Advanced plasma fusion startup Tri Alpha Energy recently received at least $50 million more in venture funding, according to a PwC/NVCA Moneytree VC report. Other trusted VC sources place the round in the $80 million range. Previous investors in the firm include Goldman Sachs, Venrock, Vulcan Capital and New Enterprise Associates. That takes the total VC funding anywhere from $90 million to $120 million -- a lot of cash, but just a token down payment in the fusion or nuclear power world.

But don't look for the firm to be featured on any of the investor's websites -- this is a stealth startup. Investors at Venrock have not responded to my inquiries and have made it quite clear in the past that they are not going to be discussing this fusion firm.

Tri Alpha published a paper earlier this year with the catchy title "Dynamic Formation of a Hot Field Reversed Configuration with Improved Confinement by Supersonic Merging of Two Colliding High-β Compact Toroids"

Michael Kanellos did a little digging on them in this blog entry from last year. Next Big Future has a few technical details and here's a good discussion of a patent filing from the inventor.

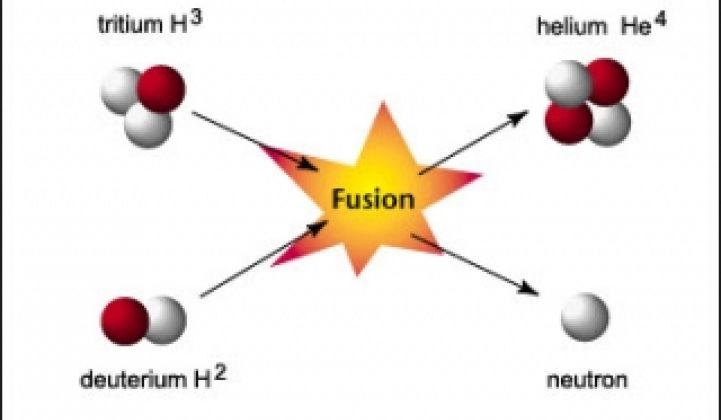

According to a dusty University of California at Irvine entry made back in 2004, Norman Rostoker, research professor of physics and astronomy, received $5.2 million from Tri Alpha Energy to research a plasma electric generator that will use as fuel a mixture of hydrogen and boron. In this generator, hydrogen will chase boron in a cylinder, eventually resulting in helium nuclei that will be made to escape into a particle accelerator. The backwards-running accelerator will slow down the nuclei, turning the energy released into electricity.

Vulcan Capital, one of Tri Alpha's investors is the VC arm of Paul Allen, Microsoft co-founder and one of the world's wealthiest men. Vulcan is also in an investor in Small Modular Reactor (SMR) firm NuScale. At this wealth-level, it seems that one designs a yacht, buys a basketball team, does a little philanthropy and invests in a nuclear startup. Allen's fellow Microsoft billionaires, Bill Gates and former Microsoft CTO Nathan Myhrvold, are investors in TerraPower, a new nuclear fission design which just received $35 million in funding. Vinod Khosla of Khosla Venutres is also a recent investor in TerraPower. Now that Larry Ellison has lost his shot at the stellar Golden State Warrior franchise, perhaps he'll start looking into nuclear investing.

Other startups in the nuclear technology field include Kurion, Hyperion, General Fusion and SMR firm, NuScale. (We have reported on NuScale and SMRs numerous times, and we've covered the strong case that small modular reactors have made in their own favor.)

NuScale investor Maurice Gunderson of CMEA has labelled utility-scale energy storage, fusion and SMRs the "game-changing" technologies in energy.