A controversial new study on the costs and benefits of net metering requested by California regulators appears to be obsolete on delivery and may be objectionable to both the solar and the utility industries.

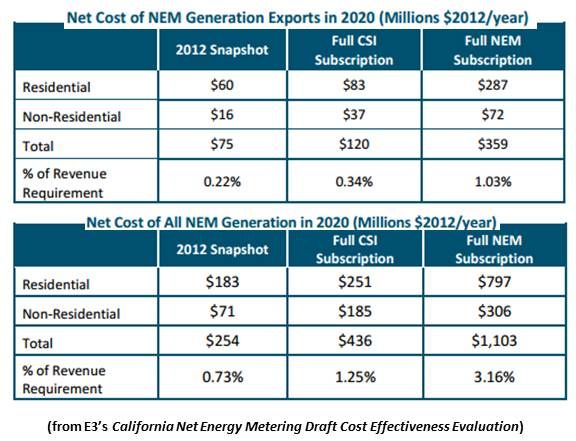

“In 2020, with a complete build-out of systems to the existing net energy metering (NEM) cap, the costs associated with NEM electricity exported to the grid under the current NEM tariffs are approximately $359 million per year, or 1 percent of the utility revenue requirement,” reports the draft version of the California Net Energy Metering Cost-Effectiveness Evaluation prepared by the California Public Utilities Commission for the California legislature from a technical report by Energy and Environment Economics (E3).

“The costs associated with all NEM generation are forecast to be approximately $1.1 billion per year in 2020 (in $2012),” the report adds. “This is approximately 3.2 percent of the forecasted utility revenue requirement.”

“The study is important because it shows cost shifts are occurring,” said Arizona Public Service Manager of Pricing Charles Miessner, “and that the cost shift to non-solar-owning ratepayers is a reality.”

But the study doesn’t change much, noted Crossborder Energy principal Tom Beach, an NEM authority. “Their ‘export-only’ scenario results are very similar to their 2009 study.”

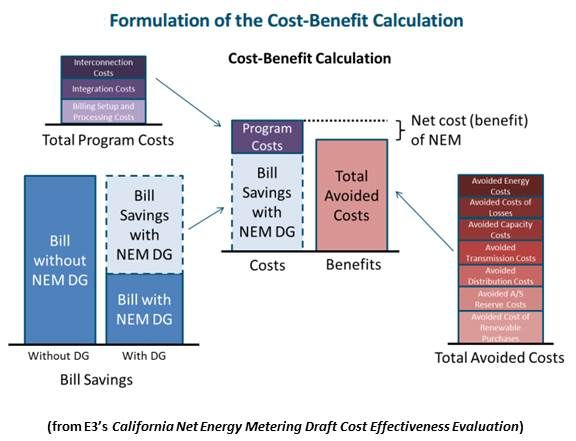

“In evaluating program costs and benefits,” the legislature mandated, “the commission shall consider all electricity generated.” That included “the electricity used onsite” and “the electrical output that is being fed back to the electrical grid.” But the mandate didn’t specify whether the onsite-consumed generation should be used as a cost or a benefit. An average of 51 percent of residential solar owners’ generation is consumed onsite, according to the study.

The study’s “all generation” scenario, which was called for by a former utility executive turned legislator, finds a much higher cost burden from NEM for ratepayers, because it finds costs associated with onsite generation as well as with the electricity sent to the grid. But, Beach said, onsite solar generation reduces costs and provides benefits to utilities.

“The 1 percent number for the ‘export only’ scenario is really pretty small,” Beach said, “given that it is for a very significant solar penetration that fills out the 5 percent NEM cap in 2020.” And the study only considers the short-term benefits of a twenty-year asset, he added. It doesn’t consider the fact that utilities will have to build a lot less infrastructure and pay for a lot less fuel over that twenty years.

“The study didn’t consider a wide enough range of factors,” agreed SolarCity Public Relations Manager Will Craven. It overlooked objectives in the original NEM law, including driving California economic growth and diversifying its energy mix, managing the state’s peak electricity demand and stabilizing its grid, cutting electricity suppliers’ interconnection costs, and growing efficiency.

It also fails to consider the costs of NEM in comparison to other costs to utility customers, said Vote Solar Solar Policy Advocate Susannah Churchill. “The out-of-service San Onofre nuclear plant's cost to Southern California Edison customers in 2012 was more than twice the $359 million the E3 study says California ratepayers will spend for NEM in 2020.”

The E3 study “uses rate design assumptions that are changing as a result of AB 327,” Sunrun Public Policy Manager Susan Wise said. The just-passed AB 327 protects California’s NEM law, GTM’s Jeff St. John explained recently, but is expected to lead to new rate designs significantly different from those on which the E3 report is based.

“The bill savings for NEM customers are entirely a function of the retail rate designs for each customer class and utility,” the E3 report acknowledges, adding that “possible changes to the residential rate structure could have significant impacts on the costs associated with residential NEM generation.”

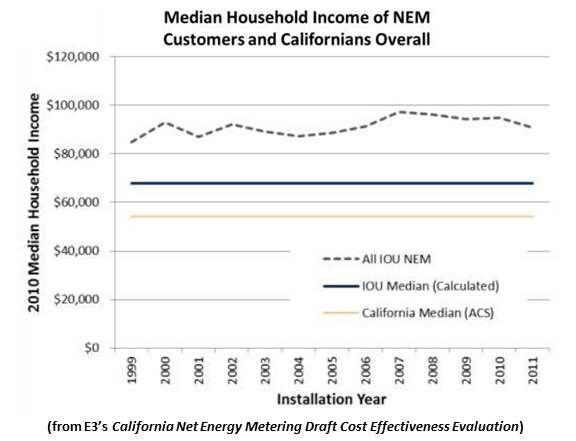

New rates, Beach said, also leave the report’s cost of service assessments in doubt. And its conclusions about the median income of solar owners are limited in value, Beach noted, because the demographic data was mostly from before the boom in rooftop solar driven by third-party-ownership financing. That financing gave middle-income consumers with good credit greater access to solar.

The E3 study could also be a disappointment to utilities, even with its flaws in their favor.

“We have found in surveys that people love the concept of green power, but don’t love the bill,” Michael Yackira, the former NV Energy CEO and the newly elected chair of the Edison Electric Institute, the leading utility industry lobbying group, recently told GTM. “If a residential customer finds they have to pay more than $5 per month, they don’t want to.”

The three IOUs covered by the E3 study serve a cumulative 11.6 million ratepayers and will have many more by 2020. E3's $359 million annual “cost shift” comes out to a $2.58 per customer per month NEM premium. The $1.1 billion E3 figure produces a $7.90 per customer per month premium.