Electric Fuel Energy and its parent company are making some bold claims about a new flow battery. If they can live up to those claims, other flow battery companies may have some stiff competition.

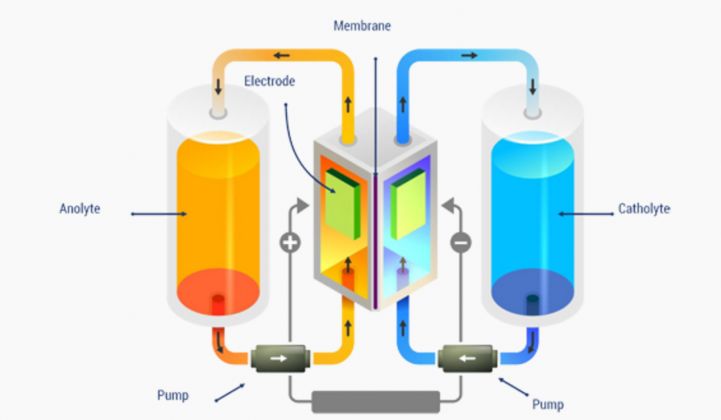

Flow batteries provide long-duration electrochemical storage with the promise of 10-hour-plus discharge times.

“Flow batteries are particularly suited for applications that require long-discharge durations, such as load-shifting. The majority of flow battery deployments in the U.S. thus far have been utility-scale systems," explained Brett Simon, a storage analyst with GTM Research.

Flow batteries come in a variety of types, championed by different industry players. UniEnergy, Imergy and CellCube are in the vanadium space; iron chromium is the chemistry favored by EnerVault; Primus Power has a zinc-bromide battery; EnSync and Redflow specialize in zinc-bromine technology.

Electric Fuel Energy (EFE) is based in Israel, wholly owned by U.S.-based Arotech Corporation and run by CEO Ronen Badichi, who is also president of Arotech’s Power Systems Division. In a recent interview with GTM, Badichi pointed out that EFE is part of a company with 20+ years of experience in batteries -- and not reliant on angel investors -- giving it a key advantage.

That relationship and experience allowed the company to solve problems faster. “The goal was to create a very low-cost battery that, combined with renewable energy, could compete with diesel generation,” said Badichi.

EFE’s battery has a proprietary iron anode and ferro-ferricyanide aqueous couple cathode. “Both have been in use a very long time,” said Badichi. “What we managed to do is to get the two to work together.”

The electrolyte, he said, is a harmless, inexpensive, unregulated organic solution frequently used as a food additive.

The end result will be a container-sized 150-kilowatt flow battery unit that delivers storage at a price of between $250 and $300 per kilowatt-hour, he claimed. Badichi also said his company intends to target developing economies, where the grid systems are weak and isolated, and also off-grid markets, including island communities. (This is where competitor Imergy has focused.)

“Places with stronger grids, such as Europe and the U.S., would not be our first choice -- but if and when subsidies for existing storage are dropped and existing storage needs to be retired, maybe there would be possibilities,” he said.

EFE is hoping to have a field demonstration project up and running by the end of this year, adding four more in 2017 and 2018; a full commercial launch is planned for 2019. The first production facility, based in Israel, is currently under construction, Badichi said.

If it does enter the market, EFE faces competition on at least three fronts. First, the current installed base of battery energy storage is predominantly lithium-ion. It has a deep advantage as a technology with a long track record.

Badichi countered that his company's flow battery can out-compete the current technology on price, even with very low economies of scale: “We don’t need a 50-gigawatt plant to make our product competitive,” he said, clearly referring to Tesla’s Gigafactory in Nevada. The battery should also have a lifespan around twice as long as current lithium-ion deployments.

Also, like other flow batteries with their typically long charging and discharging cycles, the technology can be used in areas less suited to lithium-ion. The product wouldn’t, for example, be targeting the crowded frequency-response market. “We are in the lithium battery business ourselves, so we’re well aware of what they can do -- and what they can’t,” he said.

The second challenge comes from other flow battery providers. Many are already deploying product and are much further down the development pipeline than EFE’s iron cell.

The company’s big advantage here is its technology’s ecological and safety credentials, said Badichi. To quote his company’s website: “The Iron Flow Battery offers superior safety and sound environmental characteristics...in sharp contrast to batteries based on bromine, vanadium or strong acids."

The iron flow battery also avoids plating and dendrite formation, which affects some other types of flow batteries, adding to their maintenance costs, according to EFE.

Given all these factors, how do EFE’s claims stack up? What are its chances of commercial success?

Dean Frankel, an analyst at Lux Research, has been following Arotech’s efforts in developing an iron flow battery for the last three years. It's a company with solid energy storage credentials, and any proposal it has should not be dismissed out of hand, he said.

He does urge caution, however. Frankel notes that the projected price of between $250 and $300 per kilowatt-hour is very aggressive -- especially when talking about a fully installed unit that includes installer profit, inverters, shipping and the cost of land: “For a system, without power electronics and without installation, it is believable but still aggressive.”

Energy Storage Systems, which is planning on deploying iron flow batteries for $500 per kilowatt-hour, has a more realistic target when taking into account real-world conditions, said Frankel. But even that figure is ambitious.

Frankel also sees the dominance of lithium-ion technology as a potential obstacle for any flow battery company seeking to break into the stationary energy storage market. As he points out, there were three orders of magnitude more lithium-ion batteries in operation in 2015 than flow batteries. And as the production of lithium-ion ramps up, prices continue to plummet.

Frankel acknowledges that flow batteries generally should have a big advantage in price -- if they have a chance to prove themselves.

Correction: this article incorrectly labeled EnSync as ZBB.