black Coral Capital and with additional investment from Austin Ventures. The company has raised $14.5 million in total.

“We believe we can be the number-one energy efficiency site in the world within a few years,” said Scott Harmon, CEO of Noesis Energy.

That might seem like a bold claim, but it’s pretty wide-open territory at this point in time. The price point of the software certainly helps (who doesn’t love free stuff?), but Harmon emphasized that the company’s business model isn’t just about picking the low-hanging fruit.

Many energy management companies show that fixing anomalies (the parking lot lights left on all day, the heat and AC being on at the same time) is an important place to start, with savings percentages often in the double digits.

Noesis does not discount the value of those savings, but its Pro platform is really about enabling real efficiency upgrades. “We talked to 100 different vendors, and the constant refrain is the problem with originating projects and getting them justified,” said Harmon. “There’s all this opportunity for efficiency, but no one can translate that into action."

He said that no one wants to pay for energy tracking, so it was a no-brainer to give it away. The free service can also help with meeting the benchmarking requirements that many cities have.

The real pain point for energy managers is making the business case and finding the return on investment for energy efficiency upgrades. Some in the field argue that there also needs to be the right financing models, but Harmon argues that the data is more critical than funding. The word 'noesis' comes from the Greek, and it means "understanding, or the exercise of reason."

“Most of our customers can do their own financing. They just want to know ROI,” said Harmon.

Banks and other financing institutions also want data. It’s not that they don’t like the idea of putting up money for energy efficiency, but a lack of hard data on payback has made the financial sector skittish about getting involved on a large scale.

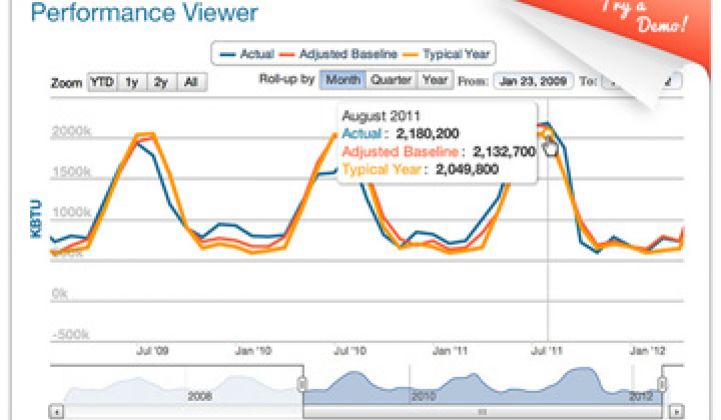

The basic Noesis software looks a lot like other offerings, taking historical data and benchmarking a building’s energy use. Most of the current subscribers, of which there are nearly 1,000, manage dozens of buildings and want to compare properties across a portfolio. The users are spread across 49 states (West Virginia is the holdout) and are also popping up around the world, including Europe, Canada and India.

The platform crunches the historical data along with weather, occupancy data and other factors that can skew the data. By incorporating how the building has performed in relation to its occupancy and weather, Noesis is then able to correct for those anomalies to get an accurate ROI on different upgrades. The origins of the software came from Managing Energy Incorporated, an energy auditing company that built its own software, which was purchased by Noesis in February 2011.

Noesis is still working out the details of how to monetize the Pro platform, which will be available in Q4. Harmon said that there is likely a small percentage of the value of the project that can be monetized, although the details have yet to be determined. For contractors and other vendors, the pain point is identifying projects and seeing them through.

“When you talk to the CFOs, they just don’t believe a lot of the proposals,” said Harmon. “Some performance contracts are very convoluted."

Ideally, Noesis will provide the transparency not only for the CFOs, but for everyone in the retrofit value chain. That value chain is huge. Noesis estimates the market at $100 million. A study from the American Council for an Energy-Efficient Economy found that the value of energy efficiency retrofits could save the U.S. $1 trillion. Any way it’s sliced, it’s huge money.

Because the market is relatively untapped, there’s plenty of competition. Energy Deck is also a freemium service that’s skewed toward smaller consumers. Melon Power is offering low-cost audits and benchmarking. EnergAi is offering $20 energy reports. Retroficiency is also looking to cut the time and cost of audits and retrofits to get owners to move into efficiency projects faster and with more confidence. On the solar side, EnergySage offers free quotes and consulting for solar installations.

Although there are novel financing schemes afoot for solar and falling prices, Harmon said that the energy efficiency market also has everything it needs to take off. “If we waited for the utilities and regulators to get this figured out, we’d be stuck in the market,” said Harmon. “All the things the industry needs it can do itself. It just needs to get into gear.”