A $1.16 million California Energy Commission grant will allow Motiv Power Systems to create a prototype assembly line for the installation of its Electric Powertrain Control System (ePCS) on four Detroit Chassis truck frames. Proving the plug-and-play concept’s viability, said Motiv CEO Jim Castelaz, will “de-risk” the conversion of heavy duty vehicle fleets to battery power.

“Detroit Chassis has the capability and skill to assemble traditional diesel trucks, and they are interested in moving to electric options,” Castelaz said. “We provide an easy way for them to do that.”

Making it easy for diesel truck makers to go electric is Motiv Power’s goal, Castelaz said. “We make the building of an electric truck from their perspective look a lot more like building a diesel truck.”

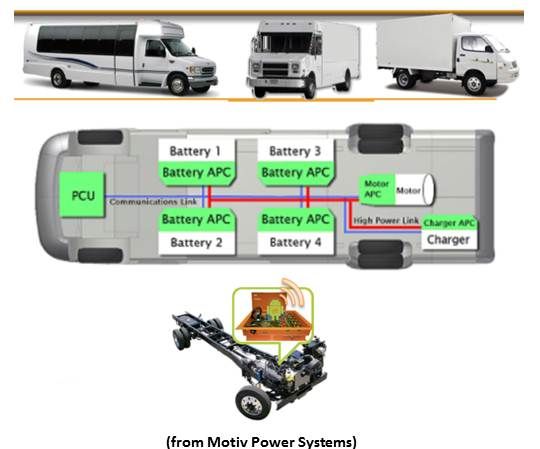

“We take the batteries and motors from off-the-shelf vendors and put them together with our controllers,” Castelaz said. “We package that into a power train kit and send it to Detroit Chassis and they install it.”

The Motiv system is a “mix of hardware and software” that “controls the electric power train.” Truck builders like Detroit Chassis “don’t have to worry about integrating electronics or embedded software or programing the electric power train,” Castelaz said. “All they have to do is the physical mechanical integration of the Motiv Power kit of components onto the chassis.”

The Motiv kit can used with almost any new truck maker’s chassis or for an older truck retrofit. This will take the experimentation done on such systems by GE Global Research into the marketplace. It could expand the options for heavy-duty vehicle buyers far beyond companies like Balqon Corp. that are building electric trucks from the ground up.

The CEC grant funds the pilot assembly line and the production of four vehicles. It “is really just Detroit Chassis’ traditional diesel truck assembly line,” Castelaz said, “but instead of dropping in traditional diesel engines, transmissions and power trains, they’re putting in this electric power train kit.”

By making the process easy and familiar, Castelaz said, “we’re trying to de-risk the electric truck for fleets.” The Motiv concept also allows traditional diesel truck makers to “use the supply chain they’re familiar with and the service chain they’re familiar with.”

The goal, he explained, “is to use this great infrastructure we have, especially in the Midwest, for building diesel trucks, to leverage existing economies of scale and use and repurpose that infrastructure for building electric trucks with as little manufacturing and process redesign overhead as possible.”

“Once the initial four vehicles are produced, Castelaz added, “Motiv will have the capacity to start filling orders right away.”

The flexibility in Motiv’s concept means it is ready and able “to work with any diesel truck builder out there that is looking for an electric option,” he said. They can add an electric option to their line without the need “to replace their diesel assembly line with an electric assembly line.”

Because Castelaz knows this is a flexibility truck makers are used to having, his system is designed “to make electric power trains plug-and-play with the traditional power train industry.”

The first four vehicles will come off the pilot assembly line as “stripped chassis,” just “frame rails with the power train and the front cabin installed.” They will have lithium-ion batteries and a 100-mile range. “We’re working with a couple of different prominent off-the-shelf lithium-ion battery suppliers,” Castelaz said.

Three of the stripped chassis will have shuttle bus bodies built on them and will be shipped from Detroit to the San Francisco Bay Area for use by Bauer’s Transportation. The fourth will have a work truck dump bed body built on it and will be sent to the City of Bakersfield for routine gardening and maintenance work.

“The applications were specified in the grant,” Castelaz said. “We wanted to show that an electric truck built on a traditional diesel assembly line, built as a stripped chassis, could be used for multiple and different applications. Shuttle bus and work truck, we thought, were pretty different.”

The flexibility of Motiv Power’s system extends to battery choice. “We can put more batteries on the vehicle and get more electric range,” Castelaz said. “It’s a cost tradeoff. It’s up to the fleets. We help them look at which routes are best for electrification and how much range we need on the vehicles to do those routes.”

“Right truck, right route,” Castelaz said, is a trucking industry expression he is hearing more as fuel prices go up.

“An 18-wheeler would not be a great application in the short term for our technology,” Castelaz said. But “some applications and routes, like Bauer’s employee shuttles that typically go 50 or 60 miles per day, are perfect.”

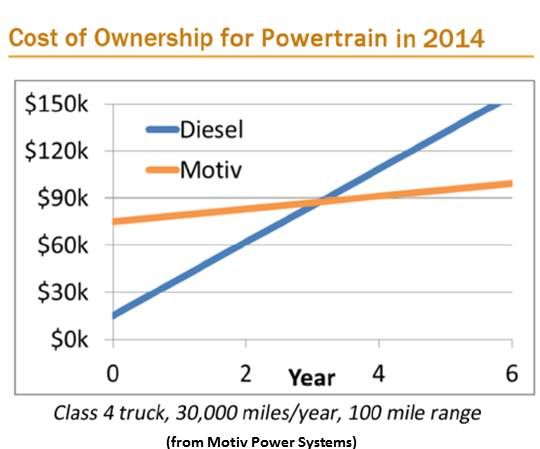

The calculation that the Motiv Power system is 50 percent less expensive over an eight-year life span, Castelaz said, “would be for the right route, a route that doesn’t exceed 100 miles.” Also, he added, “larger trucks that would be better applications would be things like a refuse truck or a heavier local delivery vehicle.”

Fleet purchasers “can specify exactly what they want out of their electric truck,” Castelaz said. “We’re compatible with pretty much any battery and motor that exists in the market today. And as new batteries, which are such a large part of the cost of the truck, come along, we will be compatible.”

The goal, Castelaz said, “is to get diesel truck makers this cleaner, newer technology and de-risk it as much as possible.” And, he added, to reduce for truck users “the risks associated with the volatility of the price of oil.”