Mid-Atlantic grid operator PJM is the epicenter for grid-scale energy storage, with almost every major contender in the industry building battery installations for the region’s lucrative fast-response frequency regulation market.

Now Japan’s NEC Energy Solutions, the owner of the grid-scale battery business of formerly bankrupt A123, is joining the fray. On Wednesday, NEC announced that it’s partnering with Amergin Energy and Akula Energy Ventures to deploy a 60-megawatt network of grid storage systems in PJM, with construction set to start this year. The systems are slated to be fully operational by mid-2016.

NEC has been working with these partners since last year, and provided “initial financing” for the new deployment, according to Wednesday’s announcement. Amergin will be the owner and operator of the projects, which will come in three 20-megawatt installations at undisclosed locations in PJM’s Atlantic-Coast-to-Illinois service territory, Roger Lin, director of project marketing for NEC Energy Solutions, said in a Wednesday interview.

Financial terms of the deal were not disclosed, making it hard to measure the cost-competitiveness of these new projects against their many rivals for a piece of PJM’s frequency regulation services market. PJM was the first independent system operator to offer higher payments for fast-responding assets, such as batteries or quick-acting load control systems, compared to the power plants that have traditionally done the ramping up and ramping down to help stabilize frequency across the grid.

That’s made for some attractive returns for battery-based frequency regulation in PJM, with payments averaging $40 to $50 per megawatt-hour since 2012, Lin said. That figure includes capacity payments for committing storage systems to be available, as well as performance-based payments for the second-by-second energy injection and absorption they provide.

With these attractive economics has come a land grab in the market, at scales that could theoretically exceed PJM’s need for this fast-responding grid service. About 110 megawatts of fast-responding assets are now on-line in PJM’s frequency regulation market, with another 100 megawatts or so in backlog.

Other companies have staked out big claims for new projects in PJM’s service territory. Those include startup Alevo’s goal of developing 200 megawatts of projects, and the 100 megawatts of project pipeline that Solar Grid Storage, now owned by SunEdison, is planning, much of it aimed at PJM.

Lin noted that NEC has a track record of successful operation in PJM that could help it reduce the costs associated with calculating risk for financing. Its A123 batteries are already supplying 54 megawatts of frequency regulation battery systems under the management of big energy storage developer AES Energy Storage. Those include 32 megawatts in Elkins, W.Va., 20 megawatts in Moraine, Ohio, and 2 megawatts in Philadelphia.

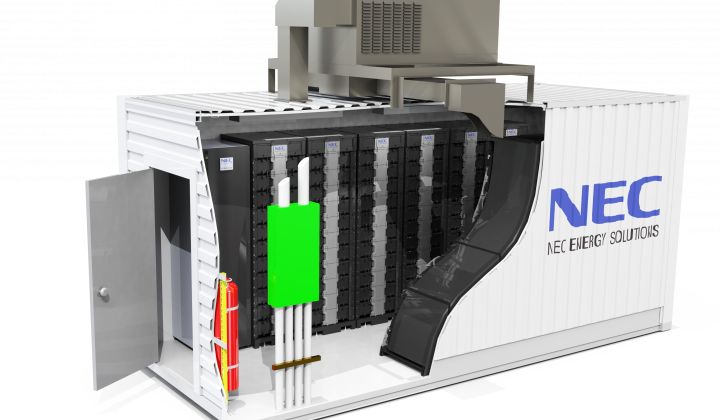

NEC’s Grid Storage Solution units include A123’s lithium-iron-phosphate batteries, the power conversion systems to turn their DC power into grid-ready AC, and the thermal management, safety monitoring and fire suppression equipment needed to prevent fires or explosions, he said. NEC will also offer operational support throughout the system’s 20-year useful life, and the company is “looking very closely at how we can establish performance and operating guarantees specific to the jobs they’re doing,” he said.

As for Tesla’s new utility-scale energy storage systems, “the type of energy storage that Tesla is offering is not well-suited for the job of frequency regulation,” Lin said. While it may be well-suited to peak shifting, demand charge management, or other longer-cycling tasks, “when you’re looking at fast-ramping, high-power discharge pulses, […] it’s really a different type of product.”

NEC Energy Solutions is also working on smaller-scale, distribution-grid-connected storage projects, such as the 4-megawatt systems it has supplied to Southern California Edison, he said. That's a field definitely being targeted by Tesla and its partners, as well as the growing ranks of solar-storage partnerships sprouting up to serve what GTM Research projects will be a $1 billion market for battery-backed PV by 2018.